- United States

- /

- Consumer Finance

- /

- NasdaqGS:SOFI

SoFi Technologies (SOFI) Is Up 18.0% After Record Q3 Revenue and Blockchain Remittance Launch - Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- SoFi Technologies reported record adjusted net revenue of US$950 million for Q3 2025, reflecting a 38% year-over-year increase and ongoing expansion of its fintech platform.

- New innovations such as blockchain-powered remittances and in-app cryptocurrency trading have driven strong user growth, while heightened institutional interest was marked by a rise in hedge fund portfolios and active options trading.

- We’ll explore how the launch of SoFi Pay with blockchain-powered remittances could shape the company’s broader investment outlook.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

SoFi Technologies Investment Narrative Recap

To be a SoFi Technologies shareholder right now, you need to believe in the company’s ability to monetize rapid product innovation and sustain strong user growth, while transitioning into a scalable, fee-centric platform. The latest record revenue news supports short-term optimism tied to product and membership growth, but does not materially shift the key short-term catalyst, management’s focus on unit economics, or the primary risk relating to future revenue growth if digital adoption slows.

The recent launch of SoFi Pay, featuring blockchain-powered international remittances, exemplifies the company’s push into diversified digital services and could provide additional momentum to member growth and engagement. This move is timely, as investor expectations remain elevated around SoFi’s ability to unlock new revenue streams through technology-driven financial solutions.

However, in contrast, investors should be aware of the risk that if actual digital adoption or product usage growth moderates relative to expectations...

Read the full narrative on SoFi Technologies (it's free!)

SoFi Technologies' narrative projects $5.1 billion in revenue and $954.1 million in earnings by 2028. This requires 19.3% yearly revenue growth and a $392.5 million earnings increase from $561.6 million today.

Uncover how SoFi Technologies' forecasts yield a $26.61 fair value, a 10% downside to its current price.

Exploring Other Perspectives

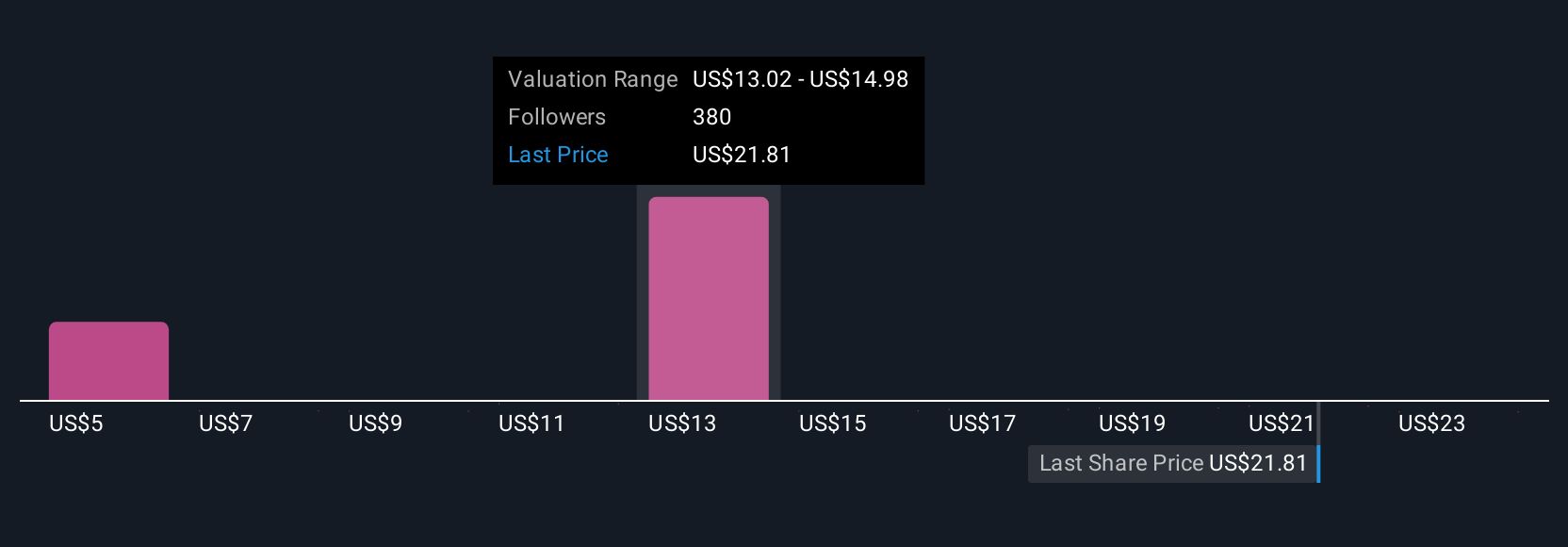

Simply Wall St Community members estimate SoFi’s fair value between US$9.24 and US$30.35, reflecting 58 distinct views. Investor expectations for digital product adoption and cross-sell opportunities continue to shape both optimism and caution around future growth, explore how your own outlook compares to these diverse perspectives.

Explore 58 other fair value estimates on SoFi Technologies - why the stock might be worth less than half the current price!

Build Your Own SoFi Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SoFi Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free SoFi Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SoFi Technologies' overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SOFI

SoFi Technologies

Provides various financial services in the United States, Latin America, Canada, and Hong Kong.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.