- United States

- /

- Capital Markets

- /

- NasdaqGS:NDAQ

Nasdaq (NDAQ): Exploring Valuation as Regulatory Tech Partnership With Revolut Expands Across Europe

Reviewed by Simply Wall St

Nasdaq (NDAQ) has expanded its regulatory technology partnership with fintech company Revolut, highlighting the growing demand for comprehensive compliance solutions in the fintech sector. This move focuses on expanded use of Nasdaq’s AxiomSL platform, a cloud-enabled solution for regulatory reporting and risk management now adopted across Europe.

See our latest analysis for Nasdaq.

Nasdaq’s move to deepen its partnership with Revolut comes as the company rides a wave of renewed investor interest. Its 1-year total shareholder return is a robust 12.7%, and shares are up 17.4% so far in 2025. Momentum has clearly been building over the past month, suggesting that the market may be viewing Nasdaq’s tech-driven strategy as a growth lever that could outweigh short-term uncertainties.

If Nasdaq’s regulatory tech ambitions caught your attention, the next step is to broaden your radar and discover fast growing stocks with high insider ownership

With Nasdaq’s shares trading below their average analyst price target, but with a higher price-to-earnings ratio compared to peers, the question now is whether the stock actually offers long-term value or if future growth is already reflected in the current price.

Most Popular Narrative: 11.8% Undervalued

At $90.92, Nasdaq shares currently sit below the narrative’s fair value of $103.13. This gap raises important questions about market optimism versus longer-term expectations, and investors are watching to see if the company can maintain its momentum.

Nasdaq's strategic investments in product innovation, international market expansion, and new product launches, especially in the index business, are expected to drive sustained revenue growth. These initiatives aim to strengthen their global position and diversify revenue streams from the Nasdaq 100, supporting long-term earnings performance.

What’s powering analyst optimism here? Dive into the full narrative to uncover the relentless profit expansion, international plays, and a high-growth formula that go beyond short-term trends. The drivers behind that higher fair value may surprise you, so see the underlying assumptions and projections for yourself.

Result: Fair Value of $103.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macroeconomic uncertainty and fierce industry competition could quickly challenge the optimistic outlook and stall Nasdaq's projected growth trajectory.

Find out about the key risks to this Nasdaq narrative.

Another View: What Do Earnings Multiples Say?

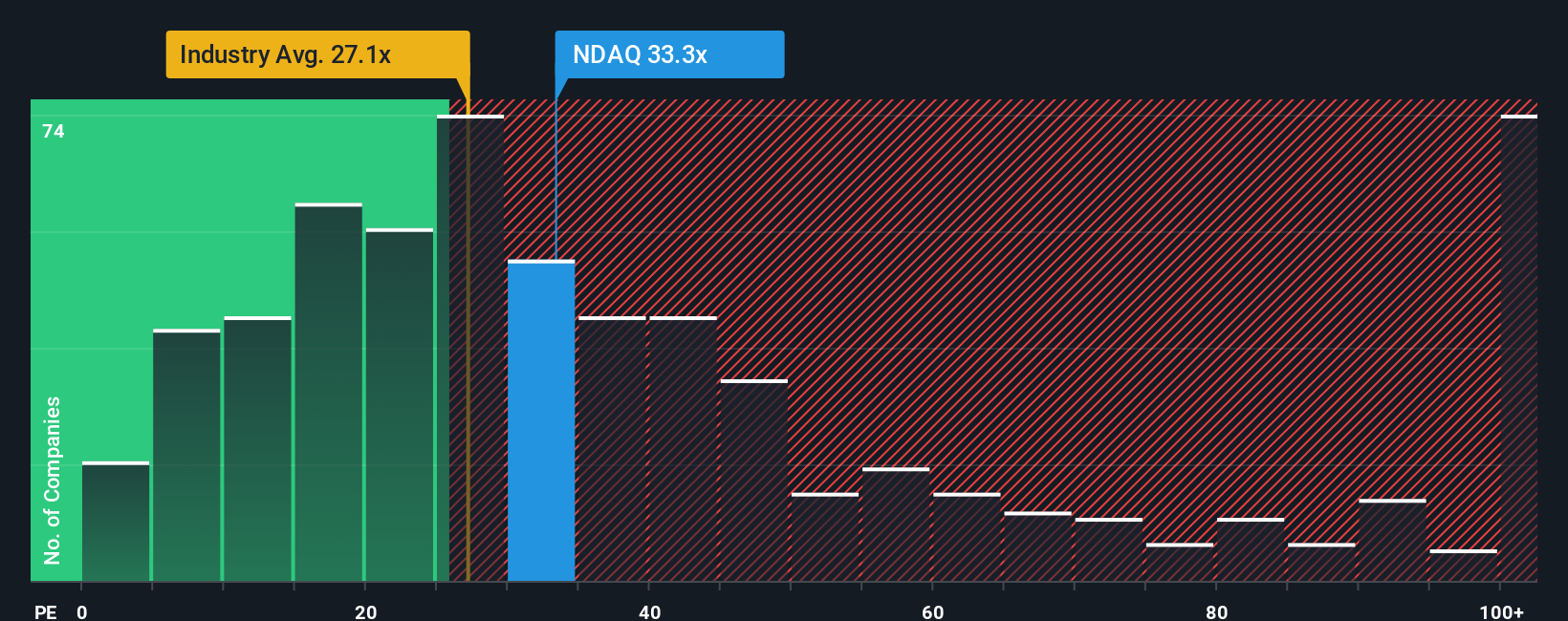

Looking at Nasdaq’s valuation through the lens of its price-to-earnings ratio shows a more cautious picture. The company trades at 31.9x, more expensive than the US Capital Markets industry average of 23.8x and well above the fair ratio of 16x. This gap could signal valuation risk if market sentiment shifts. Could this premium be justified long term?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nasdaq Narrative

If you see things differently or want to dig deeper on your own, you can shape your own perspective in under three minutes. Do it your way

A great starting point for your Nasdaq research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Step up your investing game and get ahead of the next opportunity by checking out stocks with untapped potential, bold growth, and powerful trends. Don’t miss out on the chance to expand your watchlist with these standout ideas.

- Start building wealth with these 919 undervalued stocks based on cash flows trading for less than their fair value, offering more upside for every dollar invested.

- Unlock fresh income streams by browsing these 15 dividend stocks with yields > 3% boasting yields over 3%, a potential source of steady returns in any market.

- Ride the AI boom and target tomorrow’s leaders by reviewing these 25 AI penny stocks at the intersection of innovation and long-term opportunity.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nasdaq might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NDAQ

Nasdaq

Operates as a technology company that serves capital markets and other industries worldwide.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026