- United States

- /

- Hospitality

- /

- NYSE:MCD

How Value Deals and Digital Push at McDonald's (MCD) Have Changed Its Investment Story

Reviewed by Simply Wall St

- In recent weeks, McDonald's has reintroduced its Extra Value Meals, launched 50-cent double cheeseburger deals through its app, and announced a collaboration with the popular game "Black Myth: Wukong" to attract younger consumers.

- These actions come as the company responds to rising competition in value-focused fast food, increased consumer price sensitivity, and international challenges such as boycott campaigns in India amid trade tensions.

- We’ll now examine how McDonald's renewed focus on value promotions and digital engagement may impact its long-term investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

McDonald's Investment Narrative Recap

To be a McDonald’s shareholder today, you have to believe in the company's ability to maintain global leadership through brand strength, scale, and digital innovation, while responding to intense price competition and shifting consumer preferences. The recent value-focused promotions and digital engagement initiatives are designed to support near-term U.S. traffic and could help soften some of the competitive and macroeconomic pressures, but the core catalyst for the business remains the success of its ongoing digital and international growth strategy. The biggest risk is that persistent declines among price-sensitive customers, especially in mature markets like the U.S., could weigh on same-store sales and slow overall revenue growth, at this stage, the recent news does not materially change this risk profile.

Among McDonald's latest announcements, the reintroduction of Extra Value Meals and national app-based deals stand out as most relevant, given the clear focus on regaining guest counts and protecting traffic from value-driven competitors. As other quick-service chains step up with similar discounts, this underscores how crucial value perception is to McDonald's short-term performance and how ongoing promotions may serve as an important lever for stabilizing traffic in the near term.

But despite these efforts to boost traffic and defend share, investors should be aware that lingering pressure from U.S. consumer price sensitivity could still...

Read the full narrative on McDonald's (it's free!)

McDonald's narrative projects $30.6 billion revenue and $10.4 billion earnings by 2028. This requires 5.5% yearly revenue growth and a $2 billion earnings increase from $8.4 billion.

Uncover how McDonald's forecasts yield a $335.41 fair value, a 11% upside to its current price.

Exploring Other Perspectives

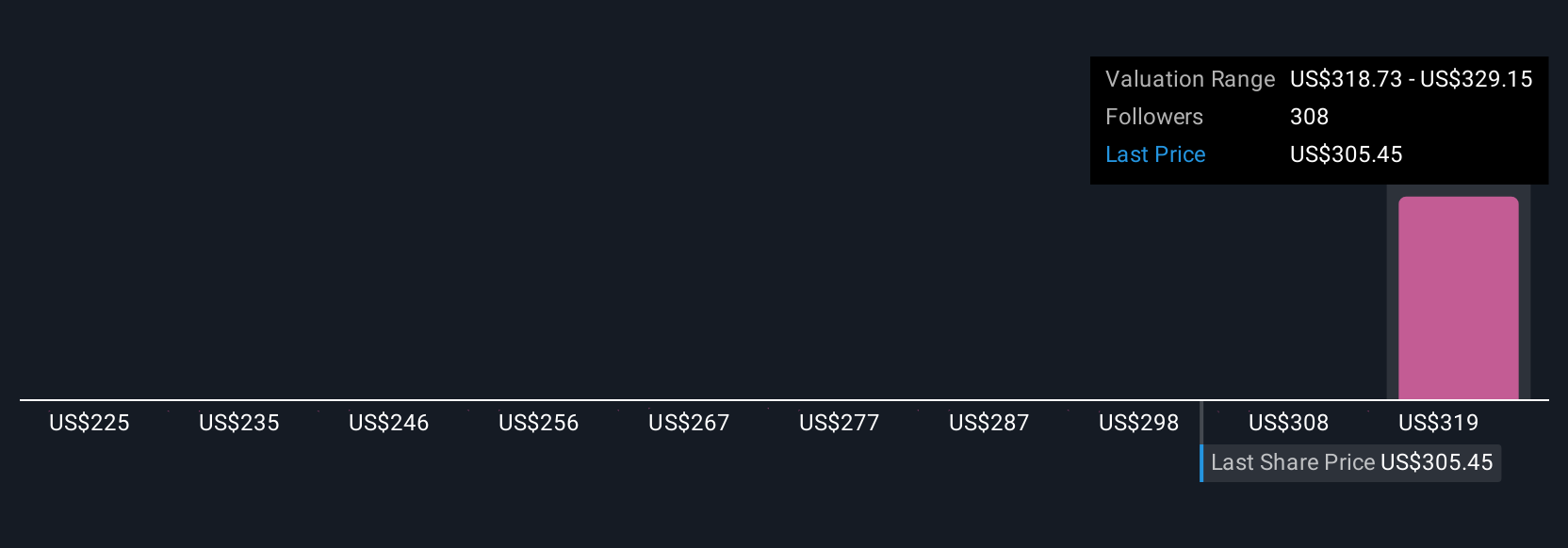

Eighteen members of the Simply Wall St Community place McDonald’s fair value between US$225 and US$335, revealing sharply different outlooks on growth potential. While menu and digital innovation drive optimism among some, ongoing pressure from low-income consumers and price competition remains a key concern for others.

Explore 18 other fair value estimates on McDonald's - why the stock might be worth 26% less than the current price!

Build Your Own McDonald's Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your McDonald's research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free McDonald's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate McDonald's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are the new gold rush. Find out which 31 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MCD

McDonald's

Owns, operates, and franchises restaurants under the McDonald’s brand in the United States and internationally.

Established dividend payer with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026