- United States

- /

- Hospitality

- /

- NYSE:PRSU

Assessing Pursuit Attractions and Hospitality’s (PRSU) Valuation After Expanding Credit Facility and International Growth Moves

Reviewed by Kshitija Bhandaru

Pursuit Attractions and Hospitality (NYSE:PRSU) increased its revolving credit facility by $100 million and extended the maturity date to 2030. The move also added its Costa Rican subsidiary as a co-borrower, signaling expanded financial flexibility for international projects.

See our latest analysis for Pursuit Attractions and Hospitality.

Following a period of ambitious capital moves, including the recently expanded credit facility, Pursuit Attractions and Hospitality’s share price has drifted lower in 2025. This reflects lingering investor caution around recent funding efforts and international expansion plans. Yet, the company’s five-year total shareholder return of 57% hints at underlying growth potential, even as short-term momentum remains muted.

If these strategic shifts have you curious about other emerging opportunities, this could be the perfect moment to discover fast growing stocks with high insider ownership.

With the stock lagging despite clear signs of financial ambition, investors are left to wonder: Is Pursuit Attractions and Hospitality undervalued at these levels, or has the market already accounted for future growth in its price?

Most Popular Narrative: 15% Undervalued

Compared to Pursuit Attractions and Hospitality’s last close of $35.69, the favored narrative estimates a fair value of $42. With the current price still below this target, attention is shifting to the foundation of these upbeat projections.

Operational focus on maximizing yield through dynamic pricing, enhanced guest programming, and integrated collections (lodging, attractions, dining) allows Pursuit to raise per-visitor revenue and improve margins. This is demonstrated by double-digit same-store pricing and RevPAR increases, which should drive future net margin expansion.

Want to know what’s fueling this premium? The narrative hinges on just a handful of aggressive operational strategies and bold margin assumptions. Curious if these moves can actually deliver? Uncover the quantitative story and see which numbers the bulls are betting on.

Result: Fair Value of $42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated assets in iconic destinations and rising labor costs could challenge Pursuit’s growth story if local disruptions or staffing pressures become more significant.

Find out about the key risks to this Pursuit Attractions and Hospitality narrative.

Another View: What Do Market Ratios Suggest?

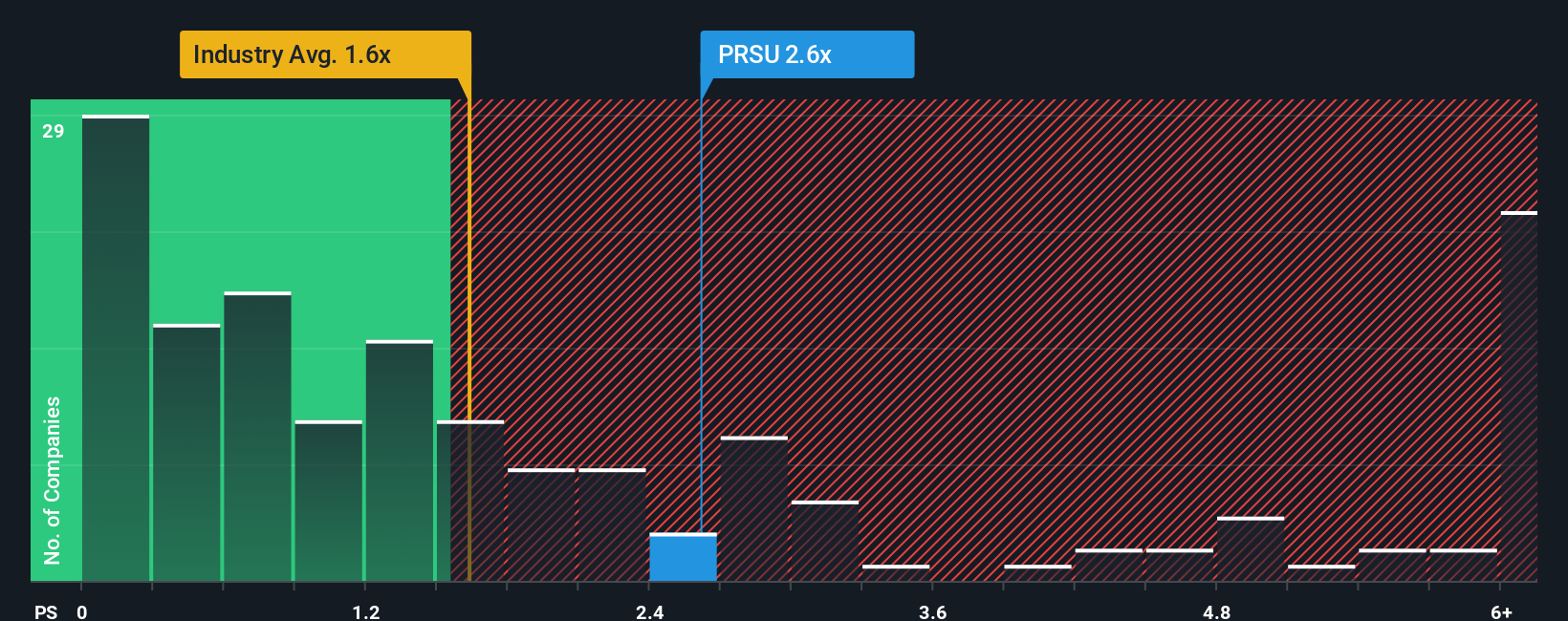

Looking at Pursuit Attractions and Hospitality’s current price-to-sales ratio of 2.6x reveals a significantly higher valuation than the US Hospitality industry average of 1.7x. Similar peers average just 1.1x, while the fair ratio tends to be around 1x. This price premium signals that investors expect standout growth and execution, but it also increases the risk of disappointment if the company underdelivers. Is the optimism already reflected in the price, or could a reassessment be on the horizon?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pursuit Attractions and Hospitality Narrative

If you see the story differently, or want to test your own assumptions, you can build your own outlook in just a few minutes. Do it your way

A great starting point for your Pursuit Attractions and Hospitality research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors seize new opportunities before they hit the headlines. Use these tailored screens to uncover companies you might otherwise miss and stay ahead of the curve.

- Claim your edge with steady returns and start tracking these 19 dividend stocks with yields > 3%, offering yields above 3% to boost your portfolio’s income stream.

- Spot fast-moving trends in technology by tapping into these 24 AI penny stocks, where tomorrow’s AI leaders are being built today.

- Capitalize on overlooked value and hunt for standouts among these 885 undervalued stocks based on cash flows, where persistent cash flow strength points to room for upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRSU

Pursuit Attractions and Hospitality

An attraction and hospitality company, owns and operates hospitality destinations in the United States, Canada, and Iceland.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives