- United States

- /

- Diversified Financial

- /

- NasdaqGS:AFRM

Is There More Room for Affirm After Surging 334% and Announcing New Partnerships?

Reviewed by Bailey Pemberton

- Ever wondered if Affirm Holdings is worth its current price or if there is more value to uncover? You are not alone, and now is a great time to dig deeper into what is driving the stock.

- The company’s stock has seen impressive gains, with returns of 5.2% over the past week, 20.2% year-to-date, and a notable 334.1% over the last three years.

- Recent headlines have kept Affirm Holdings in the spotlight, including announcements about new merchant partnerships and innovations in its buy now, pay later offerings. These news stories have fueled both investor excitement and debate around the company’s long-term prospects.

- Currently, Affirm scores a 1 out of 6 on our valuation checklist, meaning it is only considered undervalued by one metric. Let’s break down how we arrive at this valuation. For anyone who wants the full story, there may be a smarter way to assess a company’s worth by the end of this article.

Affirm Holdings scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Affirm Holdings Excess Returns Analysis

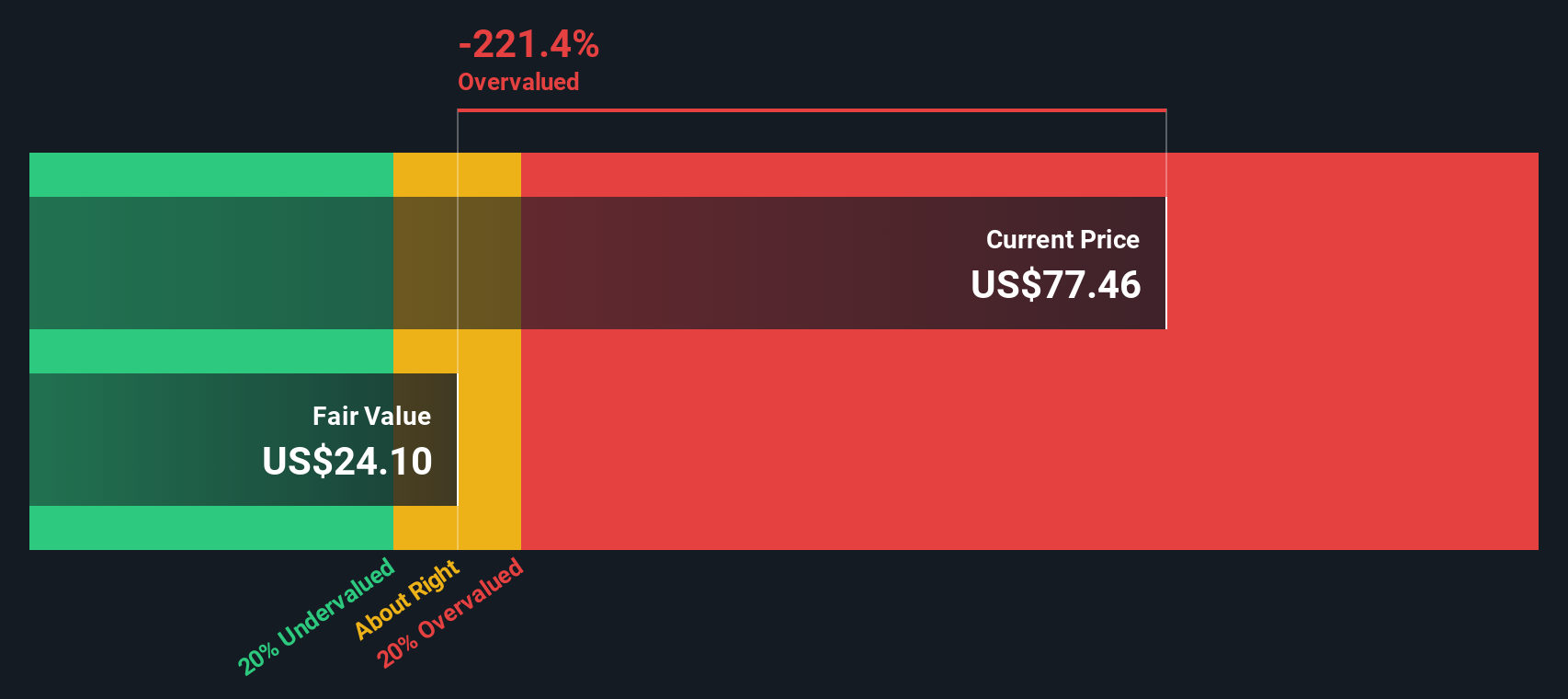

The Excess Returns model evaluates a company's intrinsic value by measuring how much profit it generates over and above its required cost of equity. In other words, it looks at how efficiently Affirm Holdings turns its invested capital into long-term returns for shareholders, after accounting for the minimum expected return demanded by investors.

For Affirm Holdings, several key figures stand out:

- Book Value: $10.00 per share

- Stable EPS: $1.94 per share (Source: Weighted future Return on Equity estimates from 6 analysts.)

- Cost of Equity: $1.22 per share

- Excess Return: $0.72 per share

- Average Return on Equity: 12.69%

- Stable Book Value: $15.29 per share (Source: Weighted future Book Value estimates from 3 analysts.)

This model's calculations suggest the stock’s intrinsic value is significantly lower than its current trading price. With an implied discount showing that Affirm Holdings is 146.5% overvalued, investors are currently paying a substantial premium compared to underlying returns and historic growth expectations.

Result: OVERVALUED

Our Excess Returns analysis suggests Affirm Holdings may be overvalued by 146.5%. Discover 855 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Affirm Holdings Price vs Earnings

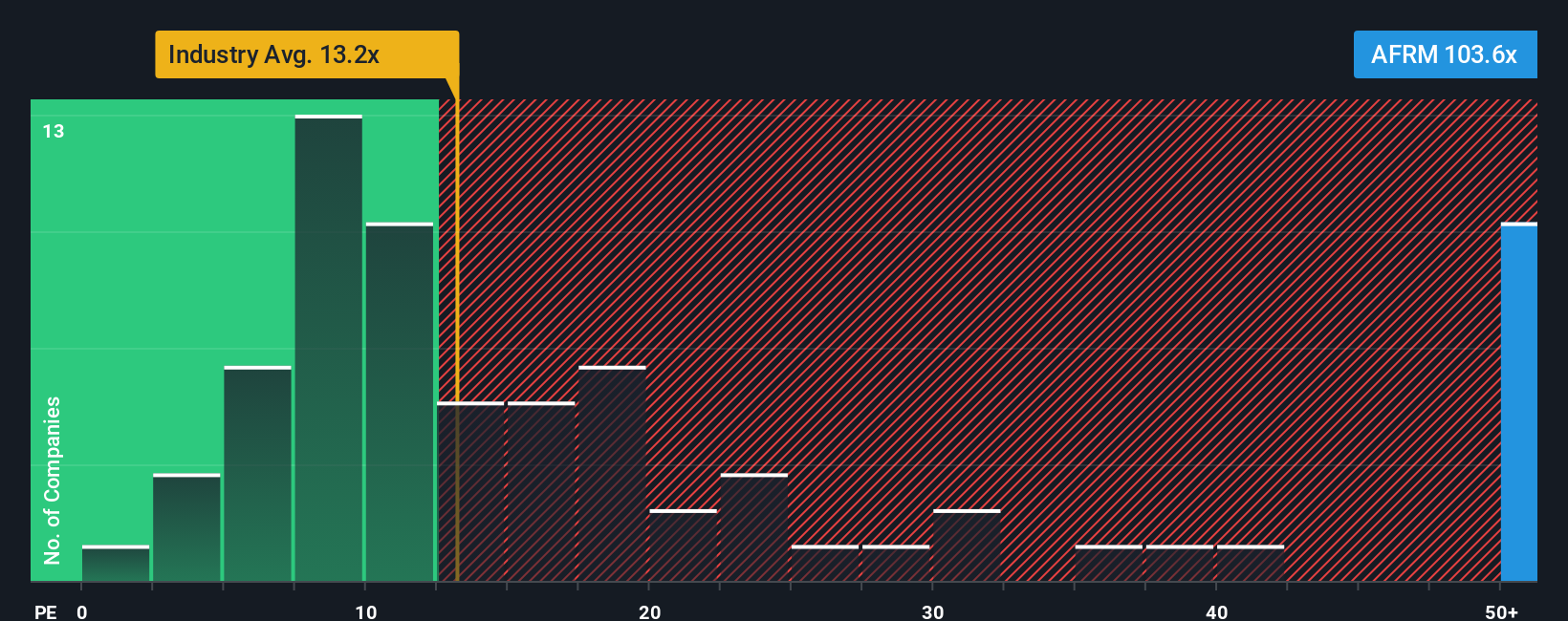

For profitable companies like Affirm Holdings, the Price-to-Earnings (PE) ratio is a widely recognized metric to assess valuation. It allows investors to compare how much they are paying for each dollar of current earnings, offering a direct look at expectations around future growth, profitability, and risk.

The "right" PE ratio is usually influenced by anticipated earnings growth and perceived risk. Higher growth companies often justify higher PE multiples, as investors are willing to pay up for expected expansion. Conversely, if a business faces significant uncertainty or lower growth, a more conservative PE is warranted.

Currently, Affirm Holdings trades at a lofty PE ratio of 106.4x, significantly above the Diversified Financial industry average of 13.5x and the peer group average of 30.2x. However, Simply Wall St's proprietary Fair Ratio for Affirm is 36.5x. This customized benchmark considers not just industry norms but also Affirm’s specific factors such as its growth outlook, market position, profit margins, size, and underlying risks.

The Fair Ratio is a more tailored measure than simple peer or industry comparisons because it accounts for nuances like Affirm's future earnings trajectories and unique risk profile. Comparing Affirm’s actual PE (106.4x) with its Fair Ratio (36.5x) suggests the stock is trading well above the level justified by its fundamentals and outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1372 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Affirm Holdings Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Simply put, a Narrative gives investors the chance to tell the story behind a stock using their own assumptions for fair value, and future revenue, earnings, and margins, instead of relying solely on headline numbers or analyst consensus.

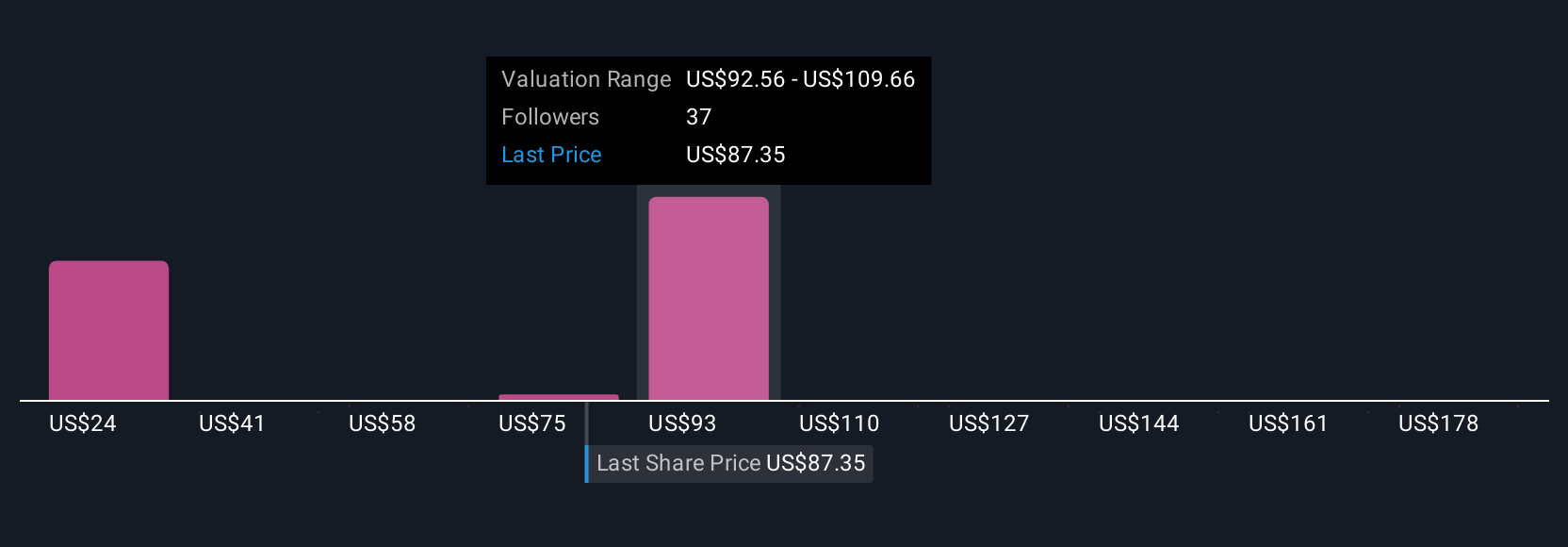

A Narrative is the bridge between a company's story and its financial forecast, allowing you to connect your understanding of Affirm Holdings' business, industry trends, and risks to a clear, updated valuation. Narratives are easy to create and compare using Simply Wall St’s Community page, where millions of investors share and update their perspectives based on the latest news, earnings, and developments.

By crafting a Narrative, you get to see how changes in revenue growth or profit margins (or a shift in strategy or market conditions) affect Affirm’s fair value. This can help guide decisions about when to buy, sell, or hold, especially as new information emerges in real time.

For example, recent analyst Narratives for Affirm range from a bullish view of $115 (optimistic about international expansion and technology leadership) to a bearish $64 (concerned about losing key partners and mounting competition), showing just how different stories can lead to very different valuations, even with the same starting data.

Do you think there's more to the story for Affirm Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AFRM

Affirm Holdings

Operates payment network in the United States, Canada, and internationally.

High growth potential with low risk.

Similar Companies

Market Insights

Community Narratives