- United States

- /

- Capital Markets

- /

- NasdaqGS:MKTX

Assessing MarketAxess Holdings (MKTX) Valuation Following Launch of Axess IQ Connect and Increased Investor Focus

Reviewed by Kshitija Bhandaru

MarketAxess Holdings (MKTX) has just rolled out Axess IQ Connect, a global web-based platform designed for Private Banks and Wealth Managers. This move highlights the firm's commitment to streamlining fixed-income trading by providing real-time insights and advanced technology.

See our latest analysis for MarketAxess Holdings.

The launch of Axess IQ Connect follows a series of moves by MarketAxess Holdings to deliver fresh technology and boost its industry profile. This includes recent index inclusions that caught investor attention. Despite these developments, persistent sector headwinds have weighed on performance. Over the past year, the total shareholder return stands at -0.37%, with momentum struggling to build in recent months.

If you're looking for your next investing prompt, it's a great time to broaden your search and discover fast growing stocks with high insider ownership

With the stock now trading at a notable discount to analyst price targets, and with recent innovations headline the story, investors have to ask whether this is a bargain entry point or if the market already reflects future growth prospects.

Most Popular Narrative: 22% Undervalued

With the last close at $170.50 and the narrative's fair value estimate at $218.83, analysts see significant potential upside for MarketAxess Holdings compared to recent market pricing. The stage is set for a debate on whether future innovations and digital expansion will bridge this valuation gap.

The company is rapidly expanding into new geographies and asset classes, particularly through its growth in emerging markets (EM) and Eurobonds. These areas saw more than 20% volume growth and double-digit commission revenue increases, suggesting the addressable market is broadening and could support higher long-term revenue and earnings.

Want to know what underpins such optimism? The narrative hinges on ambitious growth assumptions, bold shifts in profit margins, and a long-term performance outlook that most investors would not expect. Which financial lever drives this narrative higher? Dive deeper to discover the surprising forecasts and the story behind this valuation.

Result: Fair Value of $218.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on U.S. high-grade bonds and rising competition from established rivals could threaten MarketAxess's market share and reduce growth momentum.

Find out about the key risks to this MarketAxess Holdings narrative.

Another View: Looking at Market Comparisons

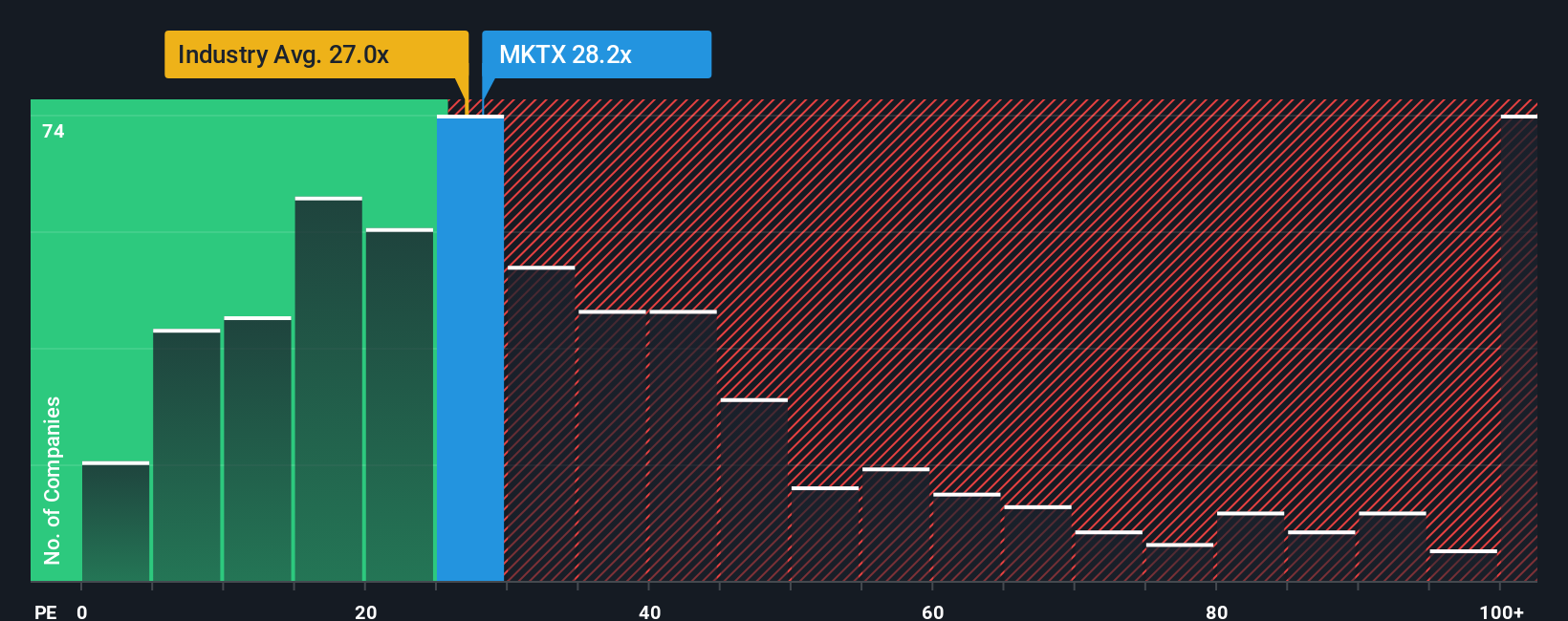

While analysts see upside based on future growth, a different approach highlights concerns. The current price-to-earnings ratio is 28.6x, notably above the industry average of 27.1x and the peer average of 27.9x. Importantly, the fair ratio is just 15.8x. This gap suggests the market is already pricing in a lot of optimism, so is there more risk here than meets the eye?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MarketAxess Holdings Narrative

If this perspective doesn’t align with your own, or you prefer to dive into the numbers firsthand, you can craft your own view of MarketAxess Holdings in just a few minutes. Do it your way

A great starting point for your MarketAxess Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Opportunity doesn't wait. Fuel your investing journey with the smartest picks on Simply Wall Street. Act now and get ahead of the next big trend.

- Boost your passive income and maximize returns by checking out these 19 dividend stocks with yields > 3% with yields over 3% backed by healthy fundamentals.

- Uncover the hidden value in the market by examining these 886 undervalued stocks based on cash flows that stand out for strong cash flow and impressive potential.

- Ride the exciting wave of technological disruption and innovation in healthcare through these 32 healthcare AI stocks making breakthroughs in medical AI solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MKTX

MarketAxess Holdings

Operates an electronic trading platform for institutional investor and broker-dealer firms in the United States, the United Kingdom, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives