- United States

- /

- Consumer Finance

- /

- NasdaqGS:JCAP

Jefferson Capital (JCAP): Taking Stock of Valuation After a Quiet 9.8% Year-to-Date Share Price Climb

Reviewed by Simply Wall St

Jefferson Capital (JCAP) has quietly outperformed many financials in the past 3 months, with the stock up roughly 9% while annual revenue still grows and net income steps back a bit.

See our latest analysis for Jefferson Capital.

That recent 4.6% 1 month share price return sits on top of a 9.8% year to date share price return, suggesting momentum is quietly building as investors reassess Jefferson Capital’s growth and risk profile around debt recovery demand.

If Jefferson Capital’s steady climb has your attention, this could be a good moment to broaden your watchlist and see what other names are moving in fast growing stocks with high insider ownership.

With revenue still climbing, profits dipping and the shares trading nearly 29% below analyst targets, is Jefferson Capital quietly undervalued here, or is the market already pricing in a full rebound in earnings and growth?

Price-to-Earnings of 7.3x: Is it justified?

At a last close of $20.35, Jefferson Capital trades on a 7.3x price-to-earnings ratio, a level that screens as undervalued against both peers and the wider consumer finance space.

The price-to-earnings multiple compares what investors are paying today with the company’s current earnings. This makes it a core yardstick for profitable, mature financial businesses like Jefferson Capital.

On this measure, the market appears to be assigning a discount multiple to JCAP despite earnings growing 30.3% over the past year and coming in ahead of the broader Consumer Finance industry. This hints that investors are skeptical that this growth pace can be sustained.

Even so, the 7.3x price-to-earnings ratio looks materially cheaper than the US Consumer Finance industry average of 10.3x and the 9.2x peer average. This gap underscores how cautiously the market is valuing Jefferson Capital’s earnings power today.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 7.3x (UNDERVALUED)

However, softer net income trends and market doubts about sustaining 30 percent earnings growth could quickly unwind Jefferson Capital’s apparent valuation discount.

Find out about the key risks to this Jefferson Capital narrative.

Another Lens on Value

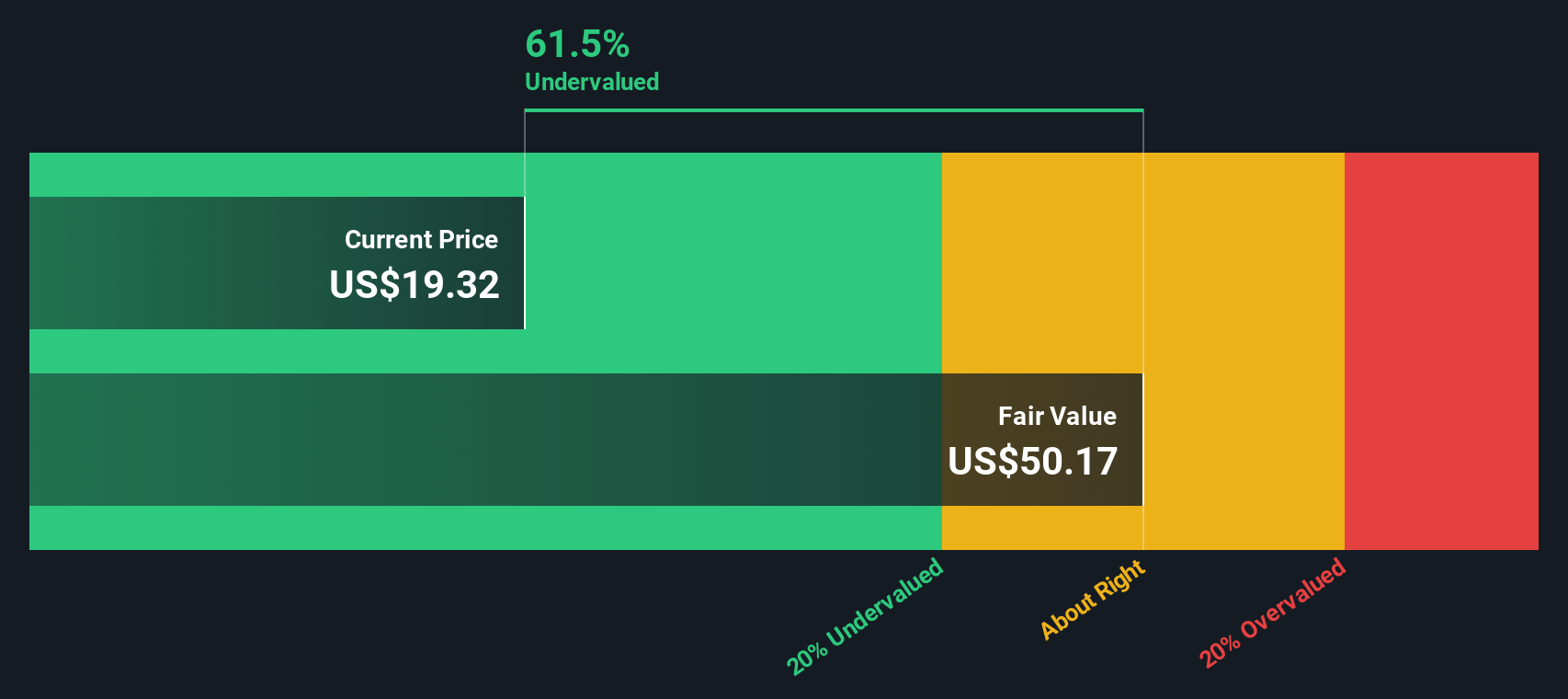

Our DCF model paints a far more optimistic picture, suggesting Jefferson Capital trades roughly 62.8% below its fair value estimate of about $54.71 per share. If that cash flow outlook holds anywhere close to true, is the current “cheap” multiple really capturing the upside?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Jefferson Capital for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Jefferson Capital Narrative

If you view the numbers differently, or would rather dig into the details yourself, you can build a custom narrative in just minutes: Do it your way.

A great starting point for your Jefferson Capital research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in an edge by scanning other opportunities that match your style, from value and income to high conviction growth themes.

- Capitalize on mispriced potential by reviewing these 908 undervalued stocks based on cash flows that could be trading at meaningful discounts to their intrinsic worth.

- Position yourself ahead of the next tech wave by targeting these 26 AI penny stocks at the forefront of intelligent automation and data driven innovation.

- Strengthen your long term income strategy by focusing on these 15 dividend stocks with yields > 3% that can help support reliable cash returns through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JCAP

Jefferson Capital

Provides debt recovery solutions and other related services in the United States, the United Kingdom, Canada, and Latin America.

Undervalued with adequate balance sheet and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026