- United States

- /

- Consumer Services

- /

- NYSE:LRN

Stride (LRN): Profit Margin Expansion Reinforces Bullish Narratives on Valuation and Earnings Quality

Reviewed by Simply Wall St

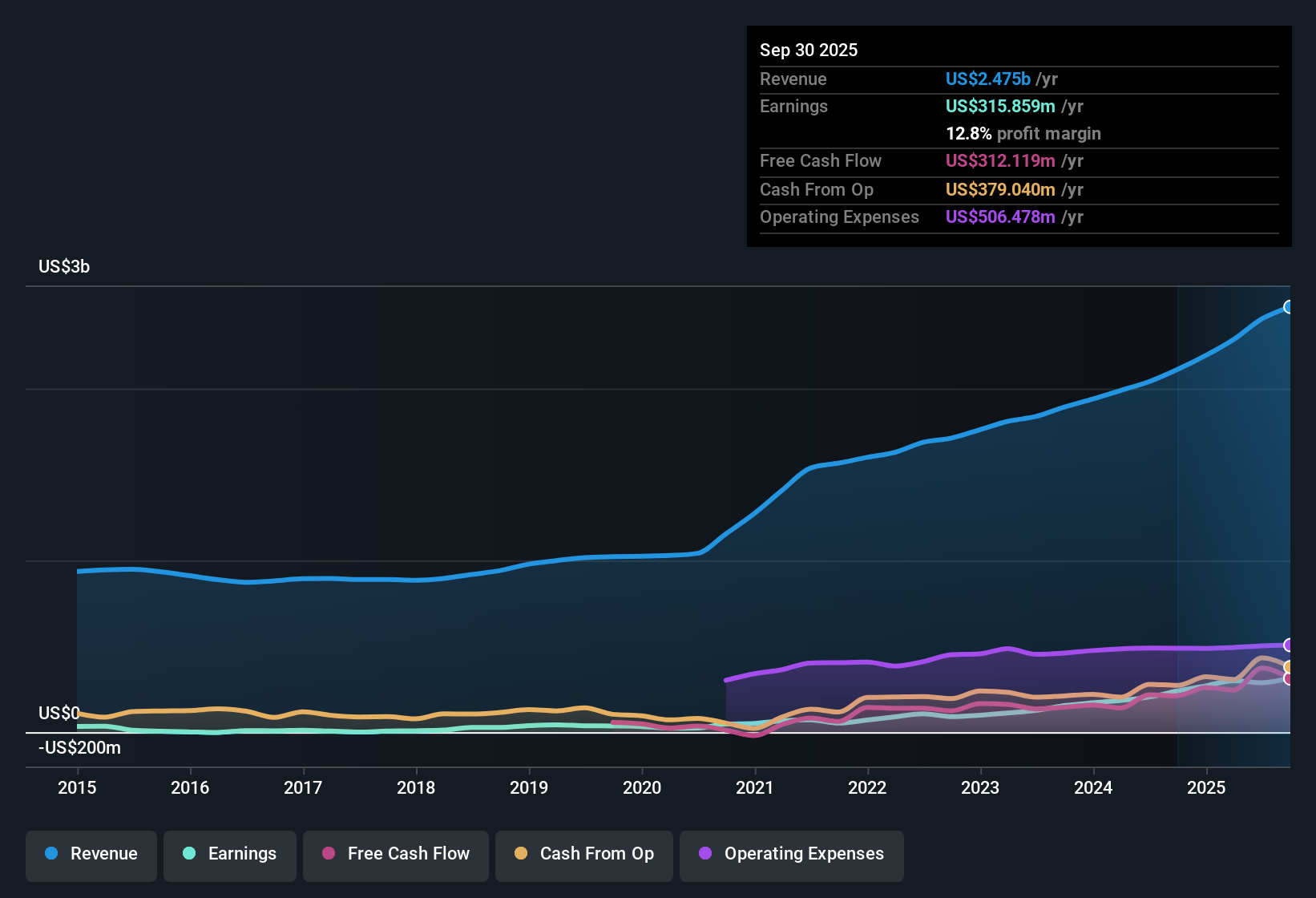

Stride (NYSE:LRN) posted a net profit margin of 12.8%, up from 11.4% a year ago, with earnings growth for the year coming in at 31.5%. Over the past five years, annualized earnings growth has averaged an impressive 37.2%. Future forecasts call for earnings and revenue to rise at 9.8% and 3.8% per year respectively, both slower than the overall US market. The latest figures highlight ongoing profit momentum, high-quality earnings, and a price-to-earnings ratio of 9.6x that looks compelling relative to both the sector and industry benchmarks. Recent share price volatility will be on investors' minds.

See our full analysis for Stride.The next step is setting these results against prevailing narratives to see where consensus holds and where new questions emerge.

See what the community is saying about Stride

Margin Gains Outpace Sector Benchmarks

- Stride’s net profit margin rose to 12.8%, overtaking last year’s 11.4% and remaining well above many sector averages.

- Analysts' consensus view points to margin expansion driven by technology investments and operational partnerships.

- Sustained demand for digital education and expanding tutoring services are seen as key drivers supporting long-term margin growth.

- Even as revenue growth lags the US market, the expectation is for profit margins to climb further, with potential to reach 16.7% within three years, which substantially supports the analysts' positive outlook for earnings leverage and operational scale.

- For an in-depth look at these profit drivers and where they might outpace Wall Street, see the full consensus narrative. 📊 Read the full Stride Consensus Narrative.

Growth Moderates, but Quality Remains High

- Annualized earnings growth was 31.5% this year, just below the 37.2% pace averaged over five years, with forecasts calling for future gains to slow to 9.8% per year.

- Analysts' consensus view highlights how this slowing growth is balanced by high-quality earnings and expanding service offerings.

- Ongoing investments in proprietary technology platforms and career-focused learning solutions are expected to support both educational outcomes and operational efficiencies, which may help sustain profit quality even as headline growth rates moderate.

- Brand strength and a positive funding environment are expected to maintain predictable revenues, tempering concerns about the slower pace and helping offset stricter enrollment caps that could otherwise hinder growth.

Share Price Sits Far Below DCF Fair Value

- Stride’s current share price of $70.05 is substantially beneath its DCF fair value estimate of $225.53, and its price-to-earnings ratio of 9.6x compares favorably to consumer services peers at 36.5x and the industry average of 19.3x.

- According to analysts' consensus narrative, this wide discount could attract value-focused investors, but the relatively low analyst price target of $122.00 tempers the bull case.

- The consensus notes that for the current price to rise meaningfully from this level, investors must believe that robust earnings growth, continued margin gains, and stable funding can sustain and eventually close the value gap against peers and industry standards.

- At the same time, recent share price volatility over the past three months is flagged as a risk, indicating the potential for sudden swings due to external factors or unexpected shifts in demand or policy.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Stride on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on these results? Create your own narrative and share where you think the trends are heading in just a few minutes. Do it your way

A great starting point for your Stride research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While Stride delivers impressive margins and value, its slowing top-line growth and strict enrollment caps may limit consistent long-term expansion.

If stable performance is your priority, focus on stable growth stocks screener (2122 results) to discover companies with reliable revenue and earnings momentum through changing market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LRN

Stride

Provides proprietary and third-party online curriculum, software systems, and educational services in the United States and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives