- United States

- /

- Capital Markets

- /

- NasdaqGS:BGC

BGC Group (BGC): Assessing Fair Value and Growth Potential After Recent Share Price Stability

Reviewed by Simply Wall St

See our latest analysis for BGC Group.

BGC Group’s share price has shown modest gains in the short term, but the momentum has not turned yet, with a 1-year total shareholder return of -18.7%. However, broadening the view reveals that investors who held for three or five years still saw impressive total returns of over 130% and 160%, respectively. This indicates that short-term sentiment is taking a breather, while long-term performance remains strong and puts recent volatility in perspective.

If you’re looking to spot the next breakout, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

BGC Group’s fundamentals present a mixed picture right now, making it worth asking: is the recent steady price merely a pause before renewed upside, or has the market already priced in any future growth potential?

Most Popular Narrative: 36.2% Undervalued

BGC Group’s current share price of $9.25 is notably below the narrative’s fair value estimate of $14.50. This sharp discount, despite steady business performance, has drawn attention to the drivers behind such a bullish outlook.

Continued expansion and strong revenue growth from BGC's electronic trading platforms (notably Fenics and FMX), supported by substantial increases in electronic volumes and market share across asset classes, suggest that BGC is positioned to capitalize on the accelerating shift toward technology-driven trading. This is likely to boost top-line revenue and expand margins due to the higher scalability and profitability of electronic versus voice-driven trading.

Want to see the growth blueprint that powers this bullish target? The core of this story is a digital transformation, scalable margins, and bold profit optimism. What key financial levers are pricing in an aggressive rebound? Dive into the narrative to uncover the surprising assumptions behind such a high fair value.

Result: Fair Value of $14.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, it is worth remembering that receding market volatility or delays in cost-saving integration following acquisitions could pose headwinds to BGC Group’s optimistic forecasts.

Find out about the key risks to this BGC Group narrative.

Another View: What Do Earnings Multiples Tell Us?

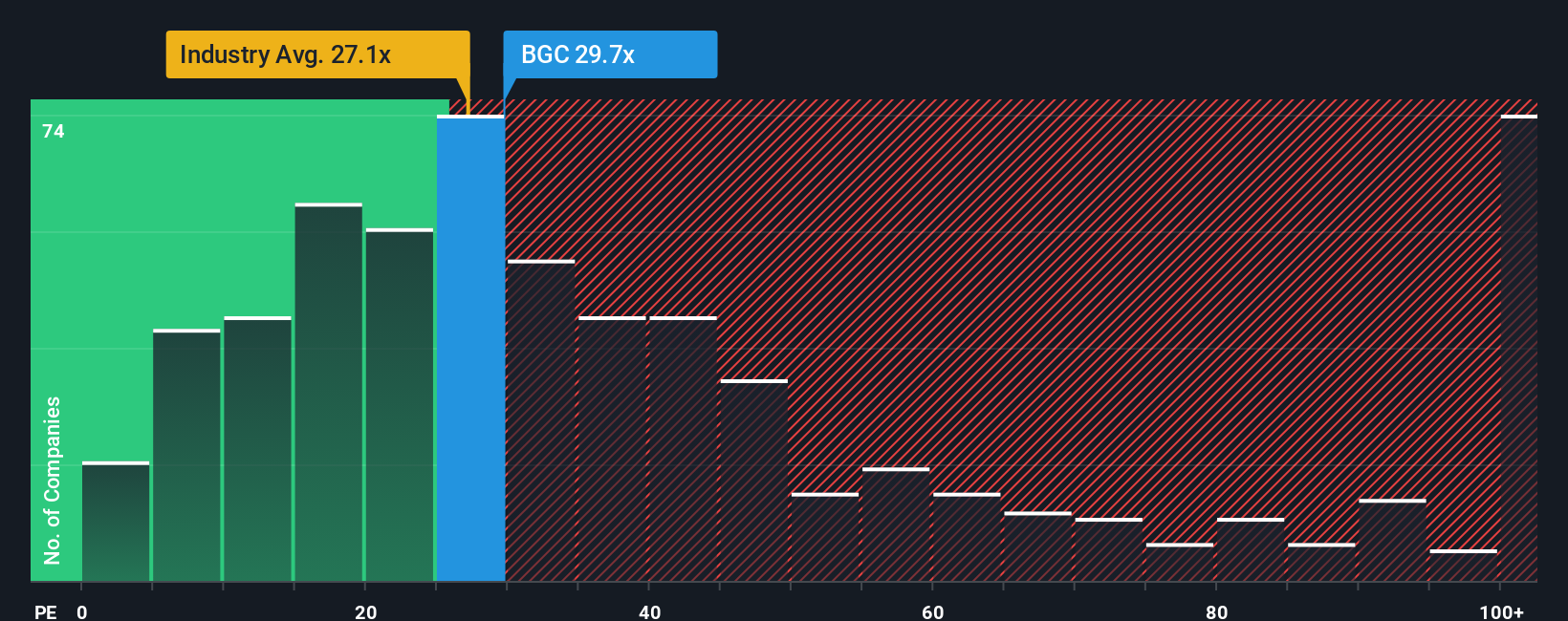

Looking at valuations from a different angle, BGC Group trades at a price-to-earnings ratio of 27.5x, notably higher than both the US Capital Markets industry average of 24.1x and the peer average of 7.8x. This premium suggests investors are paying up for future potential, but it also increases the risk if those expectations are not met. Could the market be overestimating BGC’s growth, or is this optimistic pricing justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BGC Group Narrative

If you see things differently, or want to dig deeper into your own research, you can quickly build your own perspective and narrative right here in just a few minutes. Do it your way

A great starting point for your BGC Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smarter Investment Paths?

Don’t let opportunity slip by. Fuel your portfolio with handpicked markets where innovation and growth are accelerating. Get these ideas before they take off:

- Tap into high-yield income by checking out these 16 dividend stocks with yields > 3% for companies consistently delivering attractive returns above 3%.

- Catch early waves of quantum innovation and position yourself ahead of the curve with these 27 quantum computing stocks at the forefront of tomorrow’s tech.

- Unlock value that the market has overlooked by sifting through these 870 undervalued stocks based on cash flows based on robust cash flow models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BGC Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BGC

BGC Group

Operates as a financial brokerage and technology company in the United States, Europe, the Middle East, Africa, and the Asia Pacific.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives