- United States

- /

- Capital Markets

- /

- NasdaqGS:COIN

Coinbase (COIN) Valuation Check After Recent Share Price Pullback

Reviewed by Simply Wall St

Coinbase Global (COIN) has been quietly recalibrating after a choppy few months, with the stock slipping about 11% over the past month and 14% over the past 3 months, even as crypto volumes remain active.

See our latest analysis for Coinbase Global.

Step back from the recent pullback and Coinbase still looks like a name where sentiment is resetting rather than collapsing. The stock has delivered a modest year to date share price return alongside a powerful three year total shareholder return, reflecting how strongly the market has rewarded its role as a key on ramp into the crypto economy when risk appetite improves.

Given how crypto linked names can move in sharp bursts, it can also be worth seeing what else is catching investors’ attention across high growth tech and AI stocks right now.

With Coinbase now trading well below consensus targets despite solid top line growth but pressured earnings, the key question is whether today’s reset reflects an undervalued on ramp to crypto or a market already pricing in its next leg of expansion.

Most Popular Narrative: 28.5% Undervalued

With Coinbase closing at $274.20 versus a narrative fair value near $383, the story leans toward substantial upside if its strategic shifts play out.

The company's leadership in building trusted, compliant infrastructure has resulted in partnerships with major financial institutions (e.g., BlackRock, PNC, JPMorgan, Stripe, Shopify), positioning Coinbase as the preferred onramp for institutions entering the digital asset space, which is likely to drive institutional trading volumes and custody revenues higher over time.

Curious how a maturing crypto exchange earns a premium more often reserved for elite growth names? The narrative leans on durable margins, rising institutional flows, and a bold profit profile that assumes today’s earnings are not the peak. Want to see which forward assumptions really do the heavy lifting in that valuation math?

Result: Fair Value of $383.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent fee pressure from low cost bitcoin ETFs and ongoing cybersecurity risks could quickly challenge expectations for Coinbase’s margins and institutional growth trajectory.

Find out about the key risks to this Coinbase Global narrative.

Another Angle on Valuation

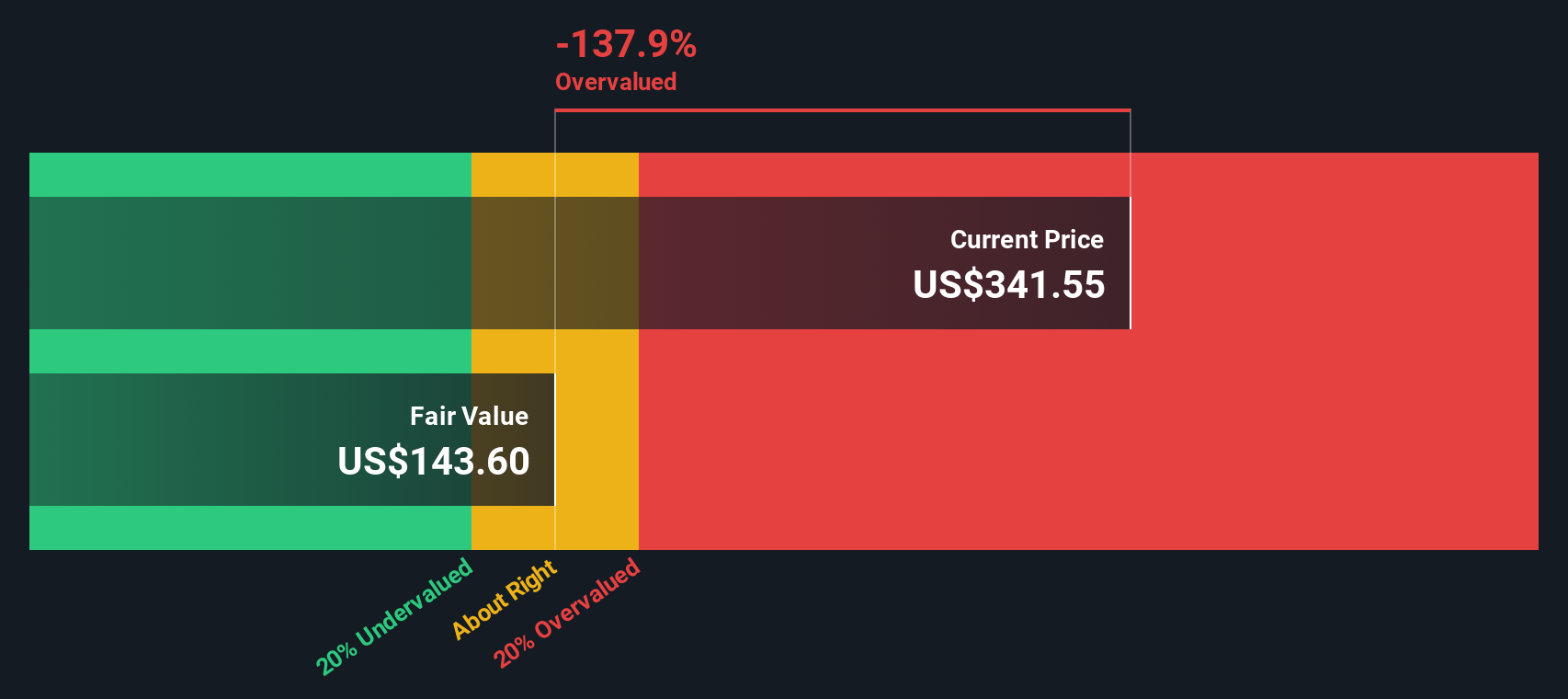

While the narrative fair value paints Coinbase as 28.5% undervalued, our cash flow lens says something very different. The SWS DCF model pegs fair value near $127.61, meaning the current $274.20 price screens as meaningfully overvalued. Which story do you think the market eventually believes?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Coinbase Global Narrative

If you are unconvinced by this take or simply prefer hands on research, you can build a personalized Coinbase view in minutes: Do it your way.

A great starting point for your Coinbase Global research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, lock in your next smart move by using the Simply Wall St Screener to uncover fresh, data driven opportunities across the market.

- Capture potential mispricing by scanning these 901 undervalued stocks based on cash flows that may be trading below what their future cash flows suggest.

- Ride powerful secular trends by targeting these 27 AI penny stocks positioned at the intersection of innovation and accelerating demand.

- Strengthen your income strategy by focusing on these 15 dividend stocks with yields > 3% that can help support returns through different market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COIN

Coinbase Global

Operates platform for crypto assets in the United States and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026