- United States

- /

- Consumer Finance

- /

- NasdaqGM:JFIN

Jiayin Group (JFIN) Reports Higher Net Income but What Drives Its Sustained Momentum?

Reviewed by Sasha Jovanovic

- Jiayin Group Inc. recently reported its third quarter and nine-month 2025 financial results, with revenue reaching CNY 1.47 billion and CNY 5.13 billion, and net income of CNY 376.49 million and CNY 1.44 billion, respectively, both rising compared to the prior year.

- The company’s basic earnings per share from continuing operations also showed a clear increase for both the quarter and the year-to-date period.

- We'll take a look at how Jiayin Group's higher net income growth this quarter informs its ongoing investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Jiayin Group's Investment Narrative?

When considering Jiayin Group, the key question for any shareholder remains whether strong profitability and cash returns can be sustained given the company’s current business conditions. The fresh Q3 results, with higher net income and increased basic EPS, suggest that recent profitability tailwinds are reinforcing Jiayin’s main short-term catalysts: strong earnings quality, undisputed value metrics, and ongoing capital returns through buybacks and dividends. However, these gains come amid pronounced share price volatility and persistent concerns about board independence and dividend reliability. With the Q3 update now in, the improved profit margins and earnings power could ease some near-term worries around business momentum, but the shift does not entirely remove existing risks connected to board composition and market confidence. The latest financial results are positive, yet some underlying vulnerabilities continue to merit close attention.

In contrast, board independence remains a concern that investors should be aware of.

Exploring Other Perspectives

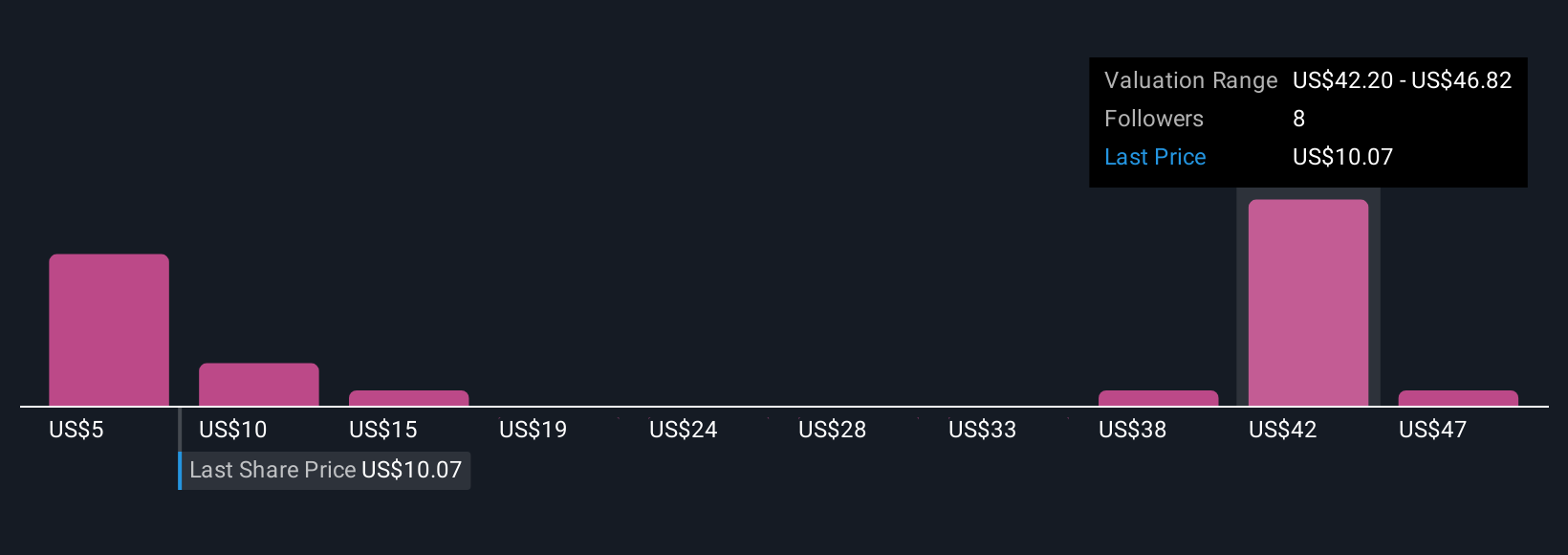

Explore 12 other fair value estimates on Jiayin Group - why the stock might be worth over 7x more than the current price!

Build Your Own Jiayin Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jiayin Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Jiayin Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jiayin Group's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:JFIN

Jiayin Group

Engages in the provision of online consumer finance services in the People’s Republic of China.

Outstanding track record with flawless balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026