- United States

- /

- Capital Markets

- /

- NasdaqGS:HLNE

Why Hamilton Lane (HLNE) Is Up 7.4% After Securing $5 Billion Guardian Partnership and Posting Growth

Reviewed by Sasha Jovanovic

- Hamilton Lane and The Guardian Life Insurance Company of America recently announced a long-term partnership, under which Hamilton Lane will oversee Guardian's nearly US$5 billion private equity portfolio and secure annual investment commitments of approximately US$500 million for the next decade, including US$250 million in seed capital for new Evergreen initiatives.

- This agreement, alongside the release of Hamilton Lane's latest quarterly results showing year-over-year revenue and net income growth, highlights the firm's strengthening relationships with major institutional investors and its expansion in customized private market solutions for insurers.

- We'll explore how the Guardian partnership enhances Hamilton Lane's investment narrative through expanded assets and deepened insurance industry reach.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Hamilton Lane Investment Narrative Recap

To have confidence as a Hamilton Lane shareholder, you need to believe that private market investment demand will support consistent fee-earning asset growth, even as competition and regulatory complexity rise. The Guardian partnership meaningfully expands Hamilton Lane’s presence in the insurance channel, reinforcing its reputation among major institutional investors, however, it does not materially affect the biggest near-term risk, which remains ongoing regulatory tightening and operational complexity as the firm enters new regions and distribution channels.

One recent, highly relevant announcement is Hamilton Lane’s addition of private market indices to the Bloomberg Terminal. This initiative aligns well with the short-term catalyst of expanding global distribution and strengthening relationships with institutional investors, supporting greater transparency and data accessibility in the private markets.

By contrast, investors should be aware that as Hamilton Lane grows, the added operational complexity and mounting global compliance costs could...

Read the full narrative on Hamilton Lane (it's free!)

Hamilton Lane's outlook projects $1.0 billion in revenue and $426.8 million in earnings by 2028. This forecast is based on a 13.2% annual revenue growth rate and a $214.6 million increase in earnings from the current $212.2 million.

Uncover how Hamilton Lane's forecasts yield a $157.17 fair value, a 27% upside to its current price.

Exploring Other Perspectives

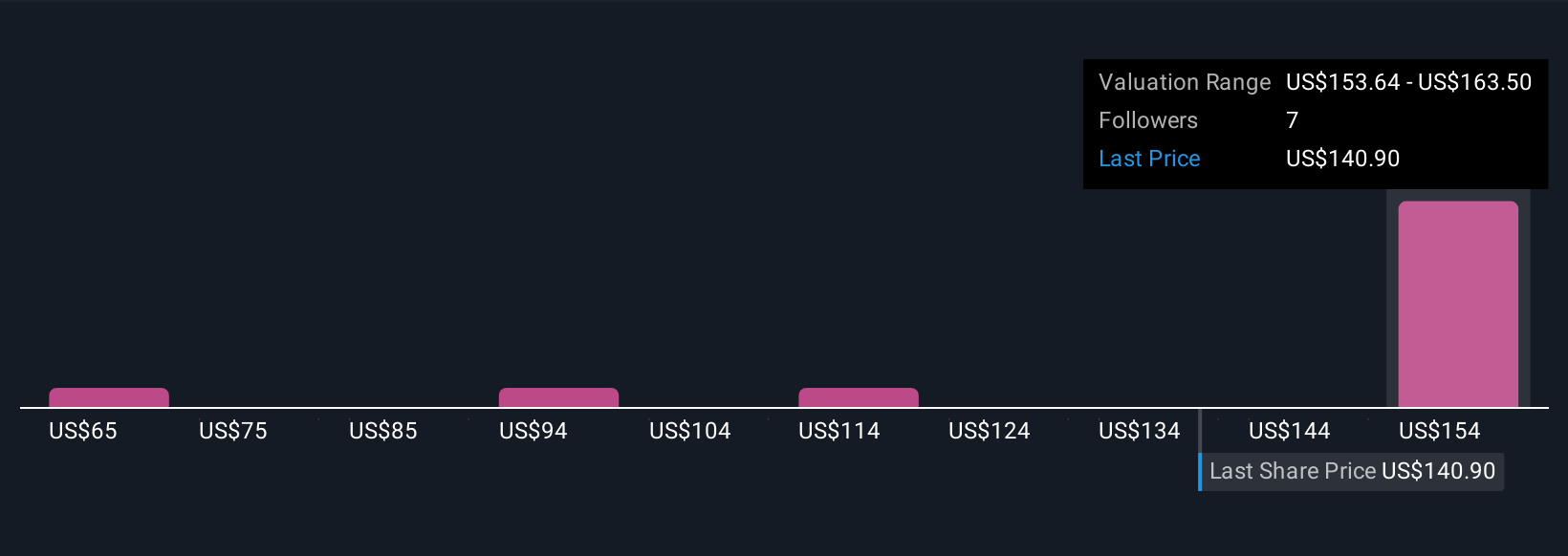

Six recent fair value estimates from the Simply Wall St Community range from US$60 to US$157 per share, reflecting considerable variation in outlooks. With Hamilton Lane’s growth hinging on expanding distribution and deepening insurer partnerships, your perspective on the company’s long-term earnings trajectory may differ from fellow investors, explore these differing viewpoints to inform your analysis.

Explore 6 other fair value estimates on Hamilton Lane - why the stock might be worth as much as 27% more than the current price!

Build Your Own Hamilton Lane Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hamilton Lane research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Hamilton Lane research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hamilton Lane's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hamilton Lane might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HLNE

Hamilton Lane

A private equity and venture capital firm specializing in early venture, emerging growth, turnaround, middle market, mature, mid-venture, bridge, buyout, distressed/vulture, loan, mezzanine in growth capital companies.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives