- United States

- /

- Oil and Gas

- /

- NYSEAM:LEU

Uncovering 3 Hidden Small Cap Gems with Strong Fundamentals

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen 1.9%, and it is up 33% over the last 12 months, with earnings expected to grow by 15% per annum over the next few years. In this thriving environment, identifying small-cap stocks with strong fundamentals can offer significant opportunities for investors looking to capitalize on robust growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| First National Bank Alaska | 221.06% | 2.98% | 1.82% | ★★★★★☆ |

| Banco Latinoamericano de Comercio Exterior S. A | 311.64% | 21.07% | 24.77% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| QDM International | 36.42% | 107.08% | 78.76% | ★★★★★☆ |

| FRMO | 0.17% | 12.99% | 23.62% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Sezzle (NasdaqCM:SEZL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sezzle Inc. operates as a technology-enabled payments company primarily in the United States and Canada with a market cap of $918.42 million.

Operations: Sezzle generates revenue primarily through lending to end-customers, which amounted to $192.69 million. The company's market cap is $918.42 million.

Sezzle's earnings surged 434.8% over the past year, outpacing the industry growth of 10.5%. The company's net debt to equity ratio stands at a satisfactory 21.6%, and its interest payments are well covered by EBIT at 4.9x coverage. Recently, Sezzle announced a strategic partnership with WebBank to enhance its Pay-in-2 and Pay-in-4 products, alongside a multi-year jersey patch deal with the Minnesota Timberwolves, which should bolster brand visibility significantly.

- Navigate through the intricacies of Sezzle with our comprehensive health report here.

Examine Sezzle's past performance report to understand how it has performed in the past.

SBC Medical Group Holdings (NasdaqGM:SBC)

Simply Wall St Value Rating: ★★★★★☆

Overview: SBC Medical Group Holdings Incorporated operates in the healthcare services sector with a market capitalization of $586.38 million.

Operations: SBC Medical Group Holdings generates revenue primarily from its healthcare facilities and services, amounting to $217.54 million.

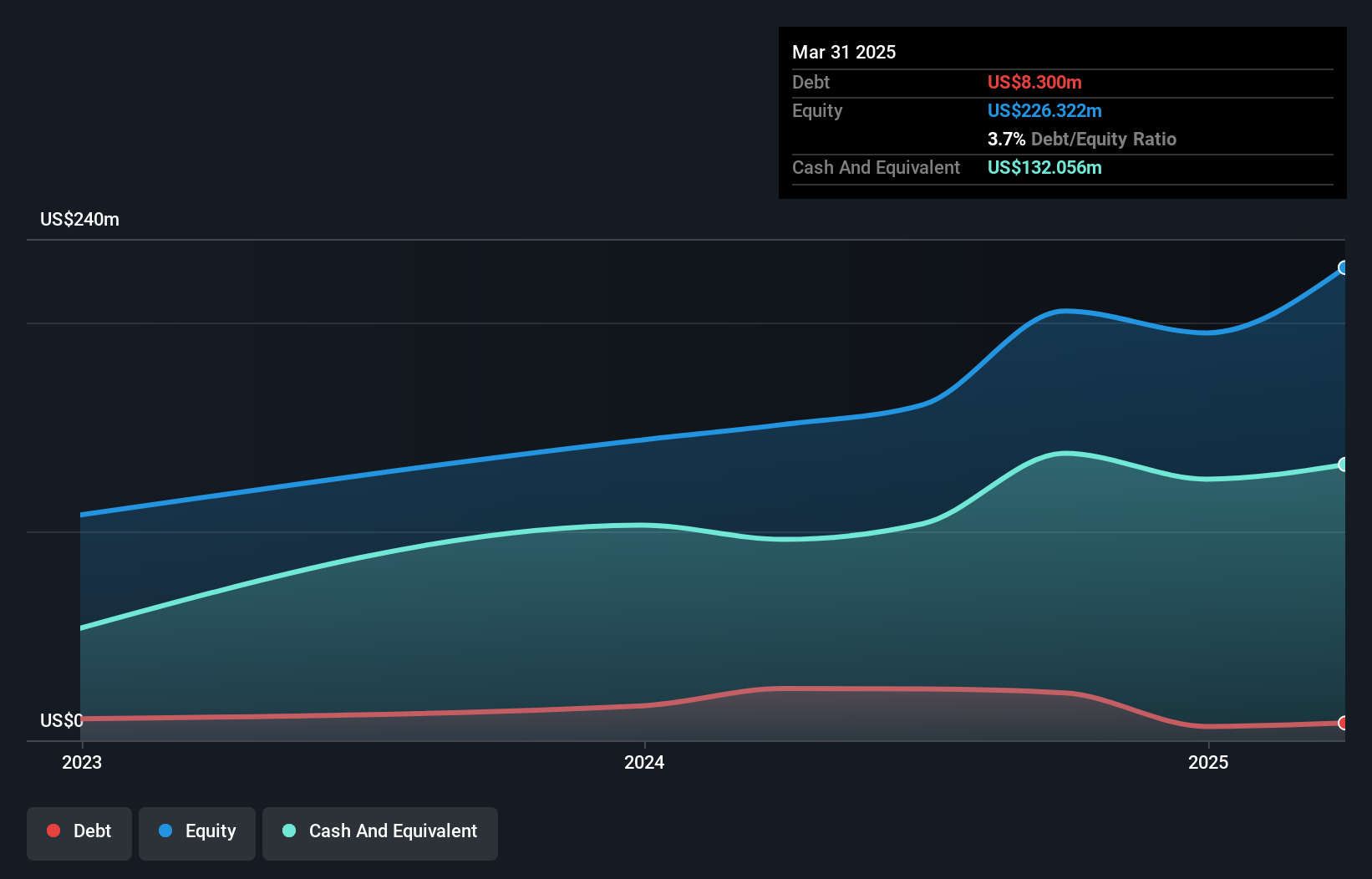

SBC Medical Group Holdings, a small-cap healthcare player, has shown impressive growth with earnings surging 164% over the past year, far outpacing the industry’s 8%. Trading at 94.1% below its estimated fair value and holding more cash than total debt, SBC's financial health appears robust. Despite high share price volatility in recent months, the company boasts high-quality earnings and positive free cash flow of US$64.23M as of June 2024.

- Click here to discover the nuances of SBC Medical Group Holdings with our detailed analytical health report.

Understand SBC Medical Group Holdings' track record by examining our Past report.

Centrus Energy (NYSEAM:LEU)

Simply Wall St Value Rating: ★★★★★☆

Overview: Centrus Energy Corp. supplies nuclear fuel components and services for the nuclear power industry in the United States, Belgium, Japan, and internationally, with a market cap of $818.88 million.

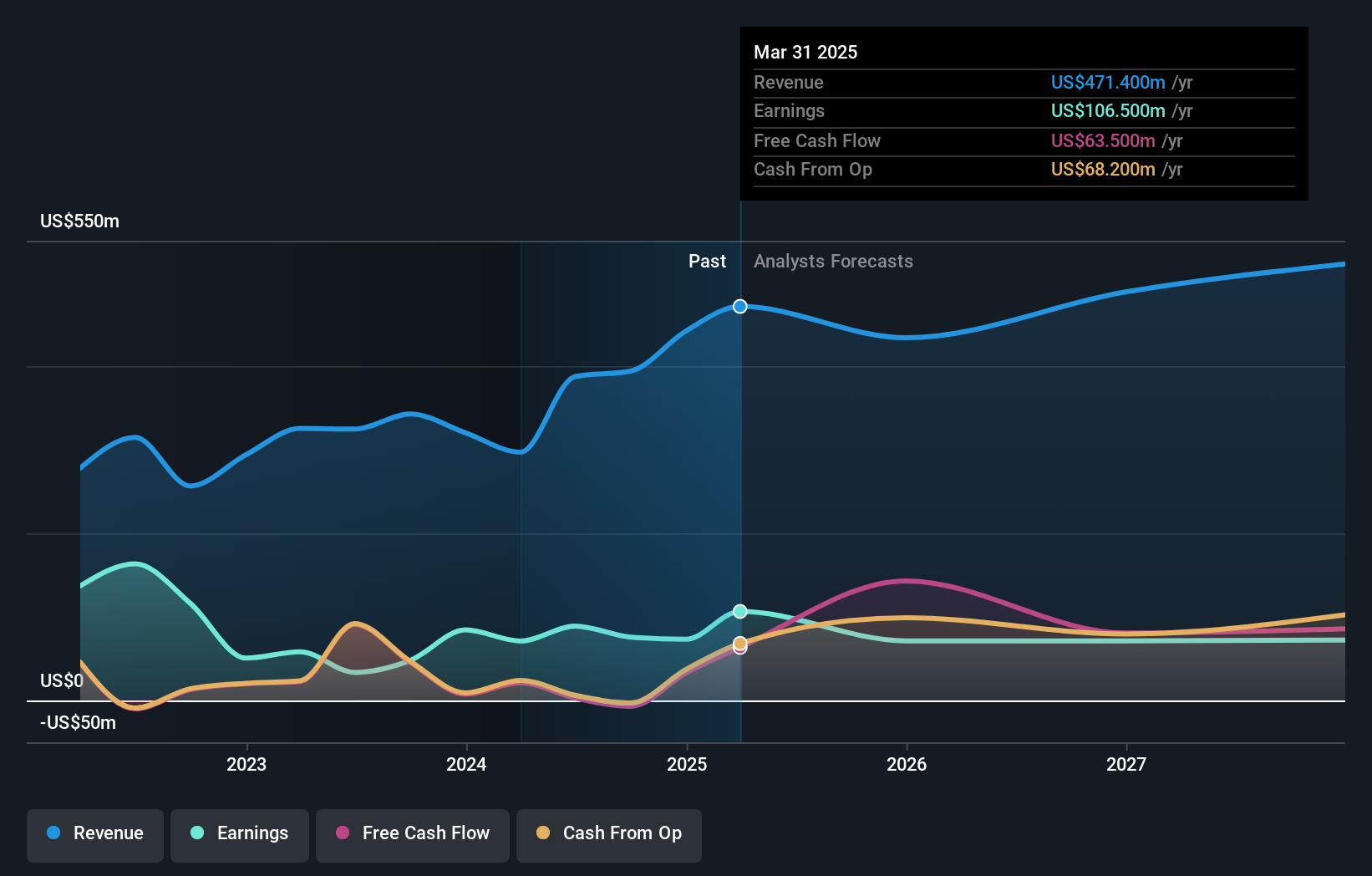

Operations: Centrus Energy generates revenue primarily from two segments: Low-Enriched Uranium (LEU) at $320.80 million and Technical Solutions at $71.80 million, with a segment adjustment of -$5 million.

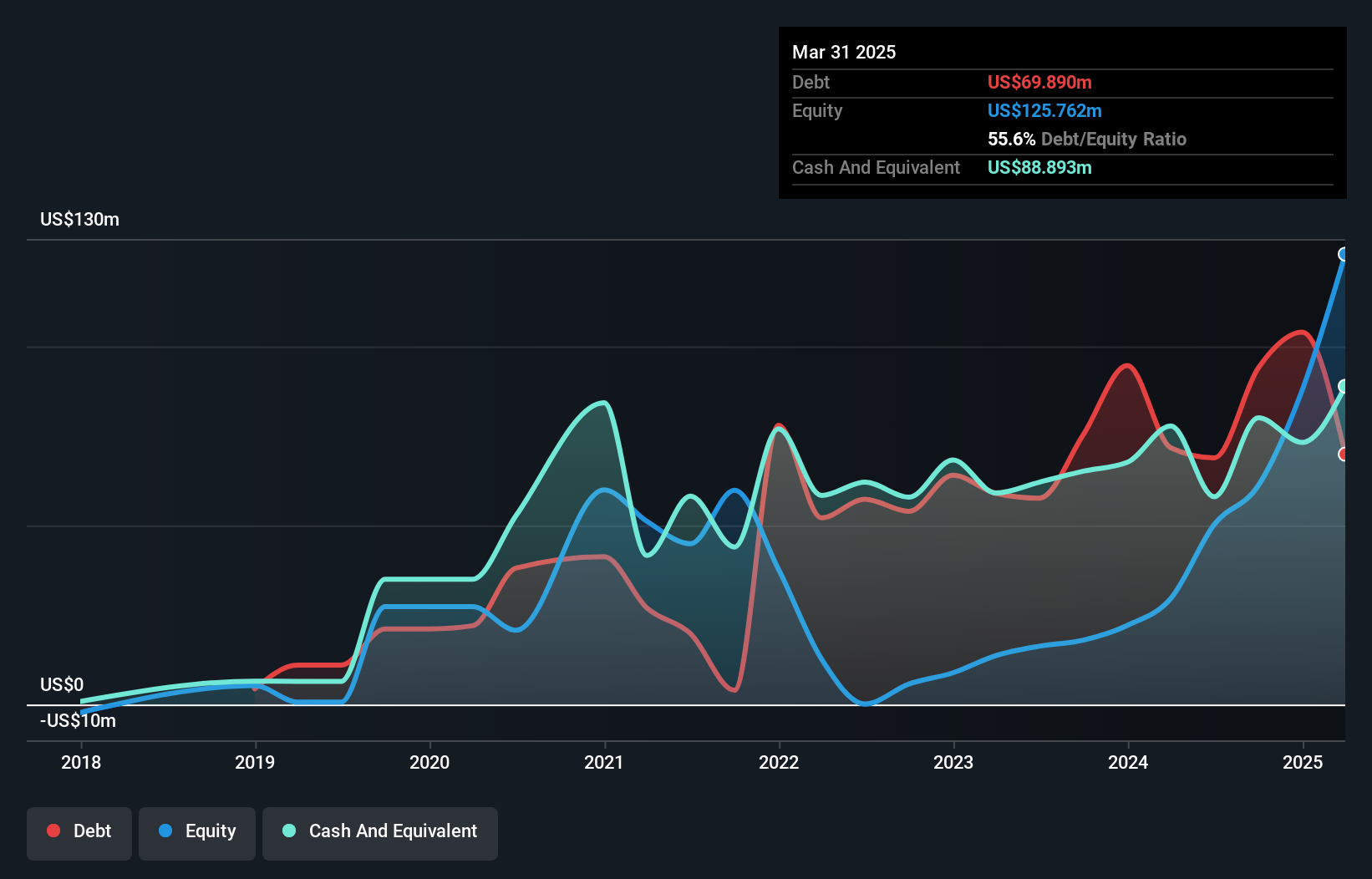

Centrus Energy, a niche player in the nuclear fuel sector, has seen significant growth with earnings surging by 165% over the past year. Trading at 67% below its estimated fair value, it presents an attractive valuation. The company reported Q2 revenue of US$189 million and net income of US$30.6 million, up from US$98.4 million and US$12.7 million respectively a year ago. Centrus has more cash than total debt and recently added Stephanie O'Sullivan to its board for strategic guidance.

- Dive into the specifics of Centrus Energy here with our thorough health report.

Assess Centrus Energy's past performance with our detailed historical performance reports.

Seize The Opportunity

- Investigate our full lineup of 207 US Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:LEU

Centrus Energy

Supplies nuclear fuel components for the nuclear power industry in the United States, Belgium, Japan, the Netherlands, and internationally.

Excellent balance sheet slight.

Similar Companies

Market Insights

Community Narratives