- United States

- /

- Hospitality

- /

- NYSE:RCL

Is Royal Caribbean Still an Opportunity After a 78% Stock Surge Into 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with your Royal Caribbean Cruises shares, or sizing up whether it's time to come aboard? You are definitely not alone. This cruise line has been making waves, and with each swing in the market, investors are looking for clear answers. Over the past year, Royal Caribbean's stock price has surged an eye-catching 78.6%, building on a three-year gain of 684.8%. Even after a bit of a pullback in the last month, with a dip of 9.9%, the stock remains up 38.5% since the start of the year. Such a strong multi-year performance often signals increased optimism about the company, possibly reflecting changes in travel sentiment or shifts in how investors view risks tied to the cruise industry.

Plenty of people are asking whether Royal Caribbean is still a good value after all these gains. That's where objective metrics help cut through the noise. When put under the microscope, the company has racked up a value score of 5 out of 6, meaning it currently looks undervalued by most standard checks. So, is now the right time to set sail with RCL, or are these good times fully priced in? Let's dive into how the main valuation checks stack up for Royal Caribbean, plus, stick around for a discussion on one often-overlooked way to understand the real story behind the numbers.

Approach 1: Royal Caribbean Cruises Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by forecasting its future cash flows and then discounting those amounts back to their present value. In this approach, the intrinsic value reflects not just recent performance but also the expected ability of the company to generate cash over many years. This translates all those future dollars into today's terms.

For Royal Caribbean Cruises, the current Free Cash Flow stands at $2.33 Billion. Analysts have projected Free Cash Flow to rise steadily, reaching $6.13 Billion by year-end 2029. After this point, additional projections up to 2035 are extrapolated by Simply Wall St, highlighting continued anticipated growth. All figures are presented in US dollars.

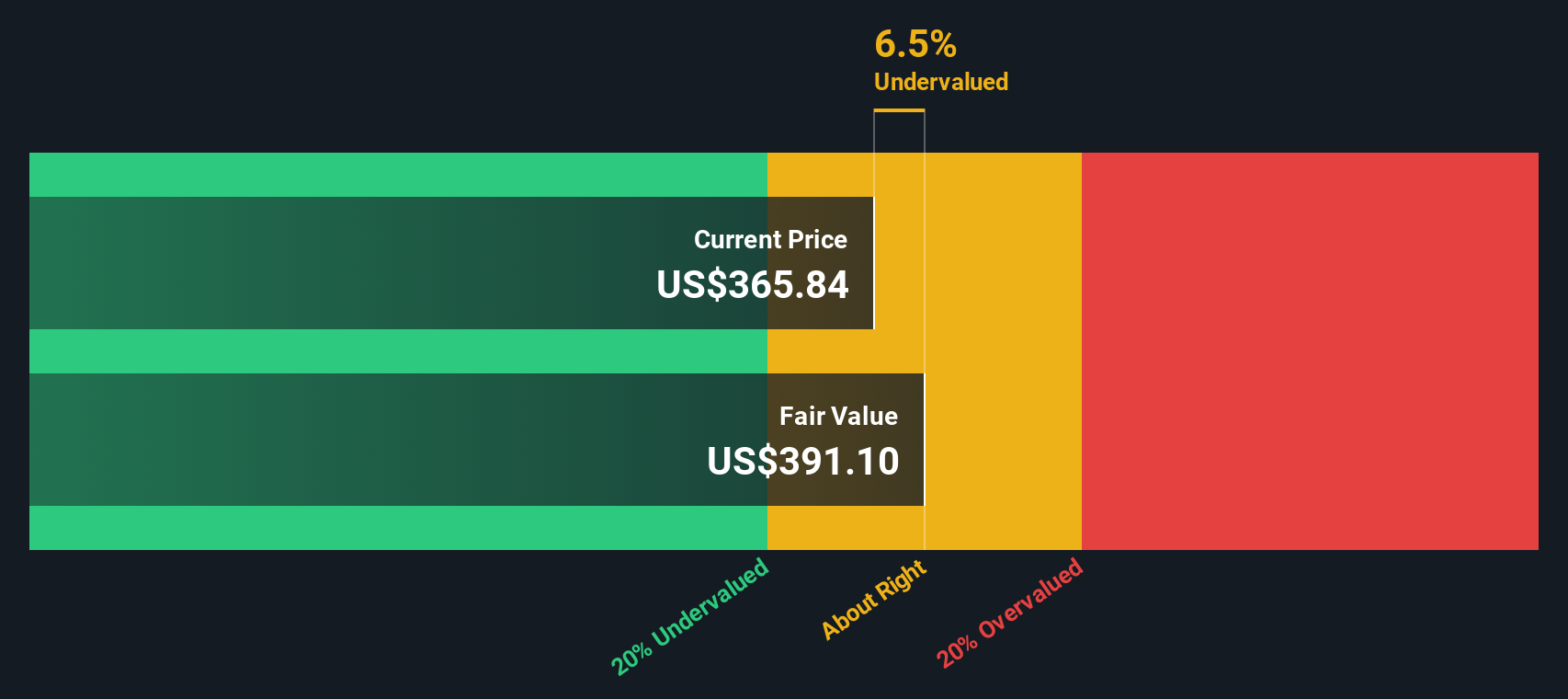

Using these projections, the DCF analysis arrives at an estimated intrinsic fair value of $411.00 per share. Given the current market price, this implies the stock is trading at a 22.8% discount to its fair value. This indicates that Royal Caribbean is significantly undervalued relative to its discounted future cash flows.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Royal Caribbean Cruises is undervalued by 22.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Royal Caribbean Cruises Price vs Earnings

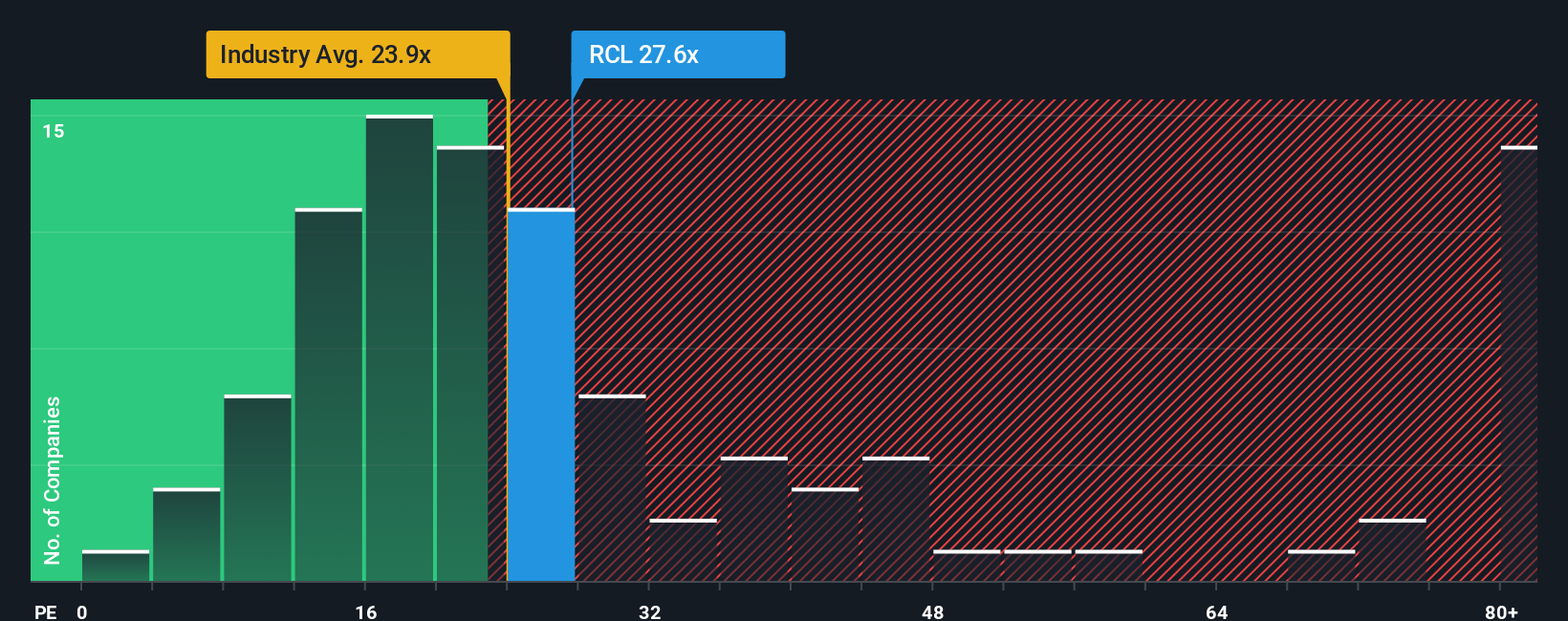

The price-to-earnings (PE) ratio is a widely used method for valuing profitable companies, as it relates a company’s current share price to its per-share earnings. For businesses with consistent earnings and positive growth, the PE ratio helps investors quickly compare value relative to peers and historical standards.

Growth expectations and risk play a major role in determining what counts as a “normal” or “fair” PE ratio. Companies with rapid growth and lower risk typically deserve higher PE multiples, while more volatile or slow-growing businesses command lower ratios. This balance helps investors understand if a stock’s valuation is justified or stretched.

Royal Caribbean Cruises currently trades at a PE ratio of 23.9x. That is slightly below the Hospitality industry average of 24.9x, and well below its peers’ average at 28.7x. However, Simply Wall St’s “Fair Ratio” estimate for Royal Caribbean is an advanced benchmark calculated by factoring in the company’s earnings growth, profit margins, industry, market cap, and risk profile, and comes in at 32.4x. This proprietary metric gives a more tailored assessment than comparing to generic industry averages or peer groups, as it fully accounts for what makes Royal Caribbean unique within its space.

With the current PE ratio below both the peer group and particularly the Fair Ratio, this suggests the market may be underestimating the company’s earnings potential or future outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Royal Caribbean Cruises Narrative

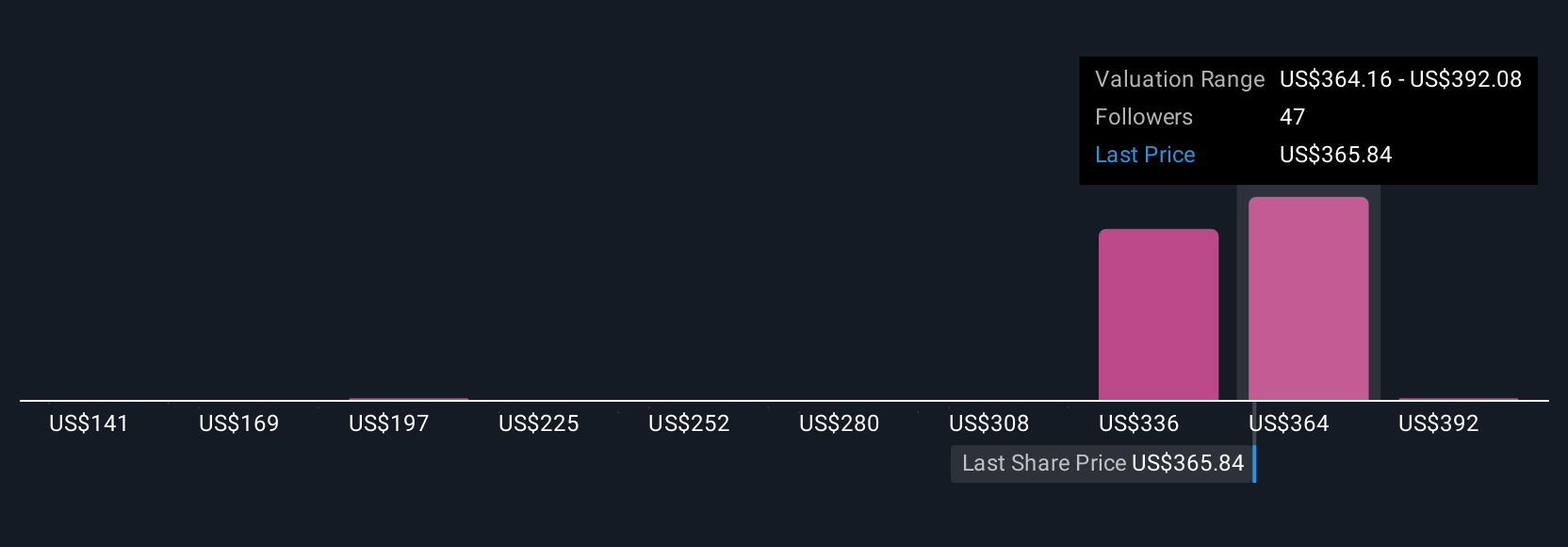

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a dynamic feature that puts your perspective at the centre of investment decisions. A Narrative is simply your story about a company, where you connect your unique outlook on Royal Caribbean Cruises to real financial forecasts and a calculated fair value. Narratives make investing more personal and actionable by letting you clearly lay out your views on things like future revenue, earnings, and margins, and then see what those assumptions mean for the stock's value today.

Available to millions of investors on Simply Wall St’s Community page, Narratives are an easy and accessible tool that links a company’s business story directly to the numbers and to actionable price targets. You can instantly see if your outlook signals that Royal Caribbean is undervalued or fully priced by comparing your fair value to the current share price, helping you decide whether to buy, hold, or sell. Narratives dynamically update as new news, earnings, or data emerge, so your investment view always stays relevant.

For example, some investors believe new ships and market expansion will drive Royal Caribbean’s value as high as $420, while others are more cautious and set their sights at $218, demonstrating how your personal Narrative can drive a smarter, more confident decision.

Do you think there's more to the story for Royal Caribbean Cruises? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RCL

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives