- United States

- /

- Diversified Financial

- /

- NasdaqGS:JKHY

Jack Henry & Associates (JKHY): Assessing Valuation After Recent Sector Weakness

Reviewed by Simply Wall St

Jack Henry & Associates (JKHY) shares have edged lower over the past week, following a modest pullback seen across a number of financial tech names. Investors seem to be weighing recent performance and considering how broader sector movements may impact the company in the future.

See our latest analysis for Jack Henry & Associates.

After a tough start to the year, Jack Henry & Associates’ 1-year total shareholder return of -18.1% shows momentum has been fading. The latest share price has settled near $148.94 despite a few recent sector jitters. Short-term volatility has added to longer-term underperformance, leaving investors reassessing the outlook for a recovery.

If you’re wondering what other movers are out there, it could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares drifting this year and some valuation measures suggesting a potential discount, investors may be left wondering whether Jack Henry & Associates is an overlooked value or if the market has already accounted for future growth prospects.

Most Popular Narrative: 15.9% Undervalued

Jack Henry & Associates last closed at $148.94, while the most popular narrative puts fair value at $177. This indicates significant upside potential if the projections play out. The gap between the current share price and narrative fair value sets up a crucial debate around growth, margins, and whether upward momentum can return.

The company is experiencing accelerated adoption of its cloud-native platforms and SaaS offerings (cloud revenue up 11% year-over-year, now 32% of total revenue and 77% of core clients hosted in private cloud). This trend is expected to drive higher recurring revenue, improved margins, and higher free cash flow conversion as legacy on-premise contracts decline.

What could send shares surging back toward fair value? This narrative hinges on ambitious growth and margin gains tied to major business transformation. Want to uncover the earnings and profit assumptions underpinning these bold projections? See the full story and decide if this momentum is sustainable.

Result: Fair Value of $177 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent banking sector consolidation and mounting pressure on contract pricing could still challenge Jack Henry's growth and the optimistic outlook favored by some analysts.

Find out about the key risks to this Jack Henry & Associates narrative.

Another View: What Do Market Ratios Say?

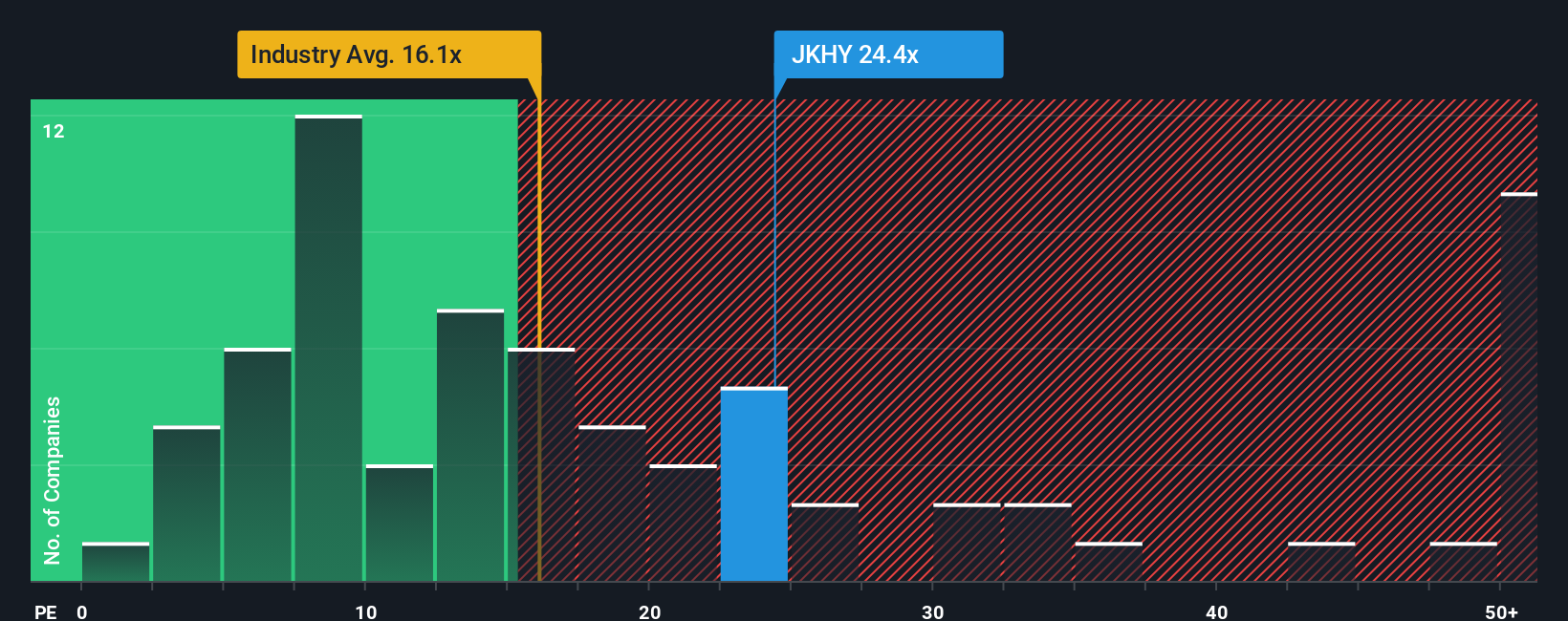

Looking at Jack Henry & Associates through the lens of price-to-earnings, the company trades at 23.7 times earnings. That is noticeably higher than both the US Diversified Financial industry average of 15.1x and the peer average of 17.7x, and well above the fair ratio estimate of 13.2x. This means the stock is at a premium versus benchmarks, which could create risk if growth disappoints or opportunity if the business surprises on the upside. Is the market overestimating Jack Henry’s long-term potential or simply pricing in quality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Jack Henry & Associates Narrative

If you want a fresh take or wish to dive deeper into the numbers on your own terms, it’s quick and easy to build your own perspective. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Jack Henry & Associates.

Looking for more investment ideas?

Unlock smarter opportunities and get ahead of the crowd with stock picks handpicked by data and trends. Don’t let the next big winner pass you by.

- Capitalize on potential with these 3589 penny stocks with strong financials, which offer promising growth stories before they hit the mainstream spotlight.

- Boost passive income by finding these 20 dividend stocks with yields > 3% yielding over 3 percent. This approach is ideal for building a resilient portfolio.

- Ride the artificial intelligence wave and seize your share of progress by checking out these 27 AI penny stocks on the cutting edge of tomorrow’s technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JKHY

Jack Henry & Associates

Operates as a financial technology company that connects people and financial institutions through technology solutions and payment processing services.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives