- United States

- /

- Consumer Finance

- /

- NasdaqGS:CACC

3 US Growth Companies Where Insiders Own Up To 26%

Reviewed by Simply Wall St

In recent days, the U.S. markets have faced some turbulence, with the S&P 500 and Nasdaq Composite both experiencing declines as investors brace for upcoming inflation data and Federal Reserve decisions. Amidst this backdrop of volatility, growth companies with substantial insider ownership can present a compelling opportunity for investors seeking alignment between management interests and shareholder value.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| Duolingo (NasdaqGS:DUOL) | 14.7% | 34.7% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Coastal Financial (NasdaqGS:CCB) | 17.8% | 45.4% |

| Clene (NasdaqCM:CLNN) | 21.6% | 61.3% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.6% | 65.9% |

| BBB Foods (NYSE:TBBB) | 22.9% | 41.5% |

| Credit Acceptance (NasdaqGS:CACC) | 14.0% | 49% |

We're going to check out a few of the best picks from our screener tool.

Credit Acceptance (NasdaqGS:CACC)

Simply Wall St Growth Rating: ★★★★★★

Overview: Credit Acceptance Corporation provides financing programs and related products and services in the United States, with a market cap of approximately $5.99 billion.

Operations: The company's revenue segment includes Offering Dealers Financing Programs and Related Products and Services, generating $846.10 million.

Insider Ownership: 14.0%

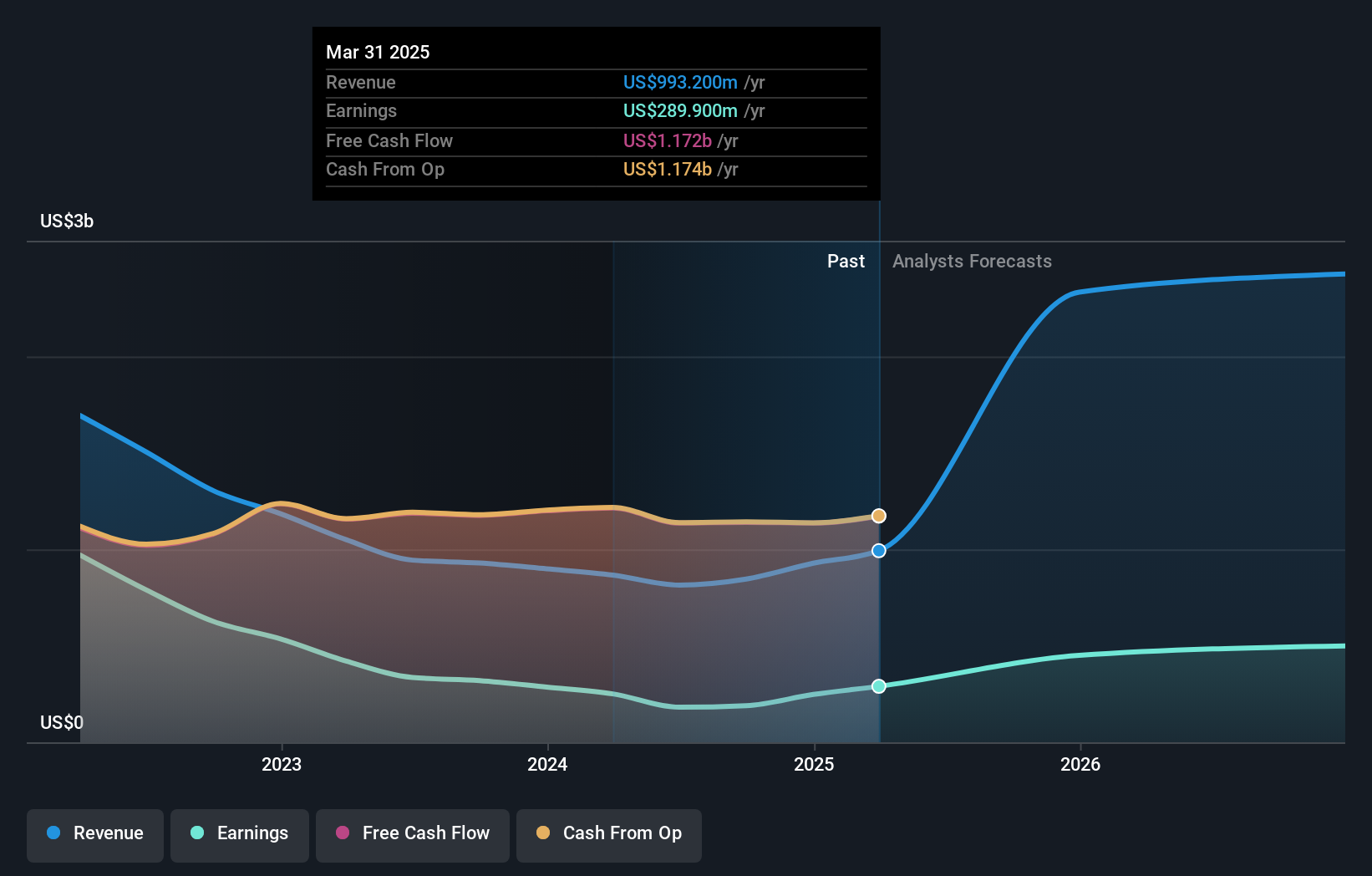

Credit Acceptance Corporation demonstrates substantial growth potential with forecasted revenue and earnings growth rates of 32.8% and 49% per year, respectively, surpassing market averages. Despite a decline in profit margins from last year, recent earnings reports show increased quarterly revenue (US$550.3 million) and net income (US$78.8 million). Insider ownership remains significant without notable recent insider trading activity. The company has extended its debt facilities while adjusting interest rates, indicating strategic financial positioning amidst ongoing buyback activities totaling US$345.28 million.

- Get an in-depth perspective on Credit Acceptance's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Credit Acceptance is trading beyond its estimated value.

LendingTree (NasdaqGS:TREE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: LendingTree, Inc. operates an online consumer platform in the United States, with a market cap of $549.31 million.

Operations: The company's revenue is segmented into Home ($119.98 million), Consumer ($216.33 million), and Insurance ($436.60 million).

Insider Ownership: 18%

LendingTree's recent partnership with Coverdash expands its offerings to include business insurance, enhancing its platform for small businesses. The company's forecasted earnings and revenue growth rates of 66.01% and 10.8% annually reflect a positive trajectory, with insider buying indicating confidence in future performance. Despite past shareholder dilution, LendingTree is trading at a favorable value compared to peers, supported by revised revenue guidance of US$870-880 million for 2024 and no substantial insider selling recently.

- Dive into the specifics of LendingTree here with our thorough growth forecast report.

- According our valuation report, there's an indication that LendingTree's share price might be on the cheaper side.

Endava (NYSE:DAVA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Endava plc, along with its subsidiaries, offers technology services across North America, Europe, the United Kingdom, and other international markets with a market cap of approximately $1.78 billion.

Operations: The company generates revenue primarily from its Computer Services segment, which amounted to £747.39 million.

Insider Ownership: 26.6%

Endava's earnings are expected to grow significantly, with a forecasted annual growth rate of 41%, surpassing the US market average. However, recent financial results show challenges, with net income dropping to £2.25 million from £12.37 million year-over-year for the first quarter ending September 2024. The company anticipates revenue growth of 10-11.5% for fiscal year 2025, despite diluted shareholder value and lower profit margins compared to last year.

- Click here and access our complete growth analysis report to understand the dynamics of Endava.

- Our valuation report here indicates Endava may be undervalued.

Where To Now?

- Click this link to deep-dive into the 203 companies within our Fast Growing US Companies With High Insider Ownership screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CACC

Credit Acceptance

Engages in the provision of financing programs, and related products and services in the United States.

Exceptional growth potential with imperfect balance sheet.