- United States

- /

- Capital Markets

- /

- NasdaqGS:TRIN

Trinity Capital (TRIN) Margin Surge to 54.4% Challenges Cautious Community Narratives

Reviewed by Simply Wall St

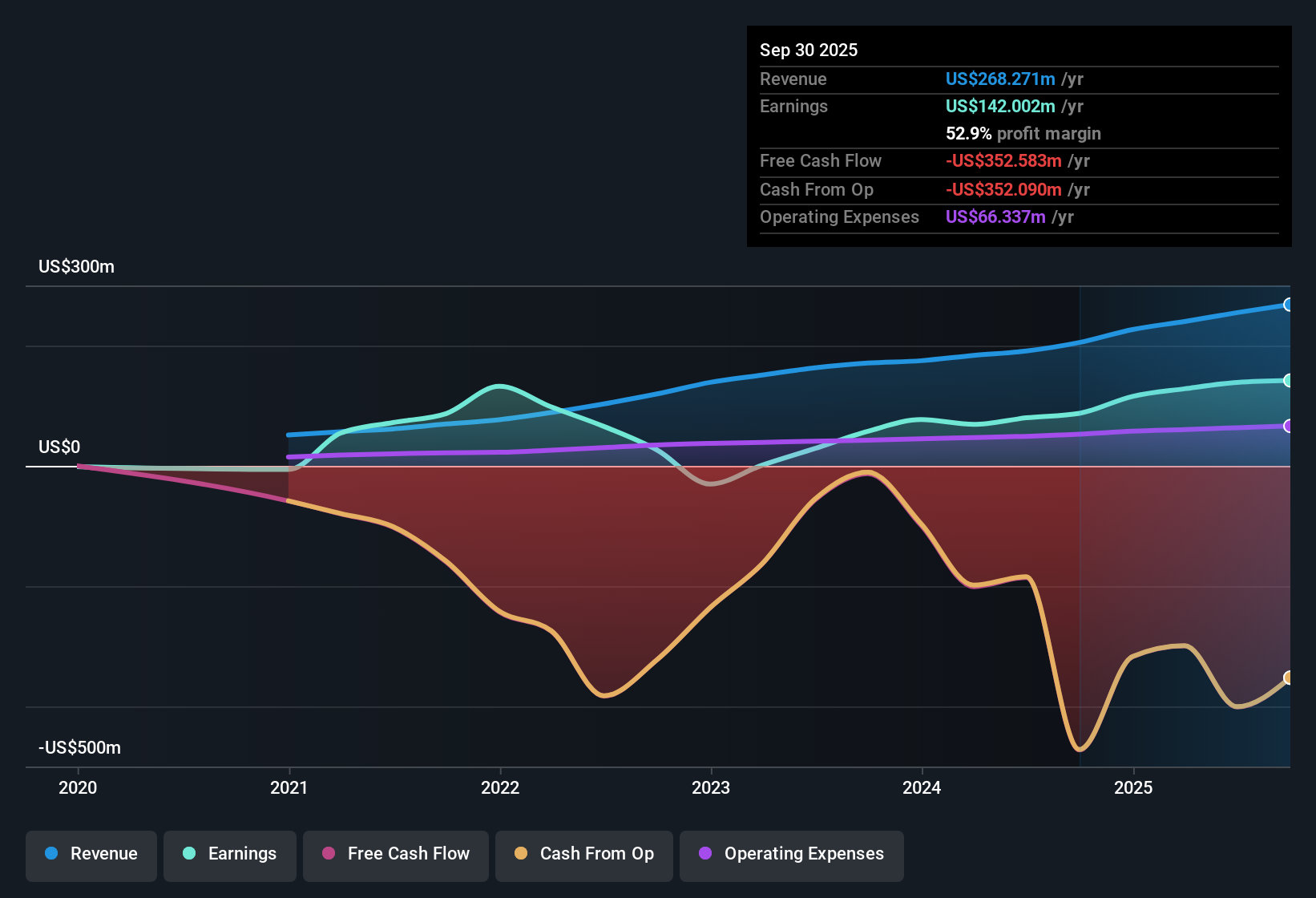

Trinity Capital (TRIN) delivered high quality earnings this period, with net profit margins rising to 54.4%, up from 41.8% a year ago. The company has been profitable over the past five years and recently reported an impressive 73.7% annual earnings growth rate, well ahead of its five-year average of 19.5%. While profitability trends remain strong, analysts are forecasting much slower growth ahead, with annual earnings expected to tick up just 0.2% and revenue to grow at 3.8%. This suggests a more cautious outlook despite the company’s robust historic performance.

See our full analysis for Trinity Capital.Next, we'll see how these headline results compare to the stories circulating in the investor community, and whether the numbers back up current narratives or prompt a rethink.

See what the community is saying about Trinity Capital

Analysts See Margins Sliding from 54% to 46%

- Profit margins are expected to contract from the current 54.4% to just 46.3% over the next three years, even as revenue is projected to grow by 10.5% annually during that period. This points to cost pressures that could erode recent earnings quality.

- According to the analysts' consensus view, these margin pressures are anticipated even though Trinity Capital benefits from scale and platform shifts.

- The consensus narrative notes that competition and higher funding costs may offset recent efficiency gains, making it harder for the company to expand margins as it grows.

- Despite large increases in assets under management and diversification into new income streams, the risk of shrinking operating leverage and compressed yields remains front and center for analysts tracking future profitability.

- Consensus holds that, while the operating platform supports resilient long-term earnings, investors should pay close attention to costs and competition as key variables shaping whether today's robust margins can be sustained through 2028.

See how analysts’ margin expectations play into the full narrative and what might shift the odds for Trinity Capital’s long-term outlook. 📊 Read the full Trinity Capital Consensus Narrative.

Share Dilution Set to Accelerate at 7% Per Year

- Analysts project the number of shares outstanding will grow by 7.0% per year through 2028, a pace that outstrips revenue and earnings growth rates and highlights dilution as a significant headwind for per-share returns.

- Sticking with the analysts' consensus view, the forecasted share increase reflects both the company’s need to raise new capital and its strategy to fund continued portfolio growth.

- While this approach supports expansion into managed accounts and the upcoming SBIC fund, it also raises the hurdle for sustainable EPS and dividend growth as more shares compete for future profits.

- Consensus analysis suggests that even with rising earnings in absolute terms, the benefits to existing shareholders may be offset if the company cannot maintain its high return on newly raised capital.

Valuation Discount: PE at 7.3x vs. Peers’ 31.1x

- Trinity Capital’s shares trade at a price-to-earnings multiple of 7.3x, much lower than the US Capital Markets industry average of 23.7x and listed peers at 31.1x, with the current share price of $14.41 still comfortably below the DCF fair value of $18.81.

- Weighing the consensus perspective, this sizable valuation discount attracts investors who see robust performance and margin quality. At the same time, it signals the market’s caution given flagged risks such as dividend sustainability and expected margin compression.

- Consensus analysts flag the small gap between the analyst target of $16.31 and the current share price, reinforcing the view that Trinity is broadly fairly valued on a fundamental basis, not dramatically mispriced.

- The discount to sector multiples may offer a margin of safety if future growth meets expectations, but concerns may re-emerge if risks around funding costs and dilution come into sharper focus.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Trinity Capital on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot an opportunity or risk others might have missed? In just a few minutes, you can shape your own take on Trinity Capital. Do it your way

A great starting point for your Trinity Capital research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Trinity Capital’s outlook is clouded by shrinking profit margins and rising share dilution. These factors raise doubts about whether its recent earnings quality can be sustained.

If you want to focus on companies with more predictable profitability and steady growth, check out stable growth stocks screener (2074 results) that consistently deliver reliable results regardless of market ups and downs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trinity Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TRIN

Trinity Capital

A business development company specializing in term loans, equipment financing, and private equity-related investments.

Undervalued with solid track record.

Market Insights

Community Narratives