- United States

- /

- Capital Markets

- /

- NasdaqGS:TW

A Fresh Look at Tradeweb Markets (TW) Valuation After Recent Share Price Momentum

Reviewed by Simply Wall St

See our latest analysis for Tradeweb Markets.

While Tradeweb Markets’ 1-month share price return of 3.2% hints at a bit of fresh momentum, the larger story is its contrasting longer-term performance, with a total shareholder return of 81.6% over five years but a 19.4% drop over the past year. This shift suggests investors are recalibrating expectations, possibly reacting to both sustained growth and evolving market risks.

If you’re thinking beyond just this week’s moves, it’s a smart moment to broaden your perspective and discover fast growing stocks with high insider ownership.

All of this leaves one burning question for investors: is Tradeweb Markets trading below its true value right now, or has the market already factored in its future earnings growth, leaving little room for upside?

Most Popular Narrative: 17% Undervalued

With the narrative fair value set at $131 and the last close at $108.86, Tradeweb Markets appears undervalued according to the most widely followed perspective. This view sets up a compelling debate over whether the current price already reflects its innovation and growth story.

Tradeweb's focus on workflow automation, integration with client OMS/EMS (such as Aladdin), and increased adoption of data analytics and post-trade solutions are driving higher-margin, recurring revenue streams. These developments can enhance operating leverage and support net margin and earnings improvements over time.

Want to know the formula behind this bullish price? The narrative hinges on fast-rising earnings and bold profit margin expansion powered by technology innovation. Curious which growth levers are expected to deliver these high returns? Dive into the full narrative to discover the quantitative projections behind the headline fair value.

Result: Fair Value of $131 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing downward pressure on trading fees and increased spending on technology could limit Tradeweb’s margin gains if market conditions become more challenging.

Find out about the key risks to this Tradeweb Markets narrative.

Another View: Valuation Ratios Tell a Different Story

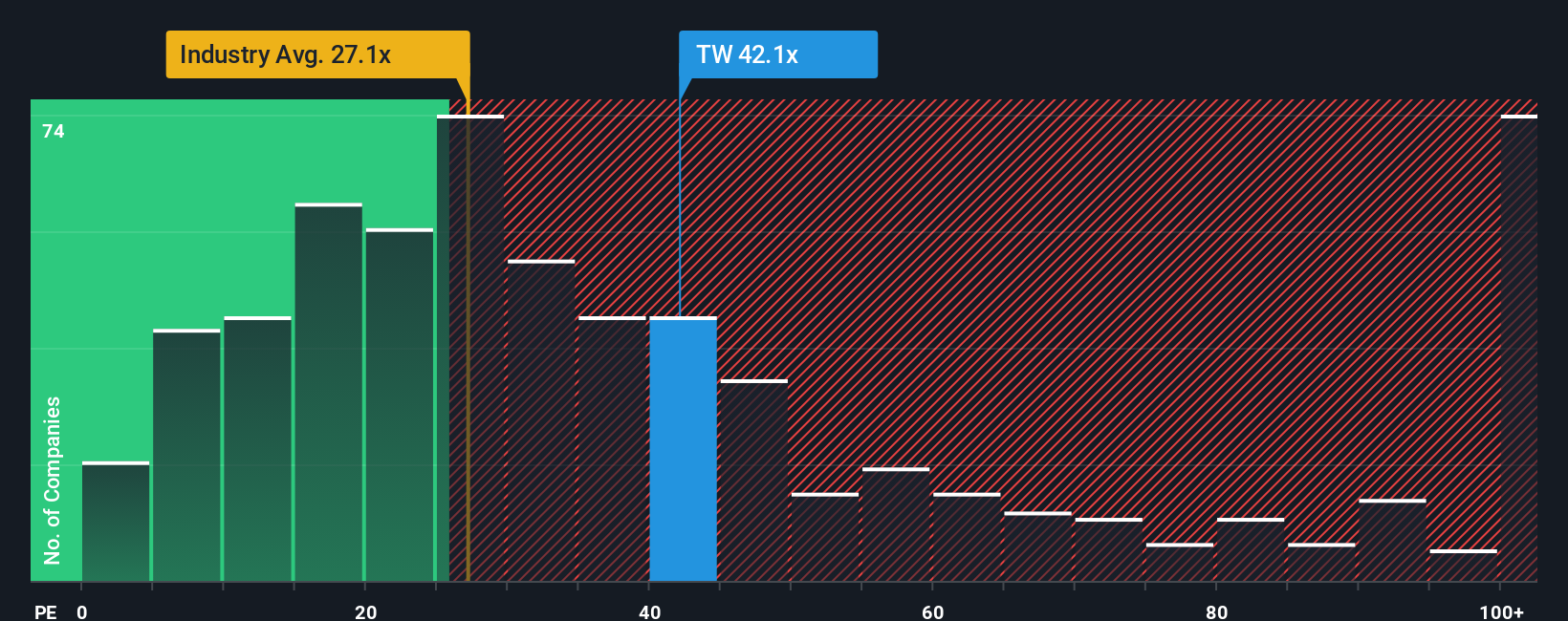

Looking at Tradeweb Markets from a price-to-earnings angle, the picture is less rosy. The current P/E ratio stands at 36.9x, which is significantly higher than both the industry average of 23.6x and the peer average of 29.2x. Notably, it is also well above the fair ratio of 16.7x, raising questions about valuation risk and whether investors are paying too much for future earnings. How does this disconnect affect your perspective on the stock?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tradeweb Markets Narrative

If you’re not convinced by these takes or want to go deeper with your own analysis, you can build a Tradeweb Markets narrative yourself in just minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Tradeweb Markets.

Looking for More Smart Investment Paths?

Set yourself up for future wins by tapping into curated lists tailored for savvy investors. Don’t settle for average. Get ahead by finding the right stocks before everyone else.

- Maximize your earning potential by checking out these 921 undervalued stocks based on cash flows, which is packed with stocks trading below their true worth and poised for a rebound.

- Supercharge your portfolio with these 15 dividend stocks with yields > 3%, offering consistent, attractive yields for those who want their investments to work harder for them.

- Ride the next technology wave with these 25 AI penny stocks, featuring companies driving innovation in artificial intelligence and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tradeweb Markets might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TW

Tradeweb Markets

Tradeweb Markets Inc., together with its subsidiaries, builds and operates electronic marketplaces worldwide.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.