- United States

- /

- Capital Markets

- /

- NasdaqGS:COIN

Is Coinbase Still Attractive After a 570% Three Year Surge?

Reviewed by Bailey Pemberton

- Wondering whether Coinbase Global at around $270 is still a smart way to play the crypto ecosystem, or if the easy money has already been made? You are not alone, and that is exactly what this breakdown will tackle.

- The stock is down about 1.1% over the last week and 15.5% over the last month. Yet it is still up 4.9% year to date and an eye catching 570.3% over three years, a pattern that suggests shifting risk appetite rather than a simple uptrend or downtrend.

- Recent moves have come against a backdrop of renewed institutional interest in crypto infrastructure, expanding product offerings across retail and institutional platforms, and ongoing regulatory headlines that keep sentiment swinging between optimism and caution. Taken together, these cross currents help explain why Coinbase can sell off sharply in the short term even while the longer term story still attracts capital.

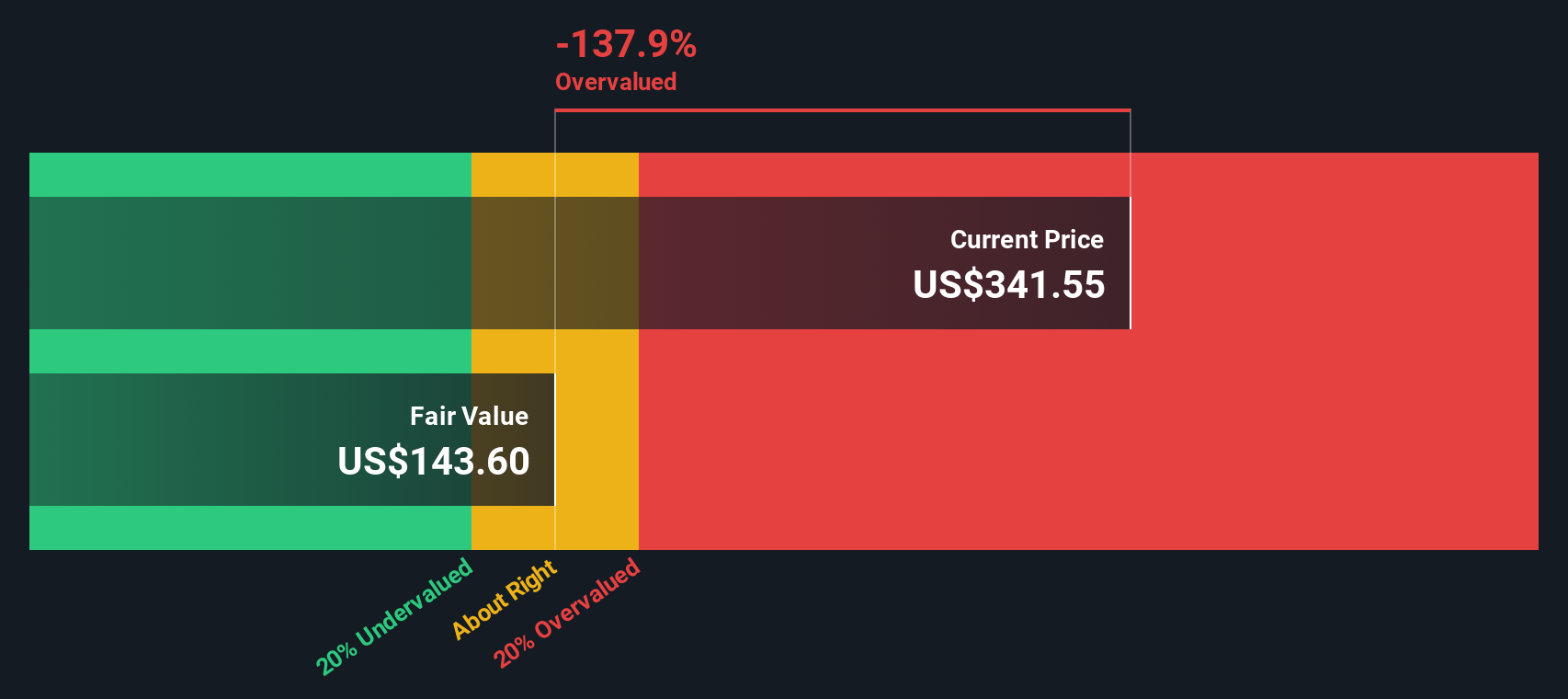

- On our framework, Coinbase currently scores a 2 out of 6 valuation checks, suggesting it only screens as undervalued on a couple of metrics. We will walk through what traditional valuation methods say about that number and then finish with a more nuanced way to think about what the market might really be pricing in.

Coinbase Global scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Coinbase Global Excess Returns Analysis

The Excess Returns model looks at how much profit a company can generate above the minimum return that equity investors demand, then capitalizes those surplus profits into a per share value today.

For Coinbase Global, the model starts with an estimated Book Value of $59.62 per share and a Stable EPS of $8.33 per share, based on weighted future Return on Equity estimates from seven analysts. With an Average Return on Equity of 15.11% and a Cost of Equity of $4.62 per share, the company is expected to generate an Excess Return of $3.71 per share over its cost of capital. The Stable Book Value underpinning this, $55.13 per share, comes from forward looking book value estimates from two analysts.

When these excess profits are projected forward and discounted, the Excess Returns model arrives at an intrinsic value of about $127.45 per share. This implies the stock is roughly 111.6% overvalued versus the current market price near $270. On this framework, investors are paying a large premium for growth and profitability that already look fully reflected in the valuation.

Result: OVERVALUED

Our Excess Returns analysis suggests Coinbase Global may be overvalued by 111.6%. Discover 906 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Coinbase Global Price vs Earnings

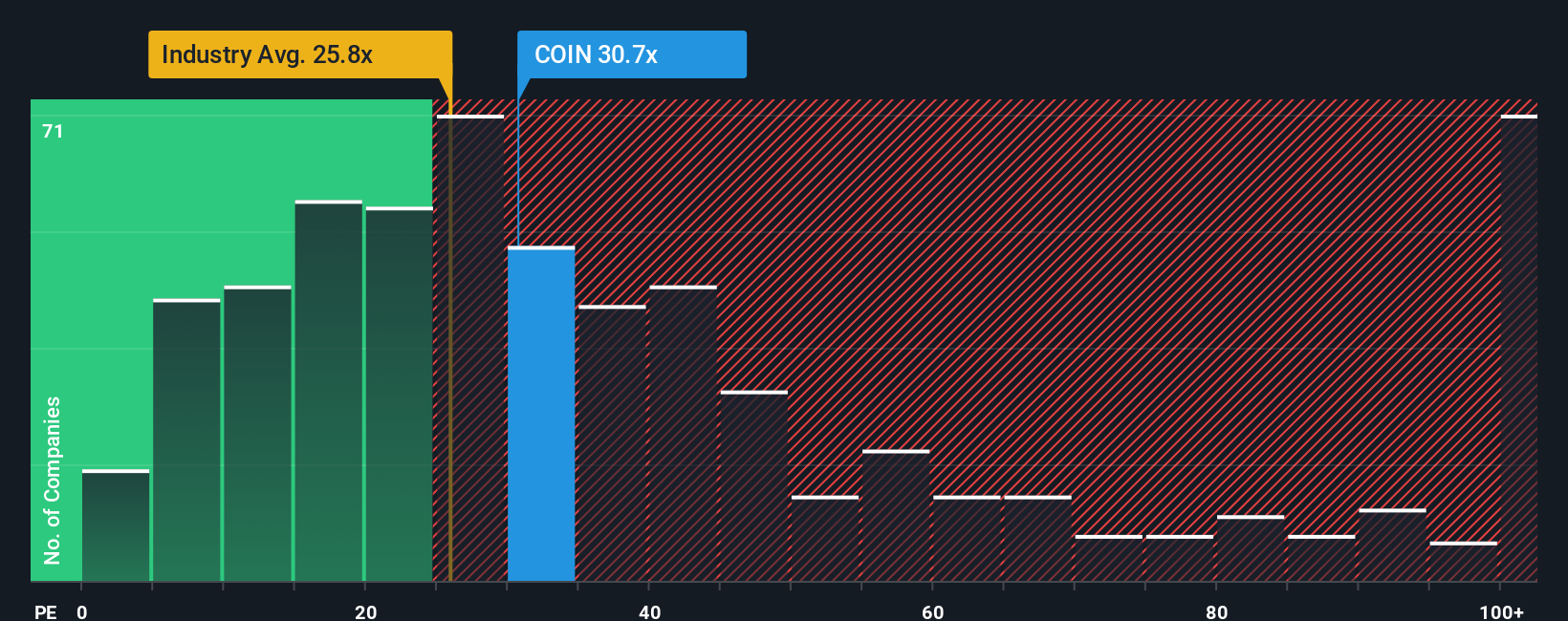

For a profitable business like Coinbase Global, the price to earnings ratio is a useful way to gauge how much investors are willing to pay today for each dollar of current earnings. It ties valuation directly to the bottom line, which tends to be more stable and comparable than revenue or book value for mature, cash generative firms.

What counts as a fair PE depends on how fast earnings are expected to grow and how risky those earnings are. Higher growth and perceived resilience usually justify a higher multiple, while cyclical or uncertain earnings should trade on a discount. Coinbase currently trades on a PE of about 22.6x, slightly below the broader Capital Markets industry average of roughly 24.2x and below the peer group average around 31.5x. Simply Wall St's Fair Ratio for Coinbase is 22.5x, a proprietary estimate of what the PE should be after accounting for its specific earnings growth profile, risk factors, profit margins, industry and market cap. Because it is tailored to the company, this Fair Ratio is more informative than a simple comparison with peers or the industry. With the market multiple sitting very close to that Fair Ratio, Coinbase looks fairly priced on this lens.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

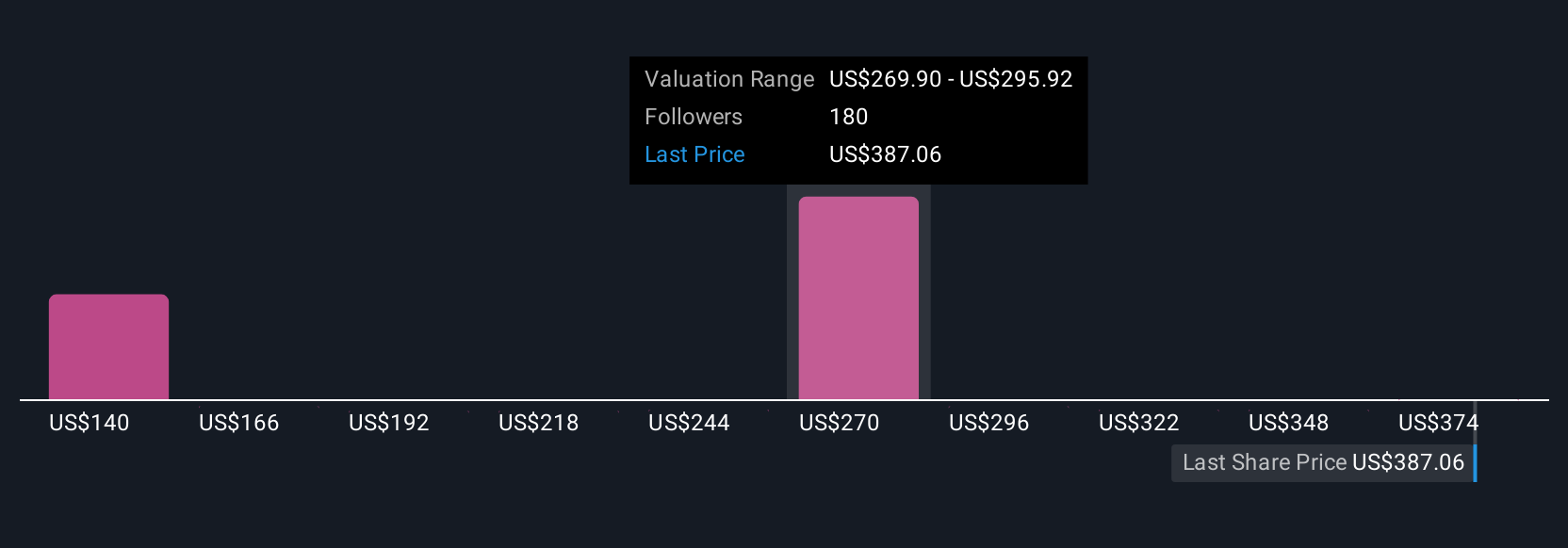

Upgrade Your Decision Making: Choose your Coinbase Global Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework on Simply Wall St's Community page where you connect your view of Coinbase Global’s story to a clear financial forecast and a specific fair value, then compare that fair value to today’s price to decide whether to buy, hold, or sell. A Narrative is your own story of the business expressed as assumptions about future revenue, earnings, and margins, which the platform translates into a dynamic fair value that automatically updates when new information like earnings, product launches, or regulation hits the news. Because Narratives are easy to create and compare, they make it clear how different perspectives can coexist. For example, one Coinbase Narrative might see upside to around $510 per share on the back of successful tokenization and higher margin services, while another more cautious Narrative might cap fair value near $185 per share due to fee pressure, regulation, and slower growth.

Do you think there's more to the story for Coinbase Global? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COIN

Coinbase Global

Operates platform for crypto assets in the United States and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026