- United States

- /

- Diversified Financial

- /

- NasdaqCM:SEZL

Is Now the Right Moment to Reassess Sezzle After Its 25% Monthly Price Drop?

Reviewed by Bailey Pemberton

- Curious whether Sezzle stock is a hidden value or overpriced in today’s market? You’re not alone, and we’re about to dig deep into what really drives its valuation.

- After a strong start to the year, with shares up 26.0% YTD, Sezzle has seen a sharp pullback recently, dropping 13.5% over the past week and 25.6% for the month.

- Recent headlines have zeroed in on changes in consumer finance trends and the broader shifts in the “buy now, pay later” space, putting Sezzle front and center in discussions about fintech disruption. These evolving dynamics have left investors rethinking both the risks and potential upside moving forward.

- Sezzle currently earns a 2 out of 6 on our valuation checks, meaning it’s undervalued in only 2 of the 6 key criteria we track. We will explore those traditional valuation approaches, and why there might be an even more insightful way to view Sezzle’s true worth later on.

Sezzle scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Sezzle Excess Returns Analysis

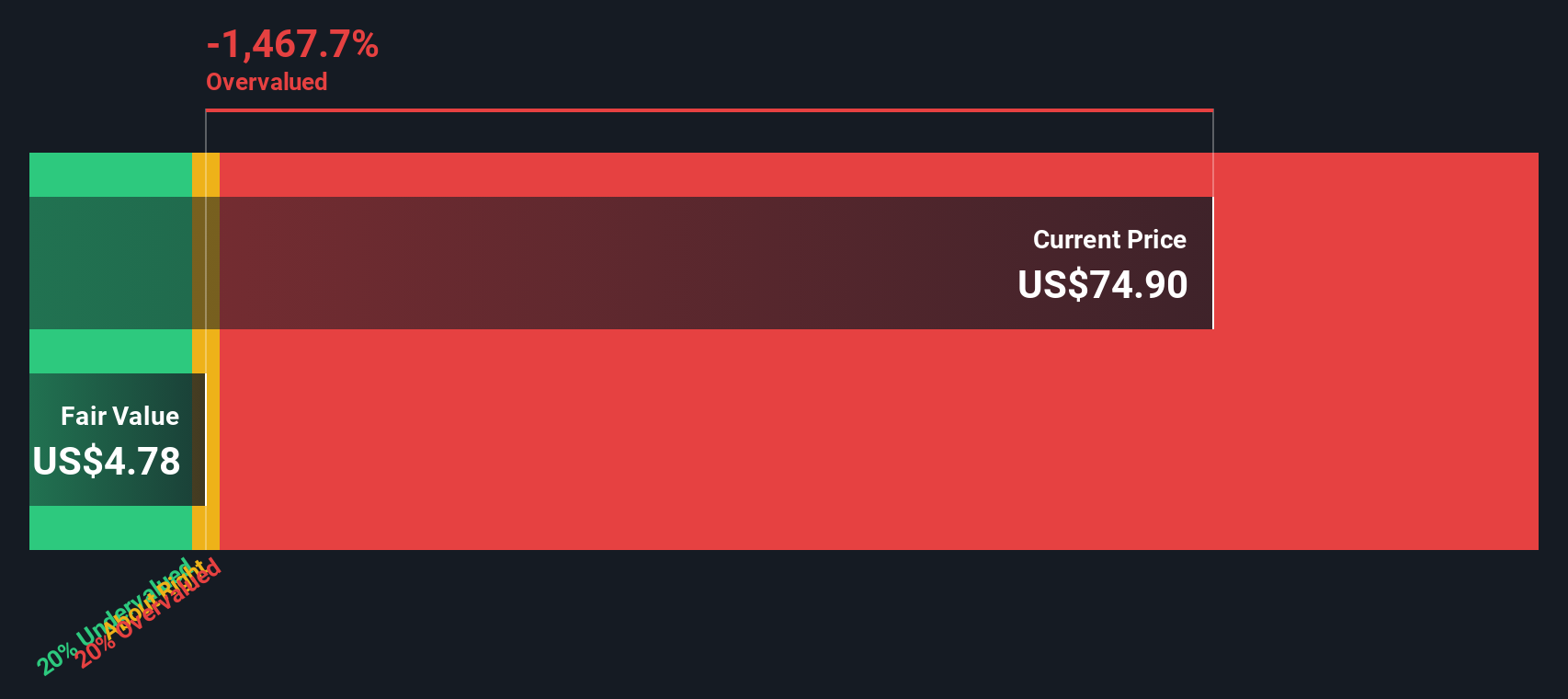

The Excess Returns model estimates a business’s true value by focusing on how much profit it can generate above the minimum return required by investors. This approach is based on the company’s return on equity and growth prospects, rather than just current earnings or cash flows.

According to this model, Sezzle’s current Book Value stands at $4.55 per share, with a Stable EPS of $0.40 per share. These figures are sourced from the median return on equity and book value over the past five years. The average return on equity comes in strong at 45.18%, while the cost of equity is just $0.07 per share. This results in an Excess Return of $0.33 per share, indicating that Sezzle has produced earnings above its cost of capital.

Despite these healthy fundamentals, the Excess Returns model estimates that Sezzle stock is 554.4% above its intrinsic value. This suggests the current share price is significantly disconnected from the sustainable returns the business can generate.

Result: OVERVALUED

Our Excess Returns analysis suggests Sezzle may be overvalued by 554.4%. Discover 883 undervalued stocks or create your own screener to find better value opportunities.

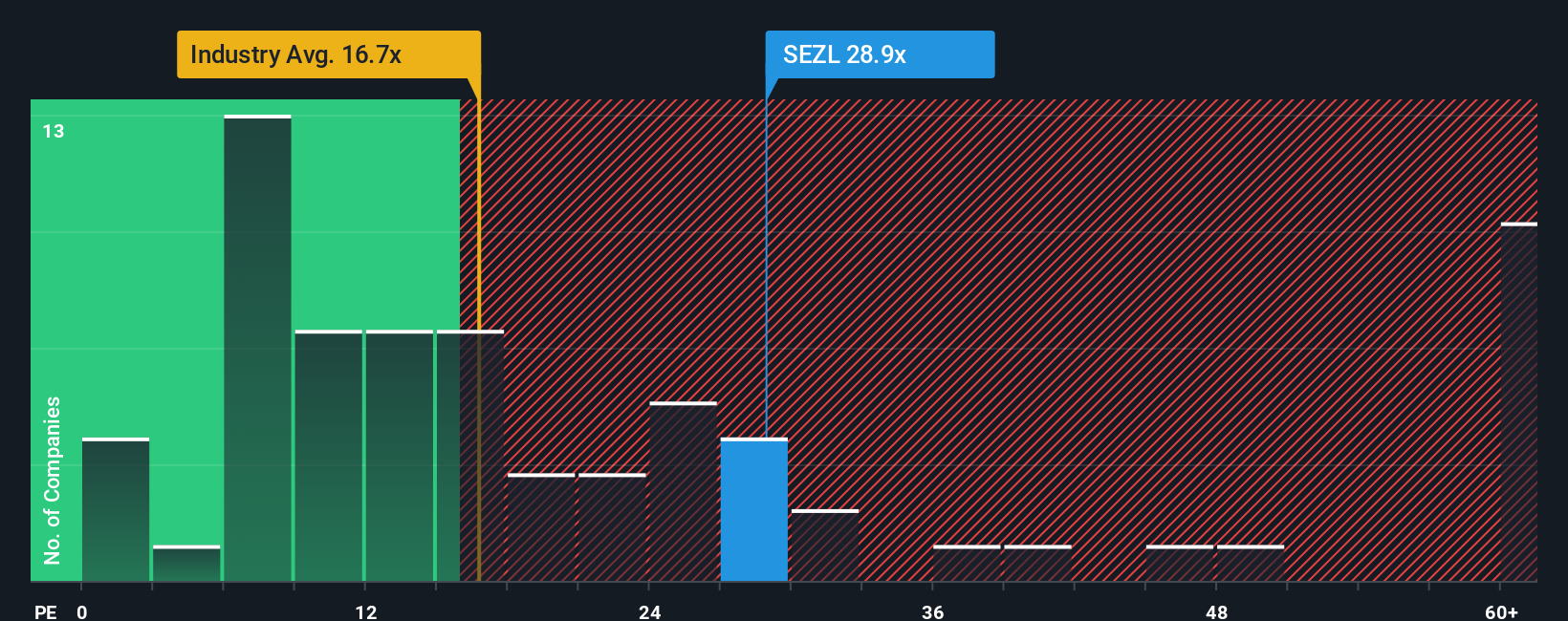

Approach 2: Sezzle Price vs Earnings

The Price-to-Earnings (PE) ratio is widely recognized as a reliable yardstick for valuing profitable companies like Sezzle. Since it compares a company's share price to its earnings per share, the PE ratio reflects how much investors are willing to pay today for a dollar of current earnings. This makes it especially useful for businesses generating consistent profits.

Growth expectations and risk level play a huge role in what qualifies as a "normal" or "fair" PE ratio. Faster-growing, less risky companies typically command higher PE multiples, while mature or riskier businesses tend to trade at lower PEs. Any PE comparison should always consider the company’s future prospects and industry context.

At present, Sezzle trades on a PE ratio of 16.90x. That is notably above the Diversified Financial industry average of 13.31x and well below its peer average of 48.13x. However, these rough benchmarks do not always capture the full picture. This is where Simply Wall St's proprietary Fair Ratio comes in. Sezzle’s Fair Ratio stands at 26.65x, reflecting considerations such as its earnings growth outlook, industry positioning, profit margins, market cap, and overall risk profile. Unlike conventional comparisons, the Fair Ratio uses a holistic approach for a more accurate, company-specific picture.

Comparing Sezzle’s actual PE (16.90x) to its Fair Ratio (26.65x) reveals a significant discount. According to this measure, Sezzle stock appears undervalued relative to its fundamentals and risk-adjusted growth prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1403 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sezzle Narrative

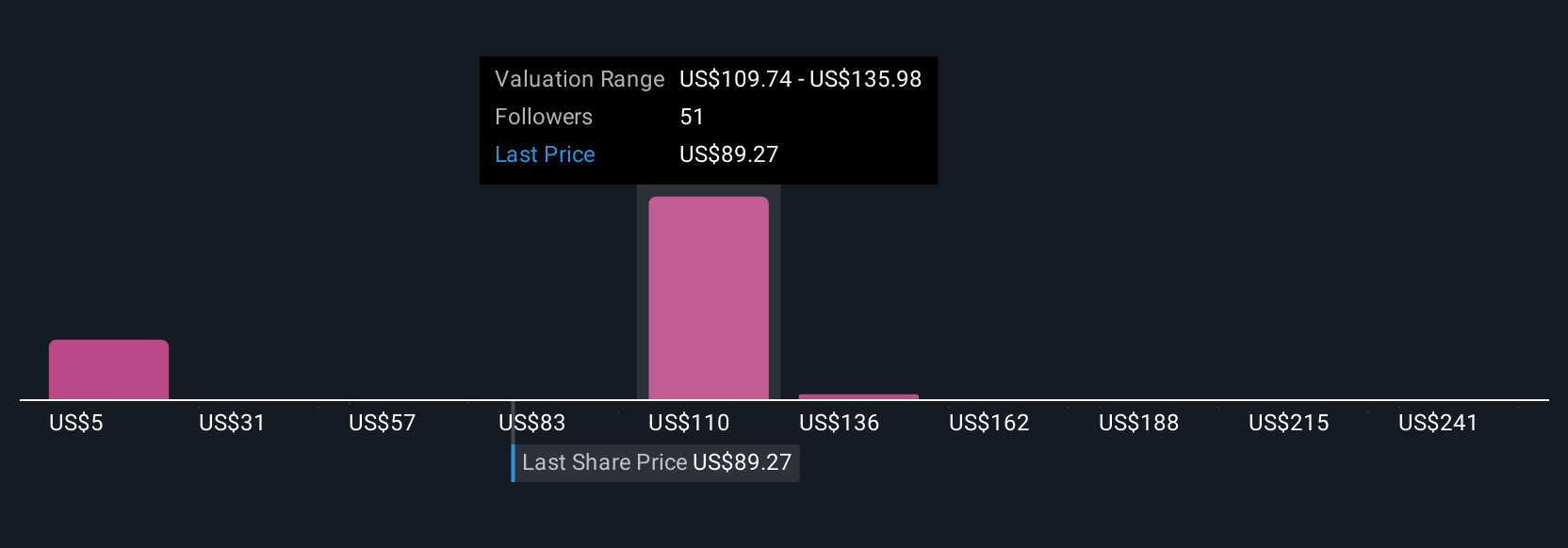

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, a smart, approachable tool used by millions of investors on Simply Wall St's Community page.

A Narrative is your story about a company. It is how you connect the dots between what a business does, its opportunities and threats, your assumptions for future sales, profits, margins, and ultimately, what you think is a fair price for its stock.

Instead of just relying on traditional ratios, Narratives empower investors to bring their own perspective, linking real company trends and personal forecasts to valuation models. It is fast and accessible, letting you adjust your forecasts and see instantly how changes in revenue, earnings, or market sentiment affect Sezzle’s fair value.

As news or earnings updates come in, Narratives dynamically reflect this fresh information in your valuation, keeping your thinking current and relevant. For example, when it comes to Sezzle, one investor might confidently project a fair value as high as $150 based on bullish forecasts for user growth and expanding margins, while a more cautious peer might estimate a far lower target near $111, focusing on risks like credit losses and competition.

Ultimately, Narratives help you decide when to act by showing how your view of Sezzle’s fair value compares to its latest price, putting you firmly in control of your investment decisions.

Do you think there's more to the story for Sezzle? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SEZL

Sezzle

Operates as a technology-enabled payments company primarily in the United States and Canada.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives