- United States

- /

- Capital Markets

- /

- NasdaqGS:NTRS

The Bull Case For Northern Trust (NTRS) Could Change Following New Wealth CIO And AJ Bell Mandate

Reviewed by Sasha Jovanovic

- Northern Trust has appointed Eric Freedman as Chief Investment Officer for its Wealth Management business and, alongside Carne Group, is now providing asset servicing and Authorised Corporate Director support for AJ Bell’s nine in-house multi-asset funds, which together hold about £5.00 billion (approx. US$6.50 billion) in assets.

- The combination of new investment leadership and a sizeable UK fund servicing mandate highlights how Northern Trust is refining its wealth platform while expanding its role in outsourced investment operations for retail-focused managers.

- Next, we’ll examine how Eric Freedman’s appointment as Wealth Management CIO could influence Northern Trust’s investment narrative and growth priorities.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Northern Trust Investment Narrative Recap

To own Northern Trust, you need to believe in its ability to compound fee-based wealth and asset servicing revenue while steadily lifting margins through technology and scale. The Eric Freedman appointment and the AJ Bell fund servicing win do not materially change the near term picture, where the key catalyst remains execution on operating leverage and the main risk is that growth continues to trail broader capital markets peers.

Among recent announcements, the AJ Bell mandate stands out as most connected to this leadership change. It reinforces Northern Trust’s positioning in outsourced fund operations for retail-focused managers, which ties directly into the company’s effort to boost fee income and improve profitability. How effectively the firm converts similar wins into broader cross-selling and margin improvement will be central to the investment case over the next few years.

Yet behind this steady progress, investors should be aware that slower expected revenue and earnings growth versus the wider US market could...

Read the full narrative on Northern Trust (it's free!)

Northern Trust's narrative projects $8.2 billion revenue and $1.4 billion earnings by 2028.

Uncover how Northern Trust's forecasts yield a $134.36 fair value, in line with its current price.

Exploring Other Perspectives

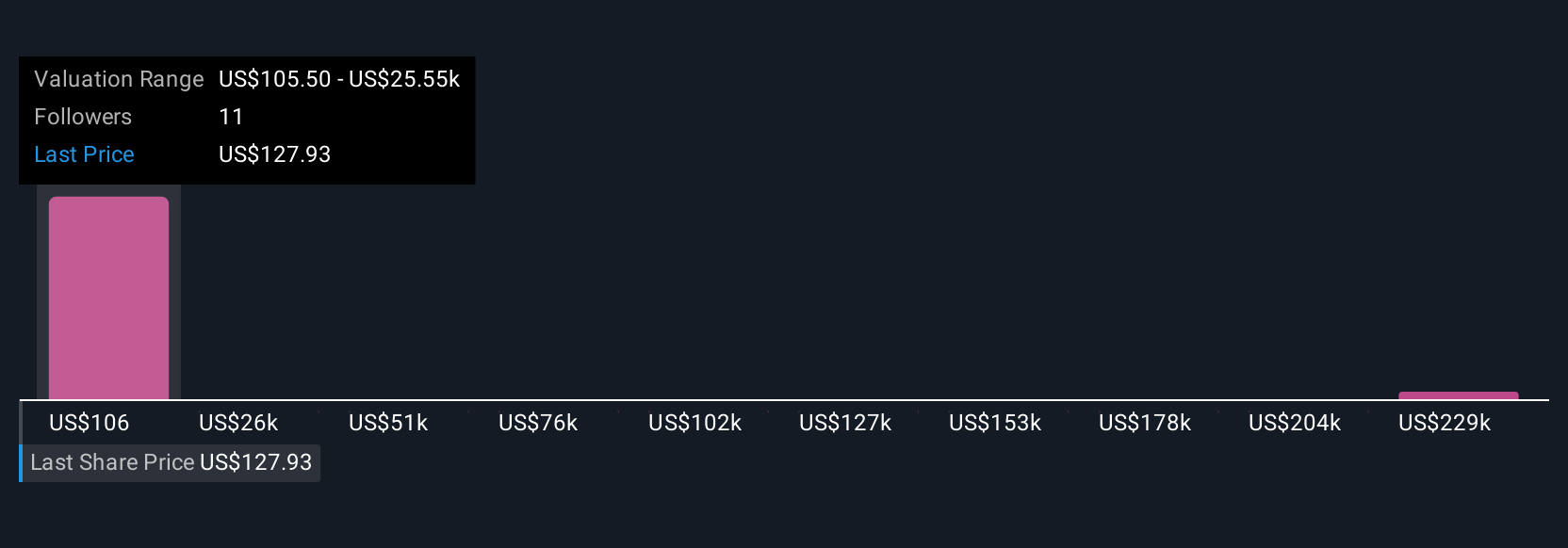

Four members of the Simply Wall St Community estimate fair value for Northern Trust between US$114 and an extreme outlier above US$250,000, showing how far personal models can diverge. Against this wide spread of opinions, the core debate remains whether Northern Trust’s efforts to improve operating leverage and margins can offset its slower forecast growth compared with the broader US market.

Explore 4 other fair value estimates on Northern Trust - why the stock might be a potential multi-bagger!

Build Your Own Northern Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Northern Trust research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Northern Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Northern Trust's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northern Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTRS

Northern Trust

A financial holding company, provides wealth management, asset servicing, asset management, and banking solutions for corporations, institutions, families, and individuals worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026