- United States

- /

- Capital Markets

- /

- NasdaqGS:GEMI

Gemini Space Station (GEMI) Is Down 18.2% After Surging Revenue But Widening Losses and Super App Plans

Reviewed by Sasha Jovanovic

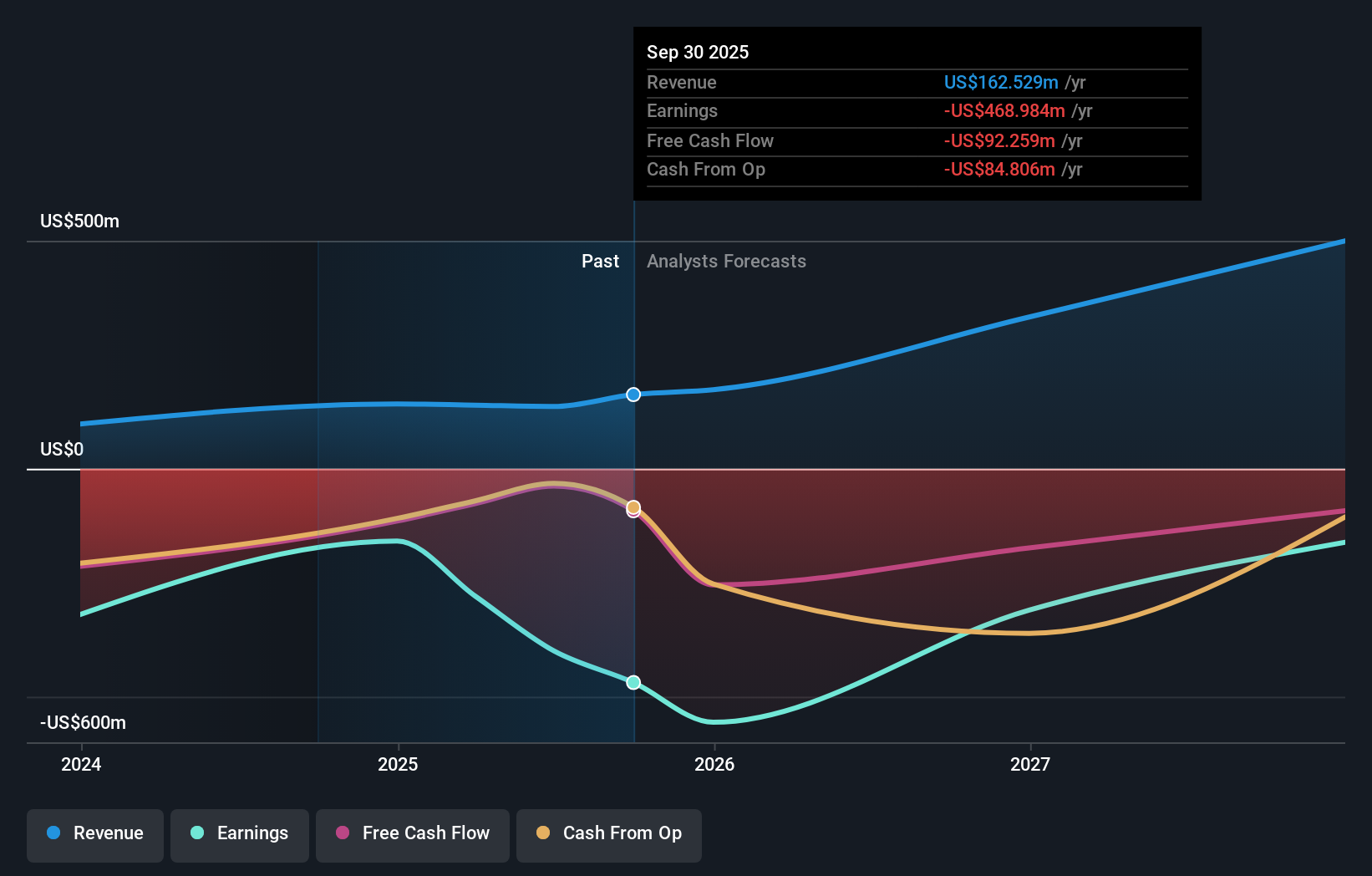

- In its recently announced Q3 2025 results, Gemini Space Station reported very large revenue growth to US$50.6 million, but net losses widened to US$159.5 million due to higher marketing and IPO-related expenses.

- The company continues to expand its platform globally, with new crypto credit card products, a MiCA license in Europe, and plans to build a super app integrating traditional and digital finance.

- We'll explore how Gemini's super app ambitions and global expansion efforts may shape its investment outlook going forward.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Gemini Space Station's Investment Narrative?

For a shareholder in Gemini Space Station, it comes down to believing that aggressive global expansion and the push for a financial “super app” can eventually turn soaring revenue growth into sustainable profitability, a leap that remains unproven today. The recent earnings release brought another round of impressive top-line growth to US$50.6 million, but net losses widened to US$159.5 million as spending surged on marketing and IPO-related costs. Short-term, this amplifies questions around cash burn and whether management’s heavy investments can drive user growth quickly enough to alter the path to breakeven. The news triggered a sharp share price fall, highlighting how sensitive market sentiment is to these losses. While product launches and licensing wins are potential catalysts, the principal risk now is that prolonged losses constrain future growth initiatives or access to capital. The recent developments make these financial risks an even bigger focal point than before.

But with all this growth, cash burn has become a much bigger issue investors should be watching.

Exploring Other Perspectives

Explore 4 other fair value estimates on Gemini Space Station - why the stock might be worth less than half the current price!

Build Your Own Gemini Space Station Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gemini Space Station research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Gemini Space Station research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gemini Space Station's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GEMI

Gemini Space Station

Develops a crypto platform to buy, sell, and store crypto assets.

Slight risk with limited growth.

Similar Companies

Market Insights

Community Narratives