- United States

- /

- Hospitality

- /

- NYSE:QSR

Should Restaurant Brands International’s Strong Q3 and Expansion Plans Amid Share Sale Activity Require Action From QSR Investors?

Reviewed by Sasha Jovanovic

- In late November 2025, Restaurant Brands International reported third-quarter results that topped analysts’ expectations, highlighted strong performances at Tim Hortons and its International segment, and continued progress in the Burger King U.S. turnaround, while a 3G Capital affiliate moved ahead with a secondary sale of up to 17.63 million shares.

- The company also outlined an accelerated global expansion plan, including a China refranchising deal and long-term unit growth targets into 2027–2028, reinforcing confidence in its multi-brand, franchise-led growth model despite insider and shareholder share sales.

- We’ll now examine how these stronger-than-expected earnings and reiterated long-term growth targets may influence Restaurant Brands International’s investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Restaurant Brands International Investment Narrative Recap

To own Restaurant Brands International, you need to believe its franchise-led model can keep compounding earnings through global expansion, brand refreshes and digital investments. The latest earnings beat and reiterated 2027–2028 growth targets support that thesis, while the 3G affiliate’s secondary sale mainly adds near-term sentiment and liquidity noise rather than altering the core catalyst of accelerating international unit growth; the bigger risk remains execution across markets like China and other underperforming regions.

The China refranchising and joint venture plan, with a push toward a larger footprint over time, looks most directly tied to today’s narrative, because it sits at the intersection of the company’s key catalyst and key risk: faster capital-light expansion on one side, and the possibility of operational missteps, partner issues or bad debt spikes on the other, particularly in markets that already require restructuring.

Yet investors should be aware that heightened competition and promotional intensity could pressure margins if...

Read the full narrative on Restaurant Brands International (it's free!)

Restaurant Brands International's narrative projects $10.1 billion revenue and $2.0 billion earnings by 2028. This requires 3.5% yearly revenue growth and an earnings increase of about $1.1 billion from $862.0 million today.

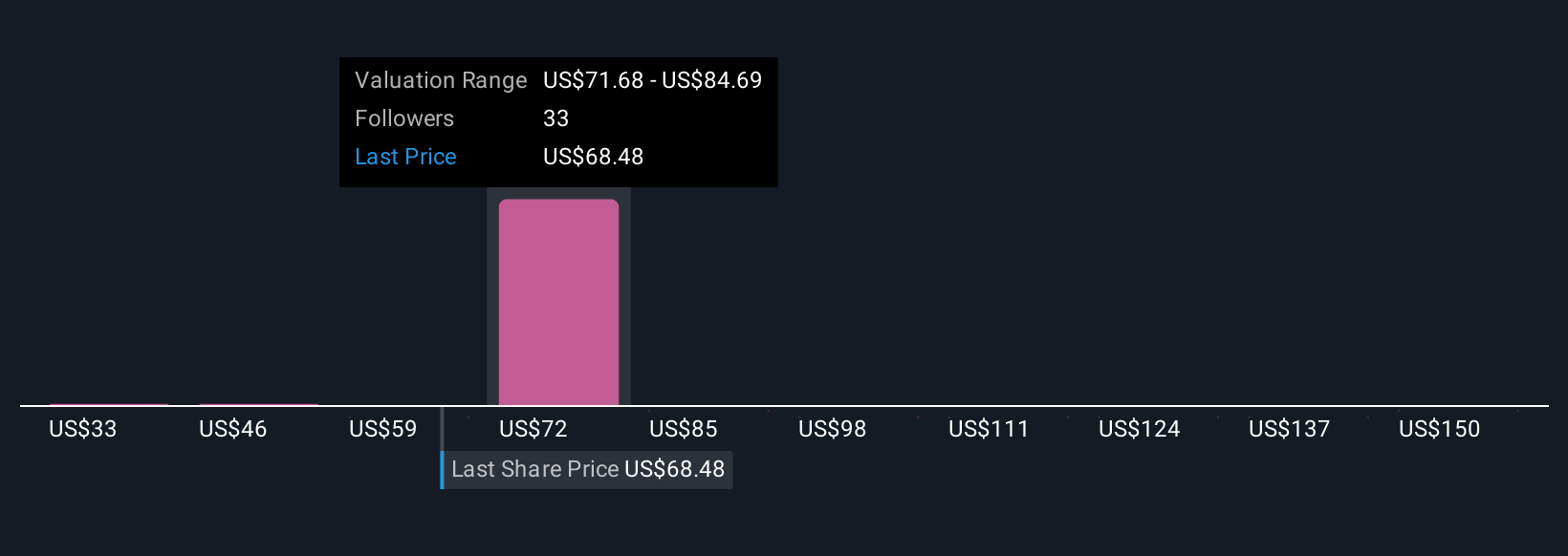

Uncover how Restaurant Brands International's forecasts yield a $77.93 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community span roughly US$43 to about US$88 per share, reflecting very different expectations. When you weigh that dispersion against RBI’s reliance on rapid international expansion to power growth, it underlines how much your view on execution risk in markets like China may shape your own assessment of the company’s prospects.

Explore 4 other fair value estimates on Restaurant Brands International - why the stock might be worth as much as 20% more than the current price!

Build Your Own Restaurant Brands International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Restaurant Brands International research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Restaurant Brands International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Restaurant Brands International's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QSR

Restaurant Brands International

Operates as a quick-service restaurant company in Canada, the United States, and internationally.

Established dividend payer with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026