- United States

- /

- Consumer Services

- /

- NYSEAM:COE

51Talk (NYSEAM:COE) Revenue Surge, Deeper Losses Reinforce Bearish Profitability Narrative

Reviewed by Simply Wall St

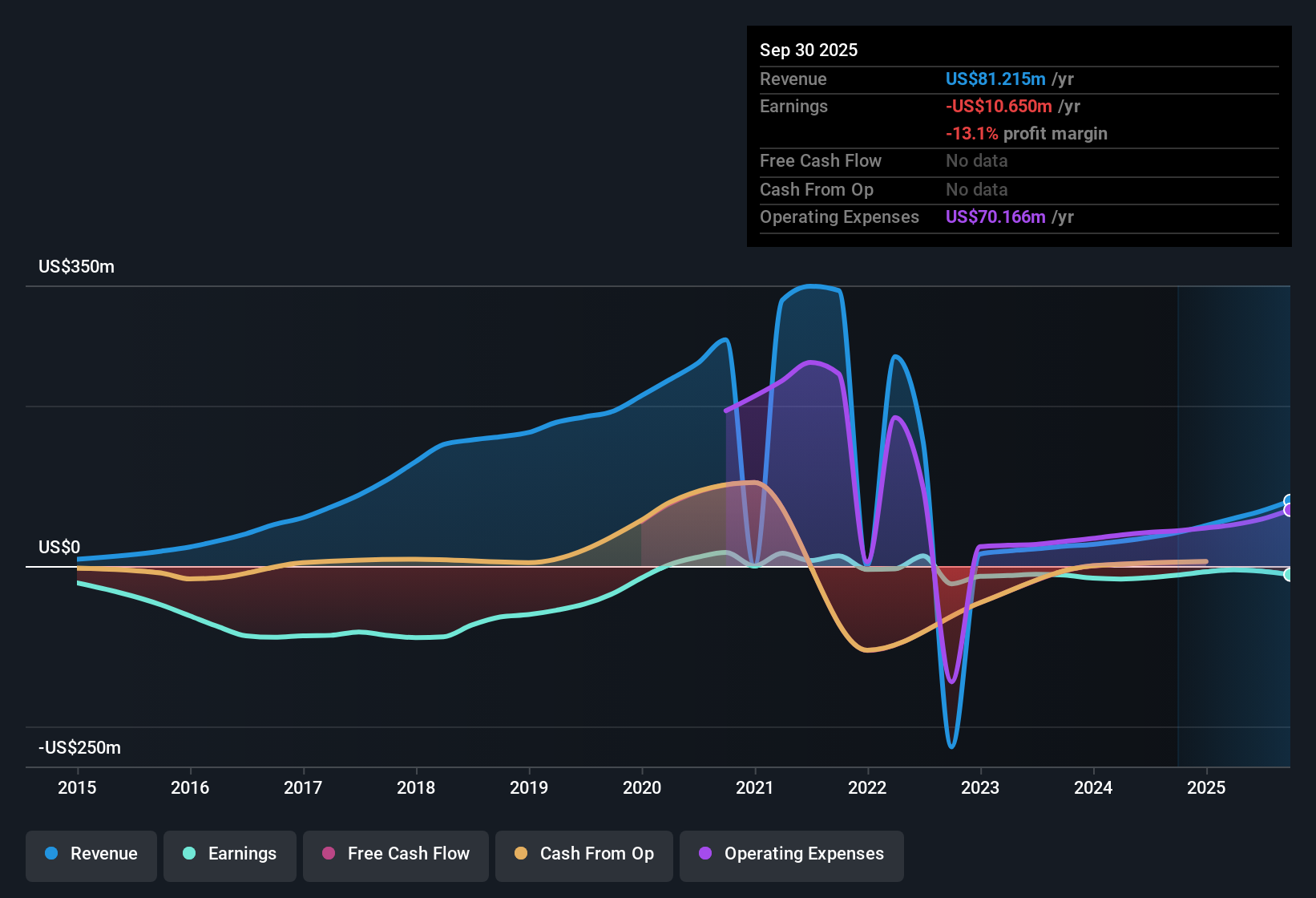

51Talk Online Education Group (NYSEAM:COE) opened its Q3 2025 update with Q2 numbers that underscored the current earnings picture, posting revenue of about $20.4 million and a basic EPS loss of roughly $0.52. The company has seen revenue move from $10.96 million in Q2 2024 to $20.4 million in Q2 2025 while EPS remained negative over that stretch, setting the stage for investors to focus squarely on how efficiently that extra top line is translating into margins.

See our full analysis for 51Talk Online Education Group.With the headline figures on the table, the next step is to weigh them against the prevailing narratives around 51Talk, examining where the latest numbers support the broader story and where they may prompt investors to reassess it.

Curious how numbers become stories that shape markets? Explore Community Narratives

Revenue Nearly Doubles Year on Year

- Top line has climbed from about $10.96 million in Q2 2024 to roughly $20.40 million in Q2 2025, showing that 51Talk is attracting significantly more spending on its platform over the past year.

- What stands out against a more cautious, bearish view is that this rising revenue base is appearing alongside still negative net income of about $3.05 million in Q2 2025,

- Critics highlight that losses on a trailing 12 month basis total roughly $6.51 million even as revenue over that same span reaches about $68.93 million. They see this as evidence that higher sales have not yet translated into sustainable profitability.

- That combination of strong dollar growth in revenue and persistent red ink lets bearish investors argue that efficiency and cost discipline, rather than demand, are the main questions the business still has to answer.

Losses Deepen Despite Higher Sales

- Net income excluding extra items has moved from about negative $1.25 million in Q2 2024 to around negative $3.05 million in Q2 2025, while basic EPS over the trailing 12 months sits near negative $1.11, reinforcing the data that earnings have declined at roughly a 46.7 percent annual pace over five years.

- Bears argue that this pattern heavily supports a more cautious stance,

- They point to negative shareholders’ equity alongside these multi year losses as a balance sheet signal that the company has been consuming more capital than it generates.

- They also note that quarter by quarter figures, such as Q1 2025 net income of about negative $1.47 million and Q4 2024 at roughly negative $1.63 million, show that red ink has been a regular feature rather than a one off event.

Valuation Rich Versus Peers

- The stock changes hands at about 3.1 times trailing 12 month sales compared with roughly 1.1 times for peers and 1.4 times for the wider US Consumer Services industry, while the current share price near $36.21 also sits above an indicated DCF fair value of about $30.72.

- From a more upbeat, bullish angle, some investors might argue that paying a higher multiple could be justified by the growth in revenue. Yet the existing numbers make that case harder to defend,

- The trailing 12 month figures still show around $6.51 million of losses, so the premium price to sales ratio is not being backed by profits or positive EPS today.

- With the market value running above DCF fair value, investors who lean on discounted cash flow work may see limited room for upside unless the company can close the gap between its growing sales and its continuing losses.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on 51Talk Online Education Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

51Talk’s rapid revenue growth sits alongside deepening losses, negative equity and a rich valuation. This combination raises questions about its financial resilience and downside risk.

If you want businesses with sturdier fundamentals instead, use our solid balance sheet and fundamentals stocks screener (1937 results) today to focus on companies built on stronger balance sheets and healthier financial footing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:COE

51Talk Online Education Group

Through its subsidiaries, engages in providing online education platform with English language education services to students in the People's Republic of China, Hong Kong, the Philippines, Singapore, Malaysia, and Thailand.

Very low risk with worrying balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026