- United States

- /

- Capital Markets

- /

- NasdaqGS:SEIC

SEI Investments (SEIC): Evaluating Valuation Following Recent Share Price Pullback

Reviewed by Simply Wall St

SEI Investments (SEIC) has experienced a slight dip in its share price, closing at $82.27. This reflects a 2% decline over the past month. Investors continue to assess the company’s recent performance and growth prospects in light of these movements.

See our latest analysis for SEI Investments.

SEI Investments’ share price has cooled slightly this month, yet the company still boasts a 2.1% total shareholder return over the past year, with a long-term track record that includes a 41% three-year and nearly 62% five-year total return. The recent dip seems more like a breather within a steady growth story rather than a change in momentum, as investors digest both recent performance and evolving expectations for the company’s next phase.

If you’re curious about where else opportunity might be building, now’s an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

With shares pulling back despite solid long-term returns, is SEI Investments offering a rare value opportunity, or are investors already factoring in all of its future growth potential?

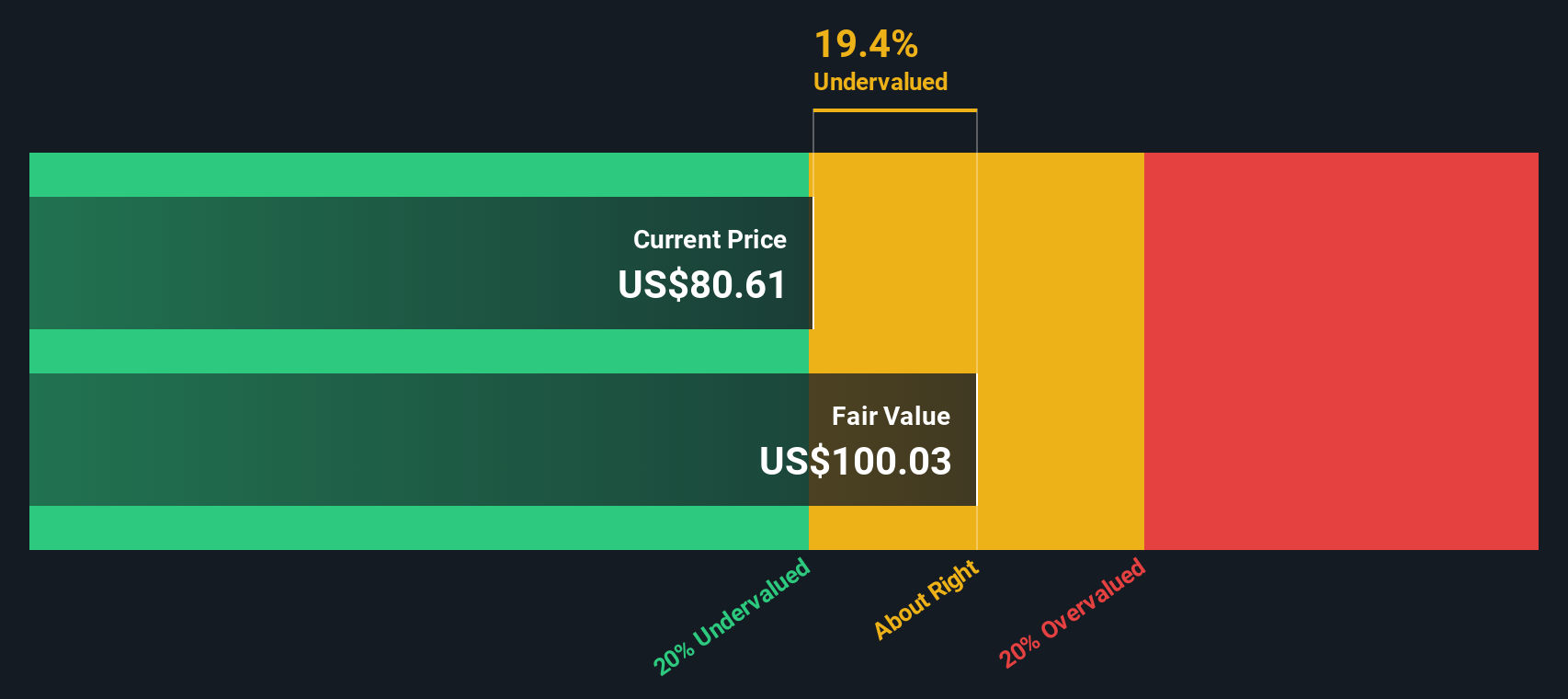

Most Popular Narrative: 14% Undervalued

According to the most popular valuation narrative, SEI Investments’ fair value is estimated above the last close price, implying notable upside if its forecasted growth is realized. The following quote highlights a key driver behind this assessment.

SEI's continued and proactive investment in modern technology platforms, targeting scalability, automation, and cost efficiency, positions the company to capitalize on increasing demand for digital transformation and outsourcing within financial services. This approach is likely driving sustained top-line revenue growth and improving long-term operating margins.

What’s powering this price target? It is not just optimism; it is a bold play on where margins and market reach are headed. The narrative leans on a handful of surprising forecasts insiders believe could reshape the company’s future earnings landscape. The full story unpacks the assumptions that may turn today’s share price into a potential bargain or a missed opportunity.

Result: Fair Value of $96 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued margin pressure and slower client onboarding could challenge the bullish case. These factors may potentially dampen the company’s near-term growth outlook.

Find out about the key risks to this SEI Investments narrative.

Another View: Looking Through the Lens of Our DCF Model

While analysts see upside based on traditional benchmarks, our SWS DCF model provides a different perspective. Using this cash flow-driven approach, SEI Investments appears overvalued, as the current share price is above the model's fair value estimate. Does this divergence reveal hidden risks, or is it overlooking real growth drivers?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SEI Investments for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 885 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own SEI Investments Narrative

If you see things differently or want to dig into the figures on your own terms, it only takes a few minutes to build your perspective. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding SEI Investments.

Looking for More Investment Ideas?

New opportunities are always emerging, and Simply Wall Street can help you find them fast. Don’t let a potential winner pass you by. Take action now:

- Capture steady income with these 15 dividend stocks with yields > 3% featuring strong dividend yields and reliable payouts that can boost your returns over time.

- Seize the potential of the quantum era by checking out these 27 quantum computing stocks. Spot companies that are at the forefront of quantum computing innovation.

- Unearth tomorrow’s market leaders by screening these 27 AI penny stocks, which shine for transformative AI applications and future-facing growth stories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SEIC

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives