- United States

- /

- Mortgage REITs

- /

- NasdaqGS:ADAM

How Should Investors React To New York Mortgage Trust, Inc.'s (NASDAQ:NYMT) CEO Pay?

In 2009 Steve Mumma was appointed CEO of New York Mortgage Trust, Inc. (NASDAQ:NYMT). This report will, first, examine the CEO compensation levels in comparison to CEO compensation at companies of similar size. Then we'll look at a snap shot of the business growth. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. This method should give us information to assess how appropriately the company pays the CEO.

View our latest analysis for New York Mortgage Trust

How Does Steve Mumma's Compensation Compare With Similar Sized Companies?

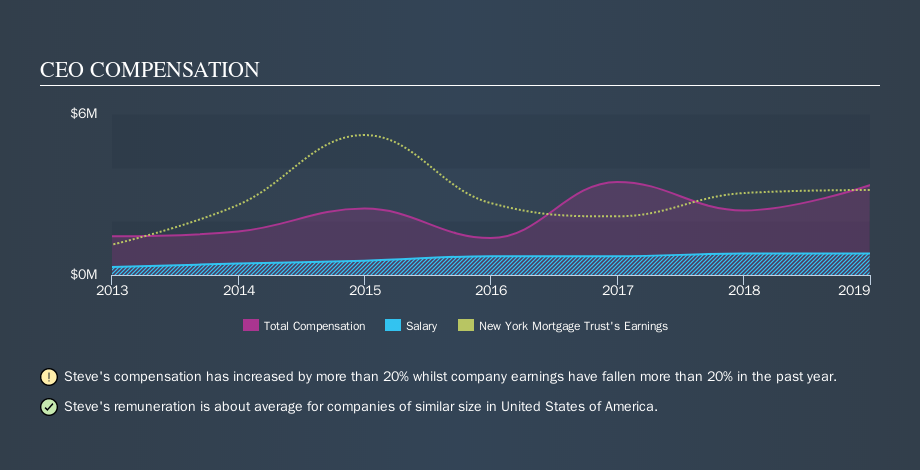

Our data indicates that New York Mortgage Trust, Inc. is worth US$1.6b, and total annual CEO compensation was reported as US$3.3m for the year to December 2018. While this analysis focuses on total compensation, it's worth noting the salary is lower, valued at US$800k. We note that more than half of the total compensation is not the salary; and performance requirements may apply to this non-salary portion. We examined companies with market caps from US$1.0b to US$3.2b, and discovered that the median CEO total compensation of that group was US$4.1m.

That means Steve Mumma receives fairly typical remuneration for the CEO of a company that size. Although this fact alone doesn't tell us a great deal, it becomes more relevant when considered against the business performance. Shareholders might be interested in this free visualization of analyst forecasts.

The graphic below shows how CEO compensation at New York Mortgage Trust has changed from year to year.

Is New York Mortgage Trust, Inc. Growing?

Over the last three years New York Mortgage Trust, Inc. has grown its earnings per share (EPS) by an average of 15% per year (using a line of best fit). It achieved revenue growth of 5.2% over the last year.

This demonstrates that the company has been improving recently. A good result. It's nice to see a little revenue growth, as this is consistent with healthy business conditions.

Has New York Mortgage Trust, Inc. Been A Good Investment?

Most shareholders would probably be pleased with New York Mortgage Trust, Inc. for providing a total return of 54% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Steve Mumma is paid around what is normal the leaders of comparable size companies.

The company is growing earnings per share and total shareholder returns have been pleasing. Although the pay is a normal amount, some shareholders probably consider it fair or modest, given the good performance of the stock. If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at New York Mortgage Trust.

If you want to buy a stock that is better than New York Mortgage Trust, this free list of high return, low debt companies is a great place to look.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:ADAM

Adamas Trust

Acquires, invests in, finances, and manages mortgage-related single-family and multi-family residential assets in the United States.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026