- United States

- /

- Capital Markets

- /

- NasdaqGS:TIGR

UP Fintech (NasdaqGS:TIGR) EPS Surge Reinforces Bullish Profitability Narratives Before Q3 2025

Reviewed by Simply Wall St

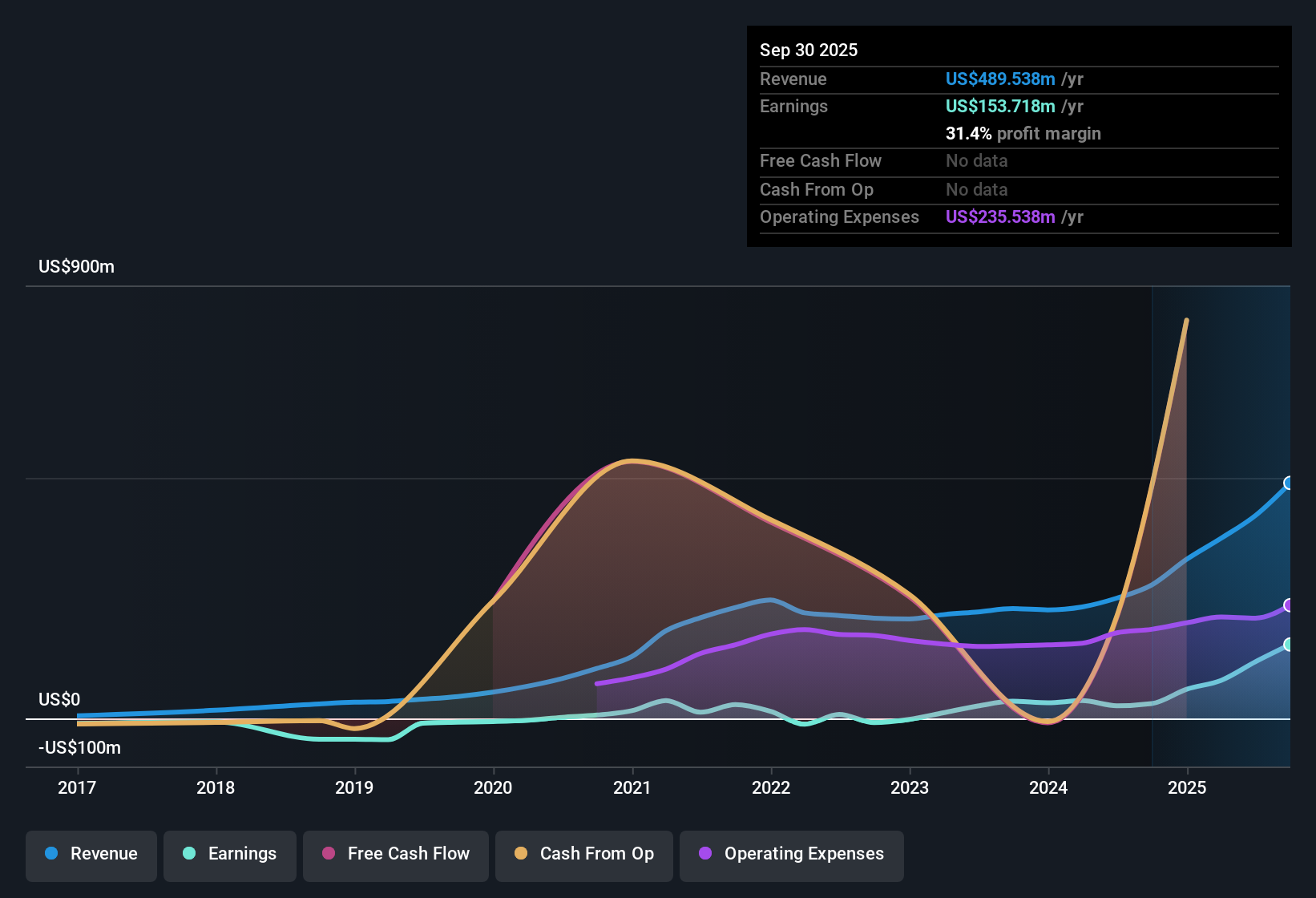

UP Fintech Holding (NasdaqGS:TIGR) has just turned in another busy quarter, with Q2 2025 revenue at about $121.4 million and basic EPS of $0.23, setting the stage for what Q3 2025 could mean for the rest of the year. The company has seen revenue climb from $73.9 million and EPS of $0.02 in Q2 2024 to $121.4 million and EPS of $0.23 in Q2 2025, while trailing 12 month profit margins have moved sharply higher, giving investors a results sheet that puts profitability firmly in focus.

See our full analysis for UP Fintech Holding.With the latest numbers on the table, the next step is to see how this earnings trajectory lines up against the dominant narratives around TIGR, and where the data may either reinforce or challenge those storylines.

See what the community is saying about UP Fintech Holding

Margins Track Earnings Surge

- Trailing 12 month net profit margin is 27.9%, up from 10.5% a year earlier, alongside earnings growth of 346.7%.

- What stands out for the bullish camp is how higher margins and faster earnings outpacing revenue growth help back the idea of scalable profitability, even though the consensus narrative still flags risks that rising client acquisition costs and tighter price competition could eventually squeeze those margins again.

- On the revenue side, trailing 12 month sales reached about $421.7 million, compared with $250.0 million a year earlier, which supports the view that scale is contributing to the margin lift, not just one off cost moves.

- At the same time, analysts expect profit margins to ease from 21.1% to 20.7% over three years, which contrasts with the recent 27.9% net margin and gives bears a datapoint for their concern that current profitability may be above the longer run level.

Valuation Discount Versus Targets

- With the stock at $9.01, it trades at a P/E of 13 times and below both the US Capital Markets industry average of 23.8 times and peer average of 15.5 times, as well as below the cited DCF fair value of about $16.38 per share.

- Consensus narrative commentators argue that competitive and regulatory pressures could weigh on long term earnings power, yet the current valuation implies a significant discount even to an analyst price target of $13.98, which leaves room for upside if forecast revenue growth of roughly 13.4% per year and earnings growth of about 12.2% per year are achieved.

- On the earnings side, trailing 12 month net income of about $117.7 million is far above the prior year’s $26.3 million, so today’s 13 times multiple is being applied to a much stronger profit base than a year ago.

- Looking further out, analysts expect earnings to reach $131.6 million by around 2028, so if that path is realized the current price embeds a lower multiple on those future profits than the sector average, which moderates part of the bearish case about over optimistic market expectations.

Growth Outlook Versus Industry Shifts

- Analysts are modeling revenue growth of 19.4% per year over the next three years and earnings growth to about $131.6 million by 2028, compared with approximately $78.8 million today, while also assuming profit margins slip modestly from 21.1% to 20.7%.

- Bears argue that the push into new markets and digital assets comes with regulatory and competitive headwinds, and they point to expected share count growth of 7% per year and a shift toward zero commission trading as factors that could dilute per share gains even if total earnings rise.

- On a per share basis, analysts see EPS reaching about $0.58 by 2028 from today’s trailing 12 month EPS of roughly $0.69, which reflects that assumed dilution and the margin drift and gives bears numerical support for their concern about per share growth lagging headline earnings.

- At the same time, quarterly basic EPS has stepped up from $0.02 in Q2 2024 to about $0.23 in Q2 2025, which challenges the view that competitive pricing and higher marketing spend are already eroding profitability, at least in the recent reported periods.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for UP Fintech Holding on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers from another angle, and in just a few minutes you can turn that viewpoint into your own narrative: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding UP Fintech Holding.

Explore Alternatives

UP Fintech’s narrative is clouded by concerns that margin strength may fade, dilution could cap per share growth, and competitive pressure might limit long term upside.

If those uncertainties bother you, use our stable growth stocks screener (2081 results) to quickly focus on businesses with steadier revenue and earnings trends that better match a long term, lower risk profile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TIGR

UP Fintech Holding

Provides online brokerage services focusing on Chinese investors in New Zealand, the Cayman Island, Singapore, the United States, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026