- United States

- /

- Hospitality

- /

- NYSE:MGM

MGM Resorts International (MGM): Examining Valuation Following Recent Share Price Underperformance

Reviewed by Simply Wall St

MGM Resorts International (MGM) shares have been moving in recent weeks, with investors weighing the company’s recent performance against shifting trends in the leisure and hospitality sector. The stock has underperformed over the past month and quarter.

See our latest analysis for MGM Resorts International.

After last year’s hot streak, momentum for MGM Resorts International has cooled. The 1-year total shareholder return now sits at -12.03% as recent share price declines have weighed on performance. The latest moves suggest investors are reassessing growth potential amid a changing landscape, especially following mixed quarterly results.

If MGM’s shift has you thinking about where else opportunity could arise, now’s a great moment to expand your search and discover fast growing stocks with high insider ownership

With shares still trading well below analyst targets and at a significant discount to estimated fair value, the question remains: does market skepticism signal an opportunity, or has all the future upside already been accounted for?

Most Popular Narrative: 27.5% Undervalued

According to the most closely followed narrative, MGM Resorts International is still trading well below its fair value estimate of $44.21, compared to a recent closing price of $32.03. Sentiment from this perspective hinges on a blend of transformative growth strategies and challenges in core markets.

"Expanding digital gaming, luxury upgrades, and global resort projects aim to boost high-margin revenues, diversify earnings, and capture new travel demand. Asset-light operations, automation, and premium segment focus are expected to structurally improve margins and support ongoing earnings growth."

Want to know what bold projections power this valuation? There is a high-stakes earnings surge and margin turnaround hidden in the assumptions. Seeking what drives the gap between today’s price and the narrative’s fair value? Dive deeper for the surprising growth ingredients and profit mix supporting this target.

Result: Fair Value of $44.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued weakness in Las Vegas demand or execution risks in major international projects could quickly undermine the current optimistic outlook for MGM shares.

Find out about the key risks to this MGM Resorts International narrative.

Another View: Is It Really a Bargain?

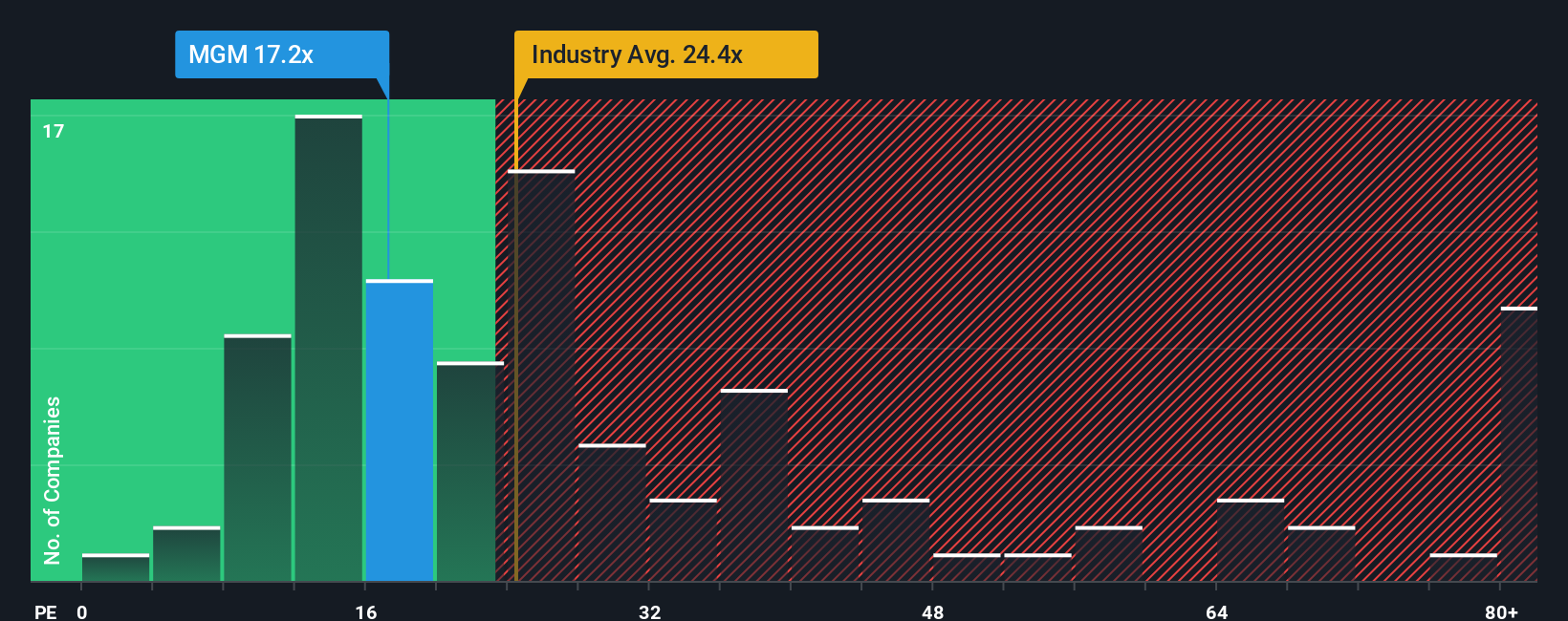

While MGM looks undervalued on a fair value basis, its current price-to-earnings ratio is 129.8x. This is dramatically higher than industry peers, who average just 33.2x, and the fair ratio of 41.3x. This sharp premium signals elevated valuation risk, even if long-term growth pans out. Is the optimism justified, or could sentiment be outpacing reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MGM Resorts International Narrative

If you see the story differently or want a hands-on approach, building your own scenario takes less than three minutes. Do it your way

A great starting point for your MGM Resorts International research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Never settle for just one opportunity. Supercharge your investing strategy by tapping into these powerful stock ideas curated for every smart investor.

- Spot companies sharing profits with investors and secure your income stream when you check out these 22 dividend stocks with yields > 3% with yields over 3%.

- Ride the wave of disruptive tech by getting ahead of the curve with these 26 AI penny stocks, which are at the forefront of artificial intelligence breakthroughs.

- Boost your portfolio’s potential by targeting stocks the market has overlooked by exploring these 832 undervalued stocks based on cash flows, which are based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MGM

MGM Resorts International

Through its subsidiaries, operates as a gaming and entertainment company in the United States, China, and internationally.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives