- United States

- /

- Hospitality

- /

- NYSE:MGM

MGM Resorts International: Valuation Perspectives as Las Vegas F1 Boosts Traffic and Osaka Expansion Unfolds

Reviewed by Simply Wall St

MGM Resorts International (MGM) saw a jump in attention from investors thanks to a strong Las Vegas F1 weekend. This event brought in extra visitors, boosted betting activity, and drove up hotel occupancy and gaming revenue. The company’s fresh expansion plans in Osaka also added to the buzz around the stock.

See our latest analysis for MGM Resorts International.

After a string of upbeat business developments, MGM Resorts International's share price staged a strong rebound, posting a 13% gain over the last month following a choppy run through most of the past quarter. Despite momentum building recently, long-term performance lags, with the 1-year total shareholder return still negative. This suggests investors remain cautious even as Vegas buzz returns and new ventures in Japan ramp up.

If the latest streak at MGM has you interested in what else is gaining traction, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With excitement from Las Vegas and new opportunities in Japan, MGM’s recent rally stands out. But is the stock still trading at a meaningful discount, or has the market already factored in all the future growth?

Most Popular Narrative: 17% Undervalued

With MGM Resorts International last closing at $35.29, the most widely followed narrative sees a fair value nearly 17% higher, suggesting the potential for meaningful upside if certain catalysts materialize and assumptions hold true.

MGM's ability to leverage urbanization and large-scale event-driven demand (for example, the "golden triangle" of major Las Vegas venues surrounding MGM properties, growing convention calendars, and sports-driven visitation) is expected to drive stable occupancy, boost non-gaming and ancillary revenues, and support recurring cash flows.

What ambitious revenue growth, margin expansion, and international bets are reflected in this price target? The core story points to strategic portfolio shifts and significant assumptions behind MGM's potential market rerating. Find out which financial elements truly fuel the optimism by examining the key drivers that set this fair value.

Result: Fair Value of $42.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing weakness in Las Vegas demand and potential execution risks from large international projects could quickly challenge the optimism around MGM’s current valuation.

Find out about the key risks to this MGM Resorts International narrative.

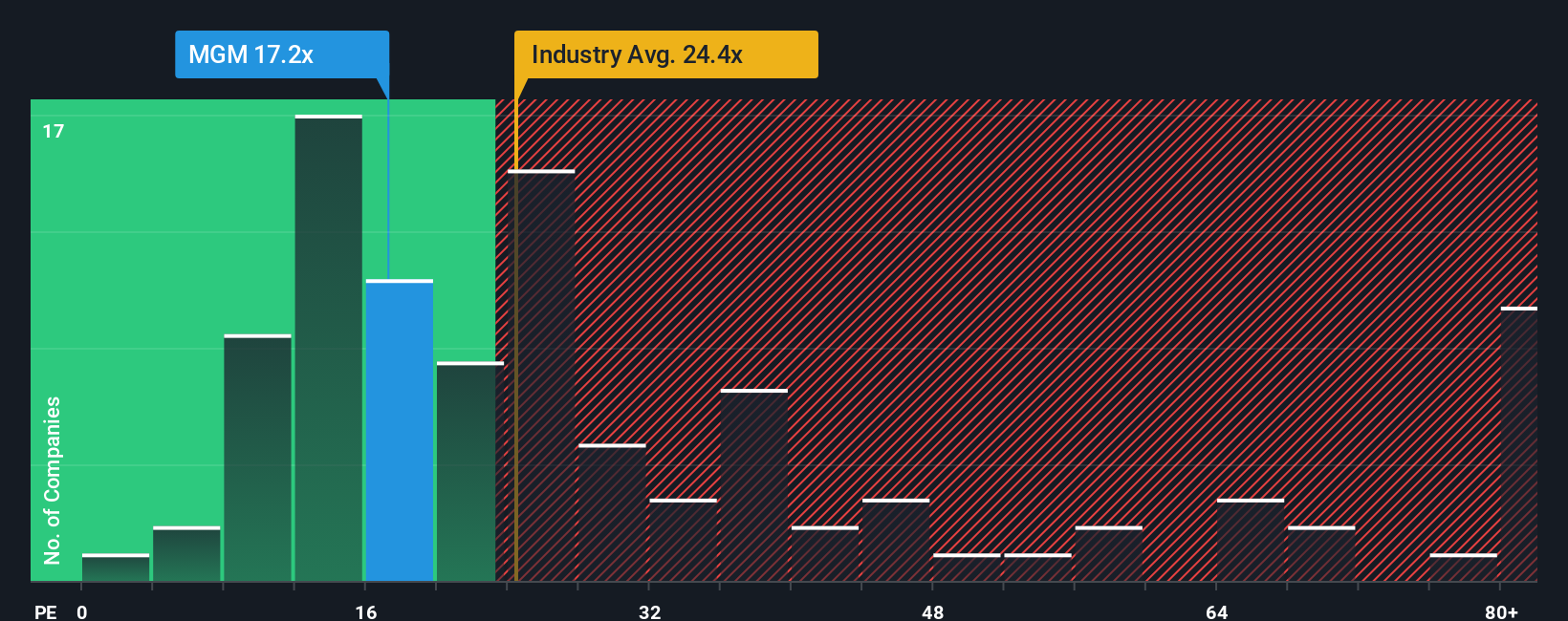

Another View: Expensive on Key Ratio

While some see value based on future growth, MGM trades at a hefty 143.7x on the market's chosen valuation measure. This is far above the industry average of 21.4x and the peer average of 15.2x. Even relative to its fair ratio of 48.3x, MGM looks pricey. Does this premium signal confidence, or should investors be wary of what the market may be expecting?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MGM Resorts International Narrative

If you see the story differently or want to dig into the numbers yourself, you can put together your own take in just a few minutes. Do it your way

A great starting point for your MGM Resorts International research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop looking for their next big opportunity. Gain an edge by using these powerful tools to track fresh trends and stay ahead of the market crowd.

- Tap into untapped income streams with these 15 dividend stocks with yields > 3%, which spots steady companies yielding more than 3% for reliable payouts.

- Accelerate your gains by targeting the innovators behind tomorrow’s breakthroughs using these 28 quantum computing stocks, offering access to quantum technology leaders.

- Secure undervalued assets before the mainstream catches on by leveraging these 921 undervalued stocks based on cash flows and efficient cash-flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MGM

MGM Resorts International

Through its subsidiaries, operates as a gaming and entertainment company in the United States, China, and internationally.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.