- United States

- /

- Capital Markets

- /

- NasdaqGS:MORN

Does Morningstar’s Overhauled Medalist Ratings Methodology Change The Bull Case For Morningstar (MORN)?

Reviewed by Sasha Jovanovic

- Morningstar, Inc. has announced significant global updates to its forward-looking Morningstar Medalist Rating for managed investments, scheduled to go live in April 2026, including greater transparency into inputs, a new explicit Price Score, and fixed rating thresholds.

- A particularly distinctive change is the tenure-weighted “Fund Manager Successful Experience” metric, which tracks managers’ month-by-month excess returns versus category indexes over the past decade.

- Next, we’ll explore how these methodology changes, especially the new Price Score tying fees directly into ratings, could reshape Morningstar’s investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Morningstar's Investment Narrative?

For someone considering Morningstar, you really need to believe in the long-term relevance of its independent data, ratings, and software to advisors and institutions, even if near-term growth is more steady than spectacular. The new Medalist Rating overhaul fits that thesis: it deepens transparency, formalizes how fees shape ratings, and leans on clear, rules-based thresholds, which should reinforce Morningstar’s brand with professionals rather than fundamentally change the economic engine overnight. With revenue and earnings still growing, high returns on equity, and a share price well below consensus targets, the bigger short term catalysts look tied to execution in newer products like PitchBook-linked indexes and retirement solutions, plus the recent management reshuffle. The main risk is that slower revenue growth and intense competition in research and data limit how much pricing power Morningstar can sustain over time.

Morningstar's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

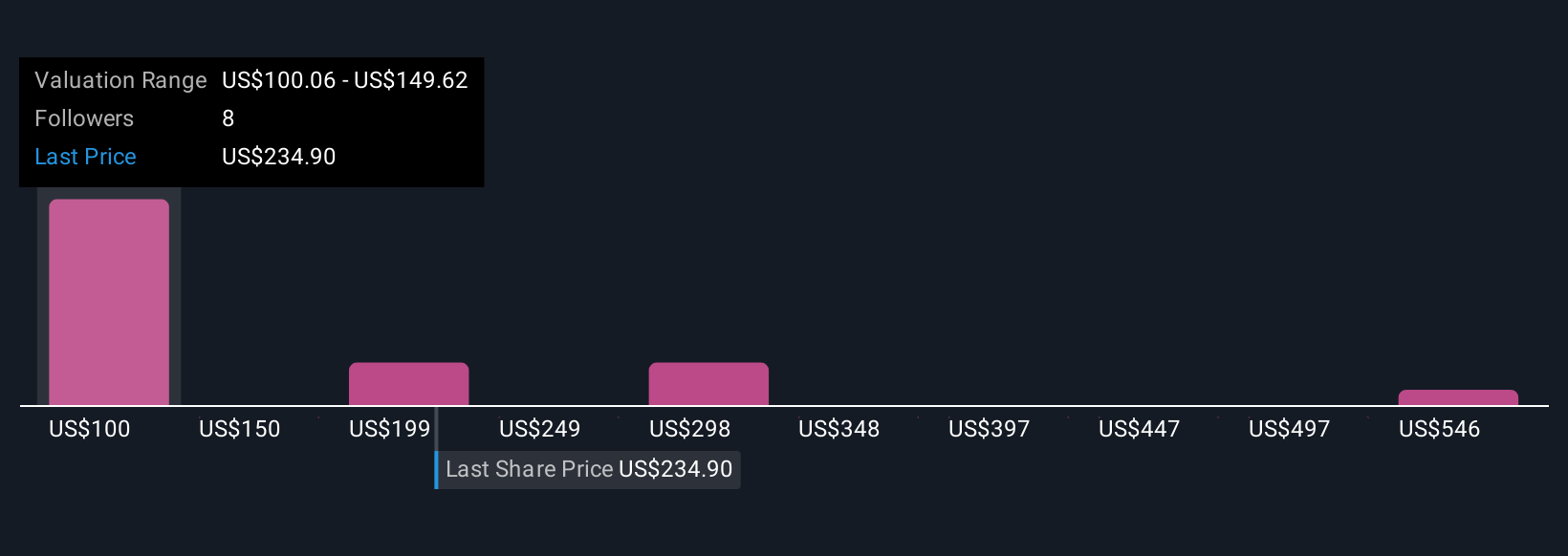

Eight Simply Wall St Community fair value estimates for Morningstar range from about US$94 to a very large figure near US$596, reflecting sharply different expectations. Set against the recent Medalist Rating overhaul and a share price still well below analyst targets, this spread underlines how differently people weigh Morningstar’s brand strength against competitive and growth risks. Readers may want to compare several of these views before deciding what Morningstar’s quality and pricing power are really worth.

Explore 8 other fair value estimates on Morningstar - why the stock might be worth over 2x more than the current price!

Build Your Own Morningstar Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Morningstar research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Morningstar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Morningstar's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MORN

Morningstar

Provides independent investment insights in the United States, Asia, Australia, Canada, Continental Europe, the United Kingdom, and internationally.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026