- United States

- /

- Hospitality

- /

- NYSE:SHAK

Does Shake Shack’s CFO Transition Signal a Shift in Strategic Direction for SHAK?

Reviewed by Sasha Jovanovic

- Shake Shack announced that Chief Financial Officer Katherine Fogertey will step down effective March 4, 2026, beginning an immediate transition to a Senior Advisor role as the company searches for a new CFO and establishes an interim Office of the CFO.

- This leadership transition comes as Shake Shack reaffirmed its financial guidance for the fourth quarter and full year 2025, aiming to provide stability amid executive change.

- We'll explore how the CFO transition and Shake Shack's reaffirmed outlook may influence the company's investment narrative moving forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Shake Shack Investment Narrative Recap

To be a shareholder in Shake Shack, you need confidence in its ability to convert ongoing investments in menu innovation, digital channels, and urban expansion into sustainable revenue and profit growth. The CFO transition announced by Shake Shack does not appear to meaningfully impact the company's near-term catalysts, which remain centered on same-store sales performance and margin improvement, nor does it introduce material new risks to its current operating outlook.

Amid this executive change, Shake Shack reaffirmed its financial guidance for the fourth quarter and full year 2025, projecting continued revenue growth. This commitment to maintaining targets during a period of transition speaks to clear operational visibility, but the path forward will still depend on how effectively the new leadership navigates ongoing cost pressures and operating complexity.

However, investors should also be mindful that while executive transitions can be managed, the real test for Shake Shack’s margins and growth ambitions may hinge on...

Read the full narrative on Shake Shack (it's free!)

Shake Shack's narrative projects $2.0 billion in revenue and $107.9 million in earnings by 2028. This requires 14.8% yearly revenue growth and a $88.0 million earnings increase from current earnings of $19.9 million.

Uncover how Shake Shack's forecasts yield a $114.36 fair value, a 31% upside to its current price.

Exploring Other Perspectives

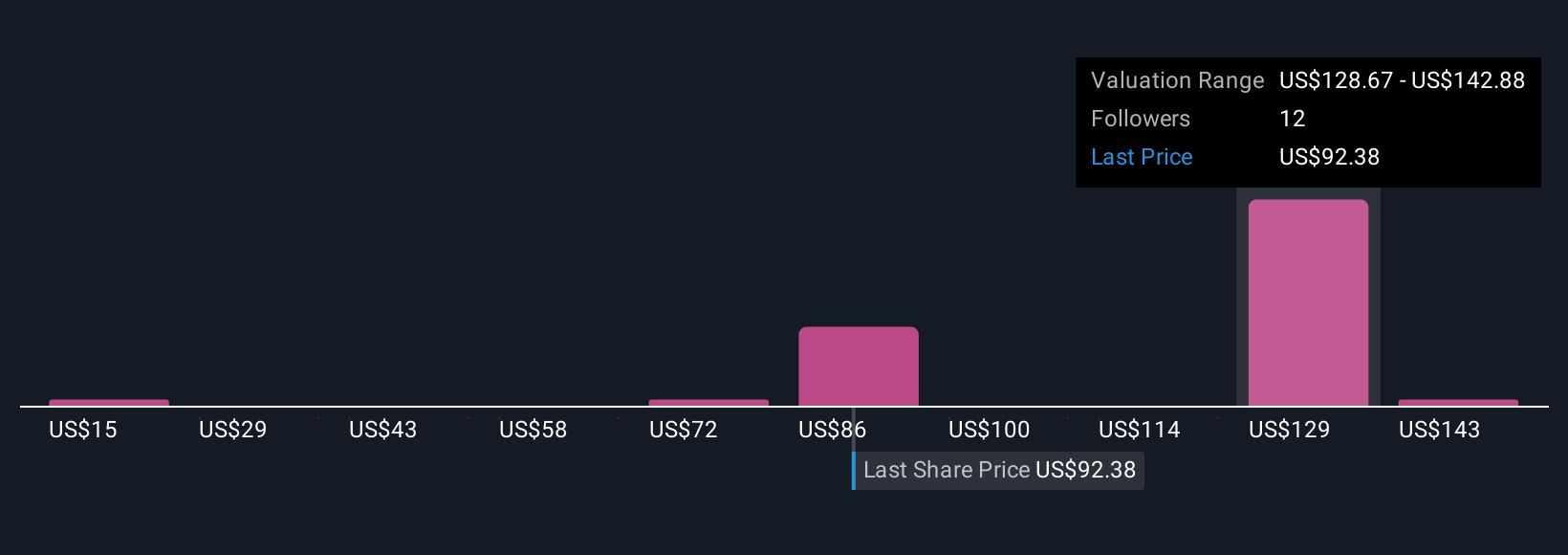

Simply Wall St Community members submitted five fair value estimates for Shake Shack, ranging widely from US$23.32 to US$157.09 per share. Amidst such strong differences, current risks around margin pressure and operating efficiencies remain central to how future performance may unfold, so reviewing multiple viewpoints can help inform your own assessment.

Explore 5 other fair value estimates on Shake Shack - why the stock might be worth less than half the current price!

Build Your Own Shake Shack Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Shake Shack research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Shake Shack research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Shake Shack's overall financial health at a glance.

No Opportunity In Shake Shack?

Our top stock finds are flying under the radar-for now. Get in early:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SHAK

Shake Shack

Owns, operates, and licenses Shake Shack restaurants (Shacks) in the United States and internationally.

Solid track record with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026