- United States

- /

- Capital Markets

- /

- NasdaqGS:PWP

What Perella Weinberg Partners (PWP)’s Promotion of Six New Partners Means For Shareholders

Reviewed by Simply Wall St

- Perella Weinberg Partners recently promoted six Managing Directors to Partners, expanding leadership across healthcare, energy, technology, financial services, and industrials.

- This development reflects a deep bench of expertise, and may reinforce the firm’s reputation for sector-specific advisory strength among clients and market participants.

- We’ll explore how the elevation of experienced leaders to Partner roles shapes Perella Weinberg’s long-term investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Perella Weinberg Partners' Investment Narrative?

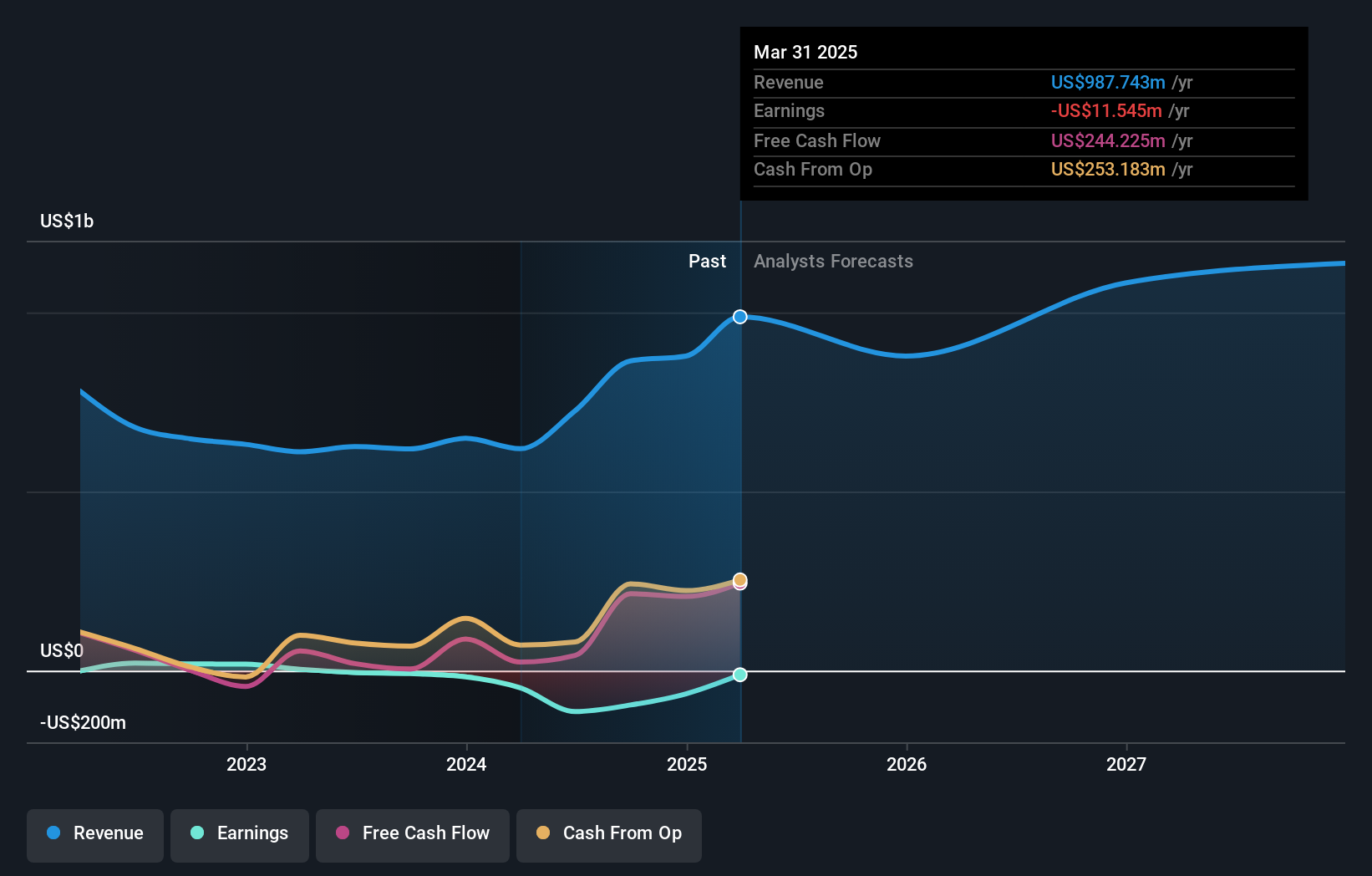

For Perella Weinberg Partners, the long-term thesis rests on the firm’s ability to leverage seasoned sector specialists and maintain client trust even as the business faces profitability challenges. The recent promotion of six Managing Directors to Partners is a tangible step toward deepening leadership across key industries, which may help address concerns around management experience given the previously short average tenure. While this expansion of the partner bench could reinforce client confidence and support revenue generation in advisory-heavy sectors, it alone is unlikely to shift major short-term catalysts such as the pace of deal activity or the impact of recent index exclusions. Risks around sustained unprofitability and increased CEO compensation amid losses remain front of mind, though a more experienced partner group could help to steady the business longer term. The recent 1.44% share price uptick suggests a limited market reaction so far.

But recent insider selling is another factor investors should keep in mind. Upon reviewing our latest valuation report, Perella Weinberg Partners' share price might be too pessimistic.Exploring Other Perspectives

Build Your Own Perella Weinberg Partners Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Perella Weinberg Partners research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Perella Weinberg Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Perella Weinberg Partners' overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover 17 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PWP

Perella Weinberg Partners

An independent advisory firm, provides strategic and financial advice services in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives