- United States

- /

- Diversified Financial

- /

- NasdaqGS:JKHY

A Look at Jack Henry & Associates (JKHY) Valuation After Q1 Beat, Upgraded Outlook, and New Client Win

Reviewed by Simply Wall St

Jack Henry & Associates (JKHY) just delivered first quarter results showing higher revenue and net income, and also raised its outlook for fiscal 2026. The company signed QCR Holdings to a multi-bank technology partnership, which adds another positive signal for future growth and competitive positioning.

See our latest analysis for Jack Henry & Associates.

Jack Henry & Associates has enjoyed a strong run after its first-quarter earnings beat and freshly raised guidance, with the share price jumping over 7% in the past week and recouping all of its modest year-to-date decline. Despite a 1-year total shareholder return of -6.9%, the company’s recent fundamentals, new client wins, and higher full-year targets are fueling renewed optimism about longer-term growth prospects.

If you're watching how companies like Jack Henry spark market momentum with new partnerships, it could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

But after recent gains and strong results, investors may be wondering, is Jack Henry & Associates trading at an attractive value or is the market already factoring in its next wave of growth? Could there still be a buying opportunity here?

Most Popular Narrative: 8.1% Undervalued

With Jack Henry & Associates closing at $162.61, the most widely followed narrative pegs its fair value at $177, suggesting there may still be meaningful upside ahead. Investors are watching closely as momentum builds behind new cloud and digital banking initiatives.

The company is experiencing accelerated adoption of its cloud-native platforms and SaaS offerings (cloud revenue up 11% year-over-year, now 32% of total revenue and 77% of core clients hosted in private cloud). This is expected to drive higher recurring revenue, improved margins, and higher free cash flow conversion as legacy on-premise contracts decline.

What is the secret ingredient behind this bullish fair value? Everything hinges on an ambitious shift to digital, promising recurring income and higher margins. Want to know exactly how analysts are connecting the dots to a higher price? Uncover the critical assumptions fueling this outlook.

Result: Fair Value of $177 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing bank consolidation and rising contract price pressure could challenge Jack Henry & Associates’ growth story if these trends intensify in coming quarters.

Find out about the key risks to this Jack Henry & Associates narrative.

Another View: Multiples Tell a Cautionary Story

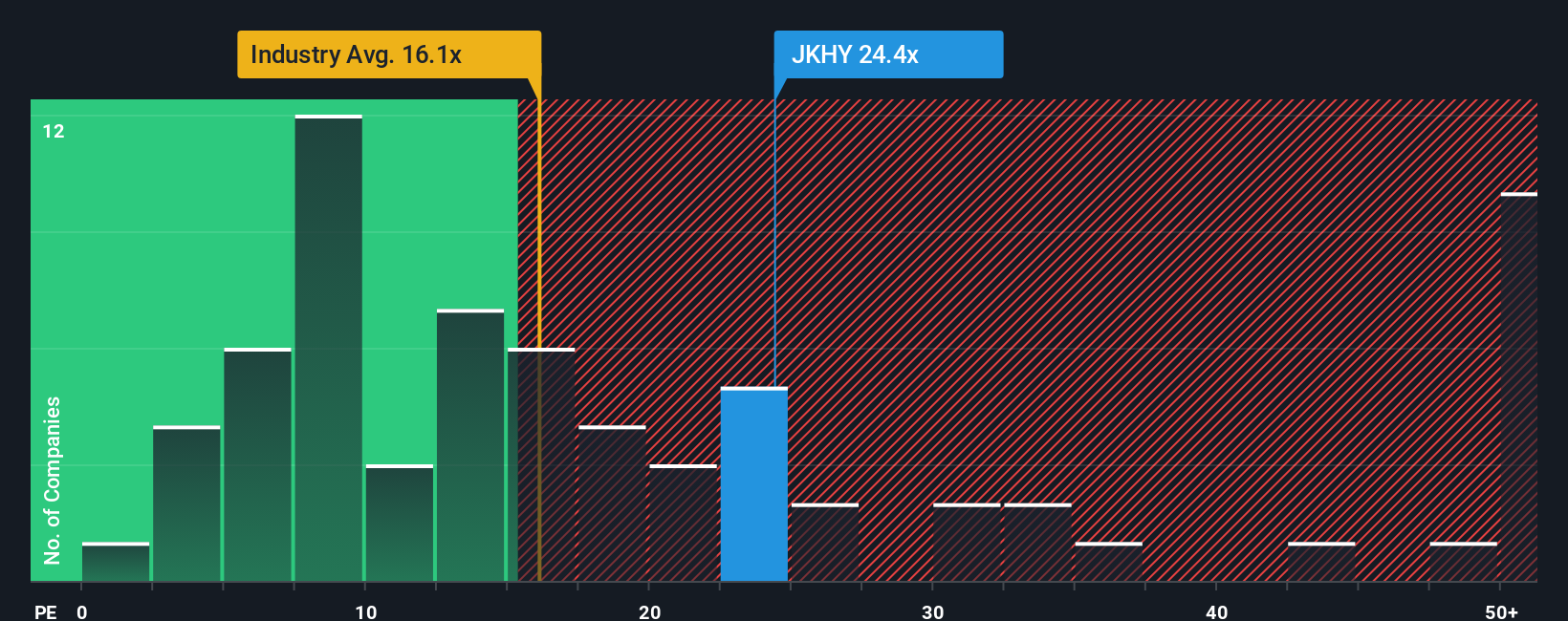

While fair value estimates suggest upside, Jack Henry & Associates trades at a price-to-earnings ratio of 24.5x, which is well above both the US Diversified Financial industry average of 13.1x and its peer average of 14.3x. Even when compared to the fair ratio of 13.2x, the gap suggests a stretched valuation and less margin for error if growth expectations slip. Are investors paying too much for quality, or is price still justified by the company’s innovation and steadiness?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Jack Henry & Associates Narrative

If the current story doesn't match your perspective, or you prefer rolling up your sleeves with the numbers, you can build your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Jack Henry & Associates.

Looking for more investment ideas?

Opportunities go far beyond just one company. Start building a smarter portfolio by checking out fresh stock ideas seasoned investors are watching right now.

- Tap into explosive growth trends by spotting promising up-and-comers among these 3575 penny stocks with strong financials, where stronger financials stand out from the crowd.

- Take your returns to the next level with cash flow bargains by targeting companies on these 865 undervalued stocks based on cash flows that analysts think the market has overlooked.

- Fuel your income strategy by targeting reliable payouts with these 16 dividend stocks with yields > 3% offering yields above 3% and proven histories of rewarding shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JKHY

Jack Henry & Associates

Operates as a financial technology company that connects people and financial institutions through technology solutions and payment processing services.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives