- United States

- /

- Capital Markets

- /

- NasdaqGS:GLXY

Galaxy Digital (TSX:GLXY): Has the Pullback Created a Valuation Opportunity?

Reviewed by Simply Wall St

Galaxy Digital (GLXY) has been on a choppy run lately, with the stock down over the past month but still solidly higher year to date. This has left investors wondering if this pullback is an opportunity or a warning.

See our latest analysis for Galaxy Digital.

Despite the recent 1 month share price return of negative 18.9 percent, Galaxy Digital is still up meaningfully with a roughly 41 percent year to date share price gain and a huge three year total shareholder return above 700 percent. This suggests that momentum has cooled in the short term, while the longer term growth story remains very much intact.

If Galaxy’s volatile run has you rethinking your exposure to digital assets, this could be a good moment to explore high growth tech and AI stocks as potential complementary growth ideas.

With earnings swinging, crypto sentiment wobbling, and the share price trading well below analyst targets, the key question now is simple: Is Galaxy Digital a mispriced growth engine, or is the market already discounting years of expansion?

Most Popular Narrative Narrative: 44.4% Undervalued

Compared to Galaxy Digital’s last close of $25.51, the most followed narrative sees fair value closer to $45.91, implying substantial upside if its roadmap plays out.

The maturation of digital asset infrastructure, evidenced by large-scale, long-term data center developments and multi-phase partnerships (e.g., CoreWeave), is poised to generate significant, high-margin cash flows beginning in 2026, enhance earnings visibility, and improve the company's overall capitalization efficiency as these business lines scale.

Want to see the math behind that upside gap? The narrative leans on explosive revenue expansion, improving margins, and a valuation multiple usually reserved for market darlings.

Result: Fair Value of $45.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on CoreWeave and the capital intensive data center build out mean that any demand shock or financing squeeze could quickly undermine this bullish setup.

Find out about the key risks to this Galaxy Digital narrative.

Another Way to Look at Value

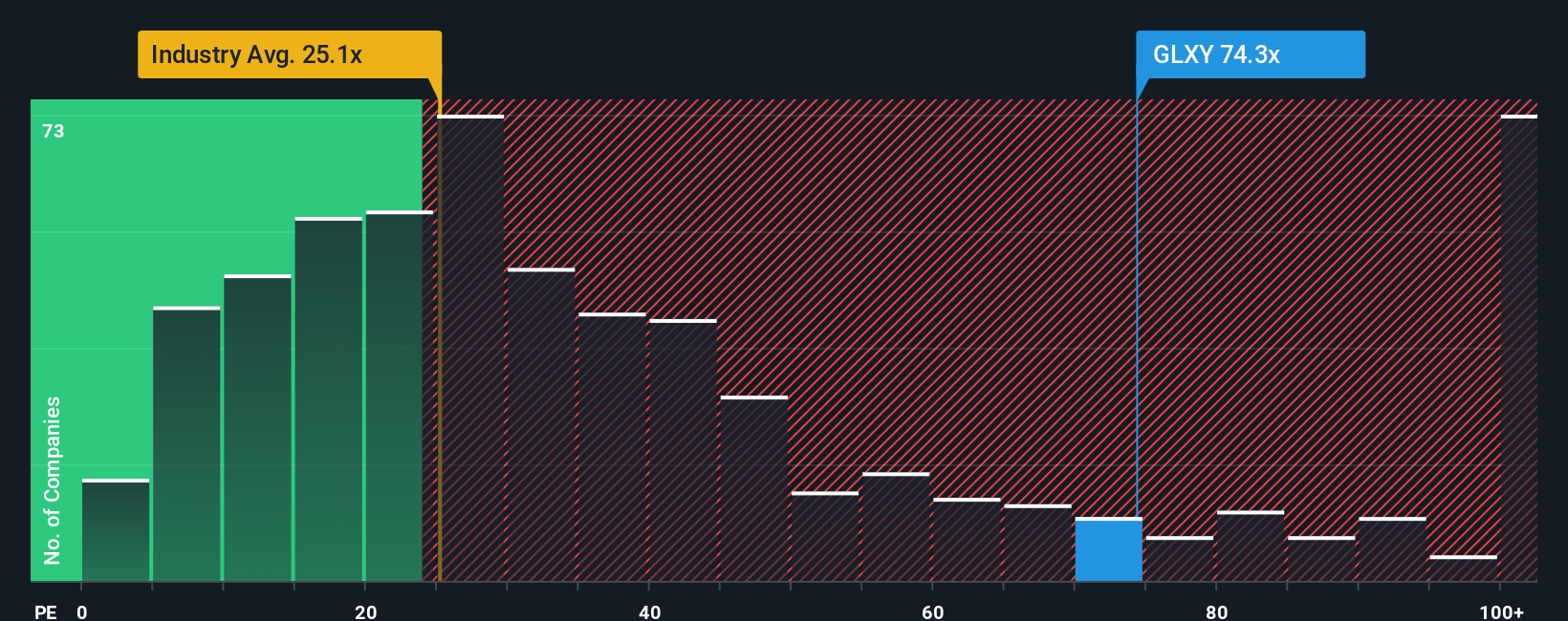

That bullish narrative leans on future growth, but current pricing tells a different story. Galaxy trades on a price to earnings ratio of 41.1 times, roughly double both peers at 20.4 times and a fair ratio of 11.8 times. This points to meaningful downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Galaxy Digital Narrative

If you see the story differently or want to review the numbers yourself, you can build a fresh view in just minutes, Do it your way.

A great starting point for your Galaxy Digital research is our analysis highlighting 1 key reward and 6 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Galaxy may be your starting point, but you will seriously limit your upside if you ignore other data driven opportunities waiting in the Simply Wall St Screener.

- Capture early stage momentum by scanning these 3576 penny stocks with strong financials that pair speculative upside with stronger financial underpinnings than typical micro caps.

- Target the next wave of innovation by reviewing these 26 AI penny stocks that are building real products and revenues around artificial intelligence breakthroughs.

- Lock in attractive entry points with these 906 undervalued stocks based on cash flows based on robust cash flow forecasts, before the broader market recognizes their potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GLXY

Galaxy Digital

Engages in the digital asset and data center infrastructure businesses.

Medium-low risk with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026