- United States

- /

- Consumer Services

- /

- NYSE:UTI

Universal Technical Institute (UTI): Evaluating Value After Earnings Growth and Ambitious Expansion Plans

Reviewed by Simply Wall St

Universal Technical Institute (UTI) just released its latest earnings and updated its strategic roadmap, providing investors with a look at both steady revenue growth and a multi-year expansion strategy. Management’s guidance points to continued momentum and new opportunities ahead.

See our latest analysis for Universal Technical Institute.

Following UTI’s upbeat results and aggressive expansion plans, the stock has felt some pressure lately, with a 1-year total shareholder return of -11.02%. Still, its three- and five-year total returns of 214% and 270% indicate that long-term momentum remains strong. Management’s roadmap also signals potential for renewed growth ahead.

If you’re curious what other fast-rising companies with insider conviction are out there, now is the perfect time to broaden your horizons and discover fast growing stocks with high insider ownership

With shares trading well below analyst price targets and robust growth plans underway, the big question for investors now is whether UTI is undervalued or if the market has already accounted for its ambitious outlook.

Most Popular Narrative: 38.8% Undervalued

Universal Technical Institute’s latest close of $23.02 is well below the most widely followed fair value estimate of $37.60. This significant gap is driven by bold underlying assumptions. If these are realized, they could support an upside for long-term holders.

Strategic investments in campus expansion, new program rollouts (notably in HVAC, aviation, and allied health), and digitization efforts are expected to support top-line expansion. The consolidation of core systems is also projected to facilitate operating efficiencies and drive long-term margin improvement beyond the near-term investment cycle.

Curious what’s fueling such an aggressive fair value? The narrative relies on assumptions regarding future growth, margin trends, and a notable profit multiple that hints at significant ambitions. Explore which forecasts are moving the needle and why some analysts believe the market may be overlooking important factors.

Result: Fair Value of $37.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on legacy auto programs or missteps in rapid campus expansion could hinder UTI’s growth story if market conditions shift unexpectedly.

Find out about the key risks to this Universal Technical Institute narrative.

Another View: Market Ratios Raise Questions

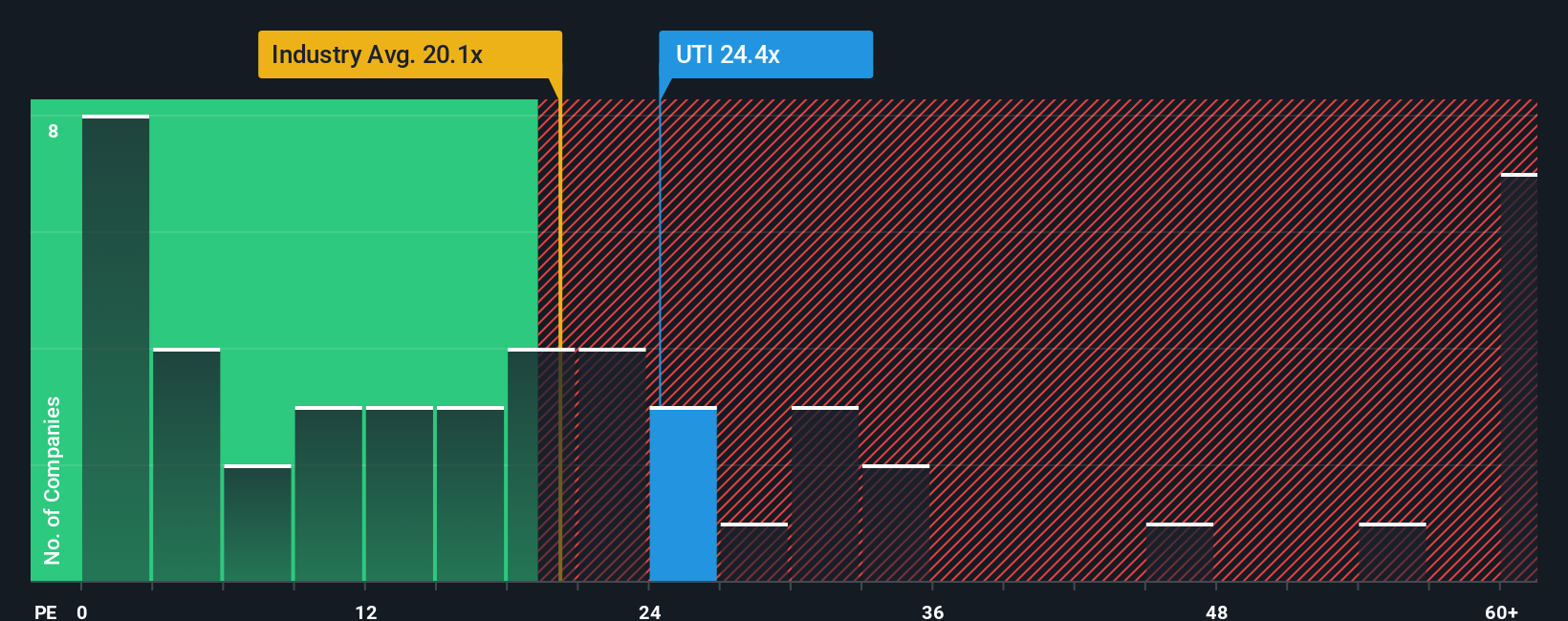

While analyst fair value targets suggest Universal Technical Institute is significantly undervalued, a closer look at its price-to-earnings ratio tells a different story. UTI is trading at 19.9 times earnings, which is higher than the fair ratio of 10.6 and above the industry average of 15.9. This means the market could be pricing in more optimism than its fundamentals might justify, and highlights additional valuation risk for investors to weigh. Is the gap an opportunity or a warning sign?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Universal Technical Institute for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Universal Technical Institute Narrative

If you have a different perspective or want to dive deeper into the numbers yourself, you can craft your own narrative quickly and easily. Do it your way

A great starting point for your Universal Technical Institute research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let opportunity pass you by. Simply Wall St’s screeners are packed with high-potential companies you won’t want to miss adding to your watchlist.

- Uncover swift-moving tech game changers by checking out these 25 AI penny stocks powering the AI revolution with innovative breakthroughs and competitive advantages.

- Lock in steady income streams and reliable returns by reviewing these 15 dividend stocks with yields > 3% featuring robust yields above 3% and proven payout histories.

- Seize market mispricings with these 914 undervalued stocks based on cash flows that are overlooked by most investors and offer exceptional value based on solid cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UTI

Universal Technical Institute

Provides transportation, skilled trades, and healthcare education programs in the United States.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026