- United States

- /

- Capital Markets

- /

- NasdaqGS:IBKR

Interactive Brokers Group (IBKR) Is Up 9.3% After Strong Q2 Earnings and New Product Launches - What's Changed

Reviewed by Simply Wall St

- Interactive Brokers Group recently reported strong quarterly earnings for the period ended June 30, 2025, with net income rising to US$224 million and the Board declaring a quarterly cash dividend of US$0.08 per share.

- The company also introduced new platform features, including an AI-powered thematic investment discovery tool and a mobile app for investor education, highlighting continued product innovation.

- Next, we'll explore how the recent earnings growth and new product launches may influence Interactive Brokers' investment outlook.

Interactive Brokers Group Investment Narrative Recap

To be a shareholder in Interactive Brokers Group, you need to believe in the continued global adoption of self-directed investing and the company’s strength in capturing growing trading activity across geographies and investor segments. The latest strong earnings results reaffirm revenue resilience, but the most important short-term catalyst, sustained trading activity, remains susceptible to unpredictable market conditions and low volatility, posing the biggest current risk. The recent news doesn't fundamentally change this risk-reward balance.

Of the recent announcements, the launch of the AI-powered Investment Themes tool stands out as most relevant. By streamlining the process of uncovering actionable trade ideas and linking investment opportunities to market trends, this feature could support platform engagement and volumes, reinforcing the catalyst of rising trading activity.

In contrast, investors should be aware that an extended period of muted market volatility could put pressure on trading volumes and revenue...

Read the full narrative on Interactive Brokers Group (it's free!)

Interactive Brokers Group is projected to reach $5.9 billion in revenue and $740.3 million in earnings by 2028. This outlook assumes a 5.9% annual revenue growth rate and a $42.3 million increase in earnings from the current $698.0 million.

Exploring Other Perspectives

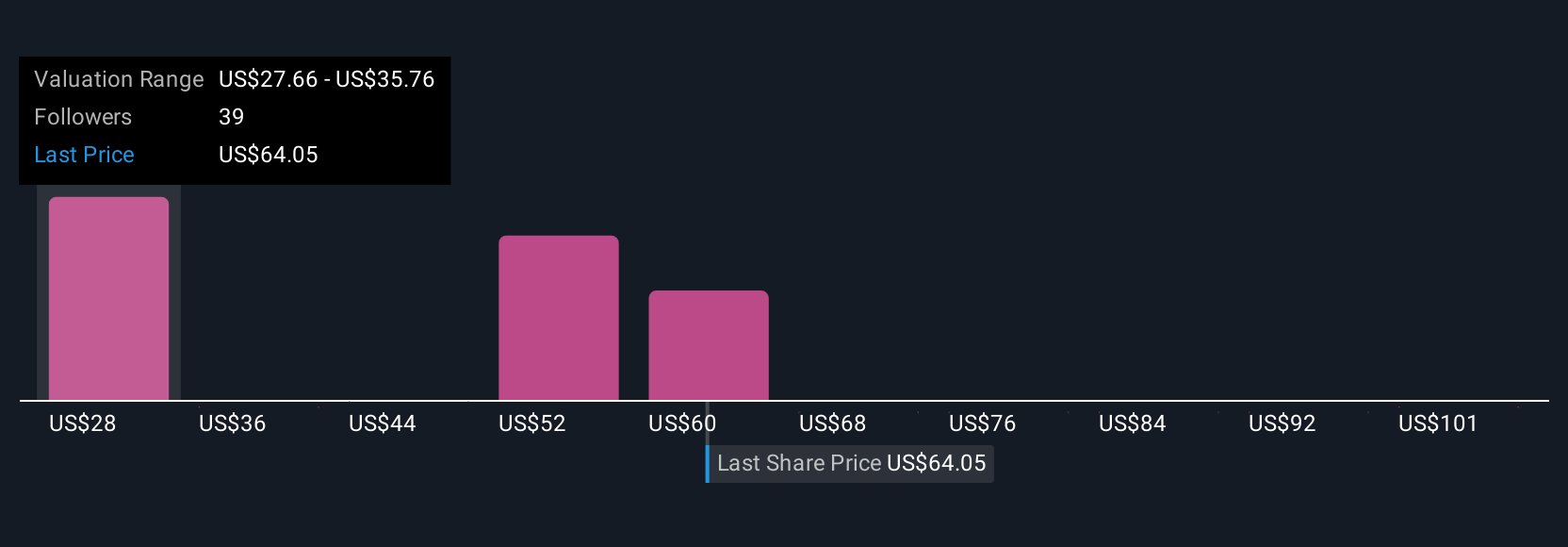

Simply Wall St Community members provided 7 fair value estimates for Interactive Brokers from US$29.43 to US$108.63 per share. While many expect product innovation and account growth to boost performance, opinions differ sharply about exposure to volatile trading volumes. Explore more views from across the community.

Build Your Own Interactive Brokers Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Interactive Brokers Group research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Interactive Brokers Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Interactive Brokers Group's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 26 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IBKR

Interactive Brokers Group

Operates as an automated electronic broker in the United States and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives