- United States

- /

- Capital Markets

- /

- NasdaqGS:NTRS

Should Northern Trust’s (NTRS) Swift Partnership on Digital Carbon Credits Prompt Investor Action?

Reviewed by Simply Wall St

- In July 2025, Northern Trust announced a partnership with Swift to test tokenized asset transactions, such as carbon credits, using commercial bank accounts in Australia as part of Project Acacia, overseen by the Reserve Bank of Australia and DFCRC.

- This collaboration not only trialed interoperability between traditional banking and digital assets but also extended Northern Trust's footprint in digital carbon credit infrastructure and sustainable finance.

- We’ll examine how Northern Trust’s push into digital asset settlement could shape its investment outlook and long-term growth prospects.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Northern Trust Investment Narrative Recap

Being a Northern Trust shareholder often comes down to believing in the company's ability to blend traditional financial services with digital innovation, particularly in sustainable finance. The recent partnership with Swift to test tokenized asset settlement in Australia is an incremental, rather than transformative, development in the near term; it does not alter the biggest current catalysts for the stock, which remain ongoing efficiency improvements and client growth. The chief risk for the business continues to be market volatility and delays in client decision-making, which could slow new business and future revenue.

Of the recent announcements, the rumored takeover approach by Bank of New York Mellon in late June is one of the most relevant events, as it created significant short-term volatility and drew attention to Northern Trust’s valuation and growth prospects. However, management's stated commitment to remaining independent means that catalysts driving organic growth, like continued development of digital asset infrastructure, are still central to the company's future direction.

However, keep in mind that the risk of slower new client mandates from market volatility is something every investor should understand before...

Read the full narrative on Northern Trust (it's free!)

Northern Trust's outlook anticipates $8.1 billion in revenue and $1.4 billion in earnings by 2028. This scenario assumes a 2.0% annual decline in revenue and a $0.7 billion decrease in earnings from the current $2.1 billion level.

Exploring Other Perspectives

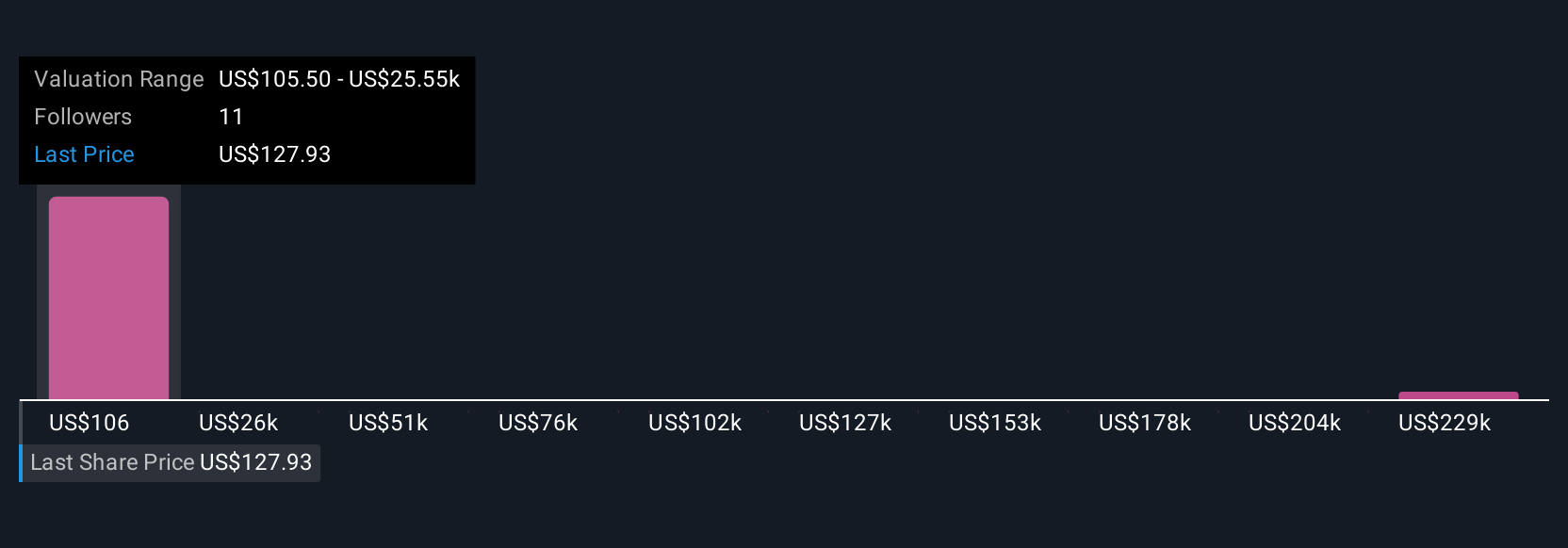

Fair value estimates from four Simply Wall St Community members span from US$105.50 to an outlier at US$254,541.26, showing a broad divergence in valuation opinions. While some expect surging growth from digital initiatives, you should weigh this against the real risk that heightened market uncertainty may affect client growth and revenue trends, consider seeking out these alternative views to inform your own analysis.

Build Your Own Northern Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Northern Trust research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Northern Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Northern Trust's overall financial health at a glance.

No Opportunity In Northern Trust?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover 17 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northern Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTRS

Northern Trust

A financial holding company, provides wealth management, asset servicing, asset management, and banking solutions for corporations, institutions, families, and individuals worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives