- United States

- /

- Hospitality

- /

- NYSE:PLNT

Assessing Planet Fitness (PLNT) Valuation After $750 Million Debt Refinancing and Capital Structure Shift

Reviewed by Simply Wall St

Planet Fitness (PLNT) just locked in $750 million of new senior secured notes, a refinancing move designed to tidy up older debt, bolster reserves, and leave room for potential share buybacks.

See our latest analysis for Planet Fitness.

The refinancing headlines cap a steady stretch for Planet Fitness, with the latest share price at $109.15 and a 90 day share price return of 6.40% alongside a three year total shareholder return of 45.09%, suggesting momentum is gradually rebuilding.

If this kind of balance sheet reshaping has you rethinking your watchlist, it might be worth exploring fast growing stocks with high insider ownership for other stocks where insiders are backing the growth story with their own capital.

With earnings still growing double digits and the stock trading about 18% below analyst targets, investors now face a key dilemma: Is Planet Fitness quietly undervalued, or is the market already baking in years of future gains?

Most Popular Narrative Narrative: 15.3% Undervalued

With Planet Fitness closing at $109.15 against a narrative fair value of $128.94, the valuation case leans in favor of further upside and long term compounding.

Analysts are assuming Planet Fitness's revenue will grow by 11.6% annually over the next 3 years.

Analysts assume that profit margins will increase from 16.2% today to 19.3% in 3 years time.

Curious what kind of earnings engine justifies that richer future profit multiple and steady margin climb? The narrative leans on ambitious growth math. Want the full playbook?

Result: Fair Value of $128.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the thesis could crack if higher churn from easier cancellations persists or if franchise expansion slows as competition intensifies.

Find out about the key risks to this Planet Fitness narrative.

Another View: Valuation Looks Rich on Earnings

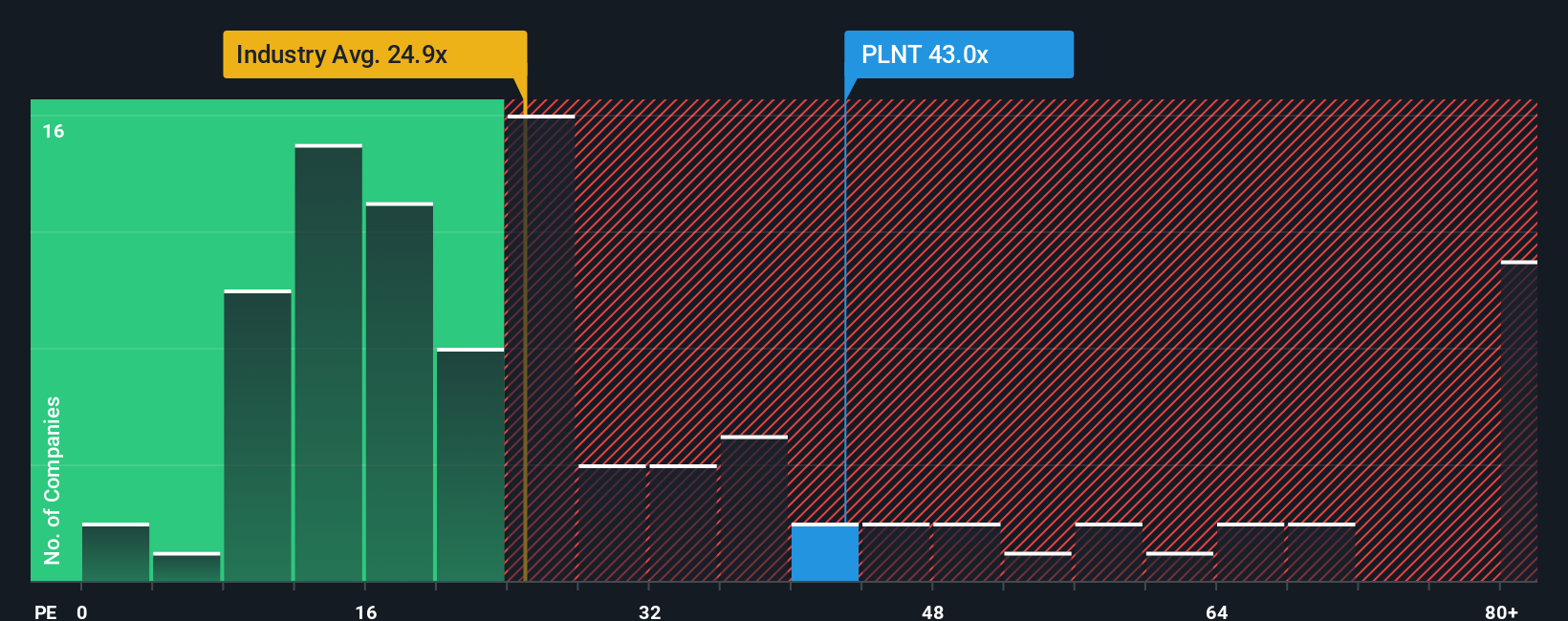

Step away from the narrative of fair value and the earnings lens tells a tougher story. Planet Fitness trades on a 44x price to earnings ratio versus 28.1x for peers and a 23.8x fair ratio, implying the market is already paying up for perfection. What happens if growth simply moderates?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Planet Fitness Narrative

If you are not sold on these narratives or would rather dive into the numbers yourself, you can build a personalized view in minutes: Do it your way

A great starting point for your Planet Fitness research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at a single stock when you can target stronger opportunities. Use the Simply Wall St Screener to uncover ideas most investors overlook.

- Catch powerful growth trends early by scanning these 27 AI penny stocks that could shape the next wave of market leaders.

- Lock in potential value before the crowd notices with these 903 undervalued stocks based on cash flows grounded in future cash flow strength, not hype.

- Strengthen your income strategy by focusing on these 15 dividend stocks with yields > 3% that aim to deliver yields above 3% without sacrificing fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PLNT

Planet Fitness

Planet Fitness, Inc., together with its subsidiaries, franchises and operates fitness centers under the Planet Fitness brand.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026