- United States

- /

- Capital Markets

- /

- NasdaqGS:TPG

TPG (TPG): Evaluating Valuation After Recent Momentum Slowdown

Reviewed by Simply Wall St

See our latest analysis for TPG.

Zooming out, TPG's momentum has clearly cooled, with a 1-month share price return of -4.70% and a year-to-date drop of -13.56%. The 1-year total shareholder return sits at -14.03%. Looking further back, its 3-year total return remains an impressive 48%. This shift signals investors may be recalibrating growth and risk expectations as the market reassesses the firm's outlook.

If you're curious about where else opportunity might be building outside the headlines, now's a perfect time to discover fast growing stocks with high insider ownership.

With TPG’s shares trading below analyst price targets and recent returns lagging, the key question now is whether the stock is undervalued at these levels or if the market has already accounted for any future upside.

Most Popular Narrative: 16.4% Undervalued

With TPG closing at $55.13 and the most popular narrative placing fair value at $65.92, the implied upside has caught investor attention. This view brings aggressive long-term growth assumptions into focus.

Strategic investments and acquisitions such as the Peppertree acquisition (immediately accretive to fee-related earnings) and new fund launches are increasing platform scale and operating leverage, translating into improved net margins and supporting long-term earnings growth as the firm captures a larger share of the expanding private markets opportunity set.

Want to know what daring growth forecast underpins this bold target? The narrative bets on standout profit margins and a future earnings multiple that rivals high-growth disruptors. Which number is the real game-changer? Find out what truly drives their fair value calculation.

Result: Fair Value of $65.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent fundraising headwinds or rising compliance costs could quickly test the bullish case. These factors could serve as near-term catalysts for a shift in sentiment.

Find out about the key risks to this TPG narrative.

Another View: Market Multiples Signal Expensive Territory

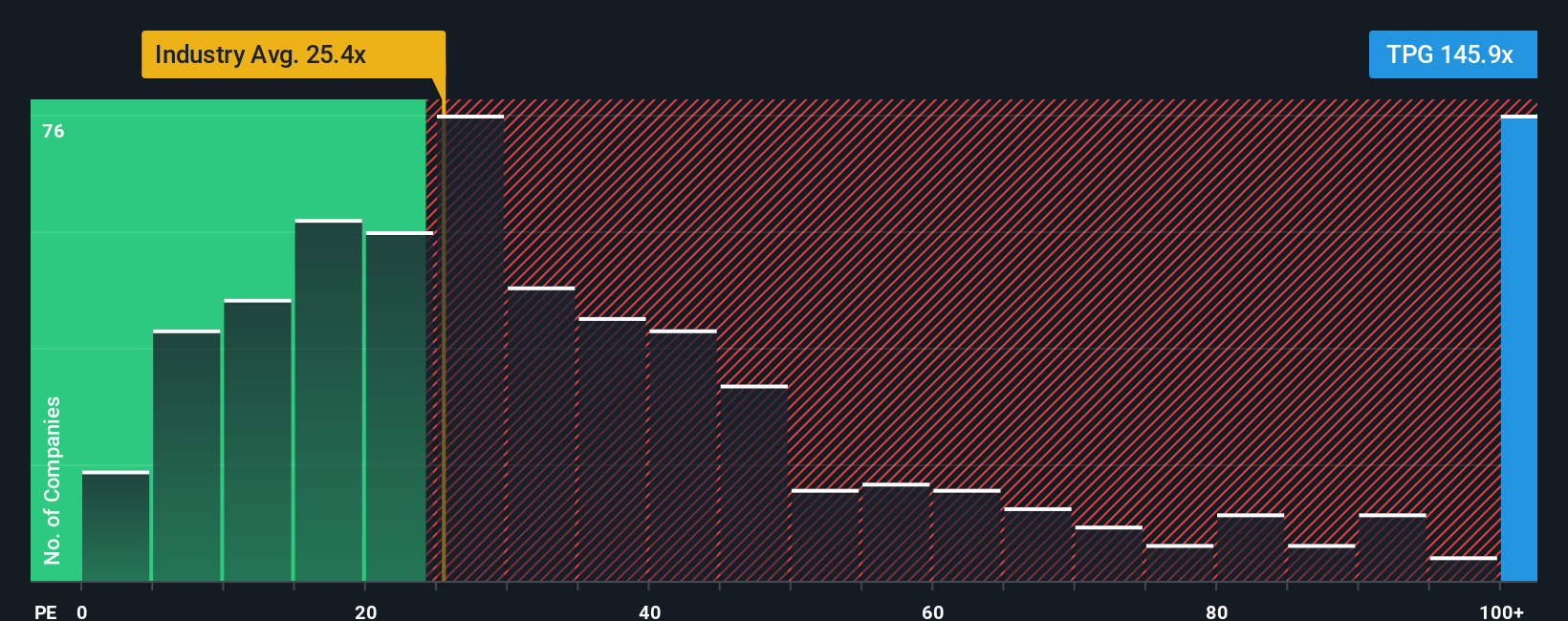

While the community fair value discussion highlights potential upside, the story shifts when we look at common valuation ratios. TPG’s price-to-earnings stands at 137.2x, not only well above the peer average of 16.6x, but also higher than the fair ratio of 30.8x. This wide gap suggests investors may be paying a premium for future growth, which raises the question of whether expectations are too high.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TPG Narrative

If you have a different perspective, or want to shape your own research story, you can build a personalized TPG narrative in just a few minutes. Do it your way.

A great starting point for your TPG research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Ready to supercharge your portfolio? Don’t miss your chance to uncover different angles. These handpicked opportunities can help you spot trends and potential winners before others catch on.

- Tap into tomorrow’s healthcare breakthroughs by investigating these 32 healthcare AI stocks and see which companies are leveraging AI to transform patient outcomes.

- Maximize your passive income by reviewing these 16 dividend stocks with yields > 3% that consistently offer yields above 3% to build a steady stream of returns.

- Ride powerful tech shifts by sizing up these 24 AI penny stocks that are shaping industries through artificial intelligence and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TPG might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TPG

TPG

Operates as an alternative asset manager in the United States and internationally.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives