- United States

- /

- Capital Markets

- /

- NasdaqGS:NTRS

Northern Trust (NTRS): Revisiting Valuation After New CIO Appointment and AJ Bell Servicing Mandate

Reviewed by Simply Wall St

Northern Trust (NTRS) just tightened its focus on wealth and asset servicing, naming Eric Freedman Chief Investment Officer for Wealth Management and winning a sizable servicing mandate from UK platform AJ Bell.

See our latest analysis for Northern Trust.

These leadership and client wins are landing against a solid backdrop, with the share price delivering a year to date share price return of 29.34 percent and a robust 5 year total shareholder return of 72.15 percent. This suggests momentum is still building as investors warm to Northern Trust’s growth and risk profile.

If these moves have you thinking beyond global custodians, it could be a good moment to scan the market for fast growing stocks with high insider ownership and see which other names are quietly gaining conviction support.

With the shares trading near analyst targets after a nearly 30 percent year-to-date rally, investors face a pivotal question: Is Northern Trust still undervalued, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 0.9% Undervalued

With Northern Trust last closing at $133.21 against a narrative fair value of about $134.36, the story hinges on modest upside and finely balanced expectations.

The analysts have a consensus price target of $117.786 for Northern Trust based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $135.0, and the most bearish reporting a price target of just $101.0.

Want to see why modest revenue drift, shrinking margins, and a higher future earnings multiple still support this fair value math? The full narrative breaks down the earnings path, the discount rate, and the share count assumptions driving that finely tuned upside call.

Result: Fair Value of $134.36 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rapid growth in private markets and successful AI driven efficiency gains could extend margin expansion and challenge the notion that current profitability is near peak.

Find out about the key risks to this Northern Trust narrative.

Another Lens On Value

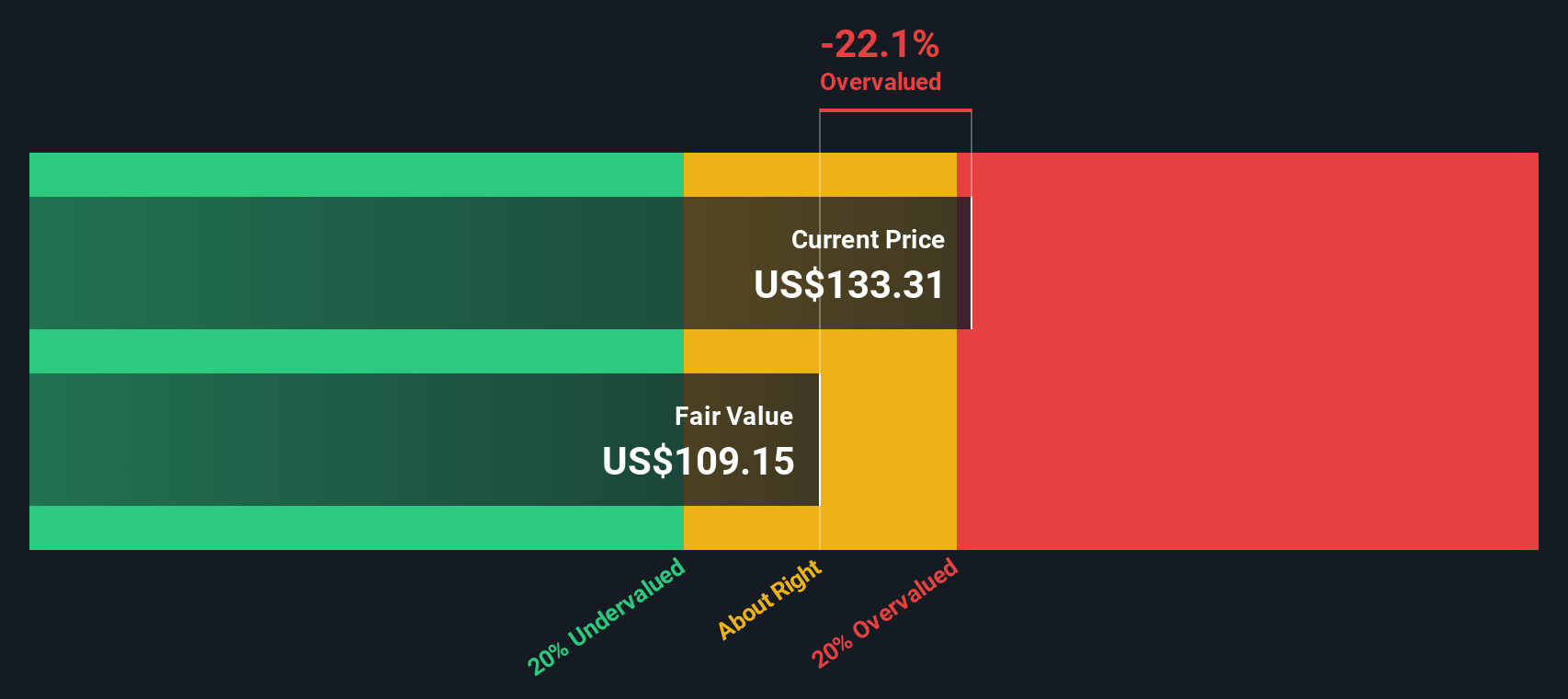

Analysts see Northern Trust as roughly fairly priced against their 2028 earnings assumptions, but our SWS DCF model suggests the shares at $133.21 sit above an intrinsic value of about $118.15, implying limited margin of safety. Which narrative do you trust when growth cools?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Northern Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Northern Trust Narrative

If you are not fully convinced by this view or would rather dig into the numbers yourself, you can craft a tailored narrative in minutes: Do it your way.

A great starting point for your Northern Trust research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

If Northern Trust has sharpened your thinking, do not stop here. The Simply Wall St Screener surfaces fresh opportunities that others may be overlooking right now.

- Capture potential mispricing by targeting companies trading below their estimated cash flow value using these 907 undervalued stocks based on cash flows before the market fully catches on.

- Position yourself for long term innovation by scanning these 26 AI penny stocks that are building real businesses around artificial intelligence, not just riding the hype.

- Strengthen your income stream by focusing on these 15 dividend stocks with yields > 3% that pair attractive yields with balance sheets built to sustain payouts through different cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northern Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTRS

Northern Trust

A financial holding company, provides wealth management, asset servicing, asset management, and banking solutions for corporations, institutions, families, and individuals worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026