- United States

- /

- Capital Markets

- /

- NasdaqGS:CG

Why Carlyle Group (CG) Is Down 9.6% After Earnings Miss and Dividend Announcement – And What's Next

Reviewed by Sasha Jovanovic

- The Carlyle Group reported third quarter 2025 earnings, showing a steep drop in revenue to US$332.7 million and net income to US$0.9 million, alongside the declaration of a US$0.35 per share dividend for shareholders of record as of November 10, 2025.

- This sharp decrease in profitability highlights the impact of market and operational headwinds on Carlyle's recent financial results despite continued commitment to returning capital via dividends.

- We will explore how the significant year-over-year decline in earnings could reshape Carlyle Group's investment narrative and future expectations.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 38 companies in the world exploring or producing it. Find the list for free.

Carlyle Group Investment Narrative Recap

To be a Carlyle Group shareholder, you need conviction in the firm’s ability to rebound from significant profit volatility and capitalize on alternatives-driven fundraising momentum. The third quarter’s sharp drop in both revenue and net income naturally puts near-term earnings growth in the spotlight, yet this event has not fundamentally shifted the biggest catalyst, ongoing expansion in assets under management, nor does it materially change the main risk: sustained pressure on management fees due to competition and market headwinds.

Among recent announcements, the quarterly dividend declaration of US$0.35 per share stands out. By maintaining its dividend despite a substantial earnings decline, Carlyle signals a commitment to returning capital to shareholders, yet the sustainability of this payout could become increasingly important if fee pressures or earnings weakness persist.

In contrast, investors should be aware that persistent market competition could affect Carlyle’s future management fee growth and earnings stability…

Read the full narrative on Carlyle Group (it's free!)

Carlyle Group's narrative projects $5.1 billion in revenue and $1.7 billion in earnings by 2028. This requires a 2.6% annual revenue decline and a $0.4 billion earnings increase from the current earnings of $1.3 billion.

Uncover how Carlyle Group's forecasts yield a $69.25 fair value, a 33% upside to its current price.

Exploring Other Perspectives

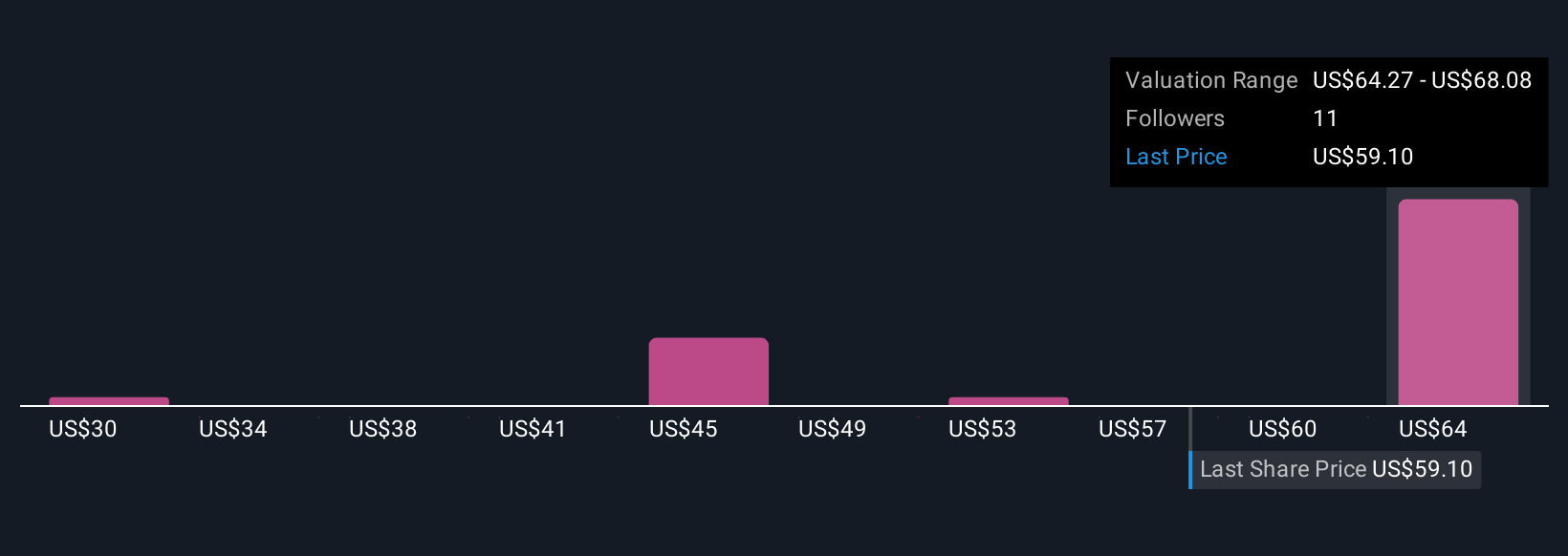

The Simply Wall St Community offered three US$ fair value estimates for Carlyle ranging from about $45.83 to $69.25 per share, highlighting wide variance in investor outlooks. With the latest earnings underscoring volatility in profits, your perspective on Carlyle’s ability to sustain and grow fee revenues in a competitive industry will shape your view, consider what other investors see and explore alternative viewpoints.

Explore 3 other fair value estimates on Carlyle Group - why the stock might be worth as much as 33% more than the current price!

Build Your Own Carlyle Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carlyle Group research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Carlyle Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carlyle Group's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CG

Carlyle Group

An investment firm specializing in direct and fund of fund investments.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives