- United States

- /

- Consumer Services

- /

- NYSE:HRB

Is Block Now a Bargain After a 20% Slide and Digital Expansion News?

Reviewed by Bailey Pemberton

- Thinking about whether H&R Block is a bargain right now? Let’s take a close look at what’s driving the stock’s valuation and see if there’s real value to be found.

- H&R Block’s share price is down 6.2% in the past week and has fallen 20.4% over the last month, deepening a longer-term slide of 21.4% year-to-date and 27.7% over the past twelve months.

- Recent headlines have focused on the company’s moves to adapt to an evolving tax landscape, including expanded digital offerings and efforts to capture new customers. These developments are being weighed by investors as they rethink their view of H&R Block’s long-run prospects.

- Despite the recent dip, it’s worth highlighting that H&R Block currently earns a valuation score of 5 out of 6, showing strength in most checks we use for assessing value. In a moment, we’ll break down the main valuation approaches and share a perspective that’s often overlooked in traditional analysis.

Find out why H&R Block's -27.7% return over the last year is lagging behind its peers.

Approach 1: H&R Block Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by forecasting its expected future cash flows and then discounting those amounts back to today’s dollars. This approach allows investors to assess what the business might be worth based on how much cash it is likely to generate over time.

For H&R Block, the model begins with last year's Free Cash Flow of $578.9 million. While analysts forecast near-term performance, the model uses a 2 Stage Free Cash Flow to Equity process that projects H&R Block’s cash flows over the next decade, adjusting each year for expected changes. According to these projections, the company’s 2035 Free Cash Flow could be around $570.2 million, with intermediate years reflecting both modest declines and slight growth, all considered in $.

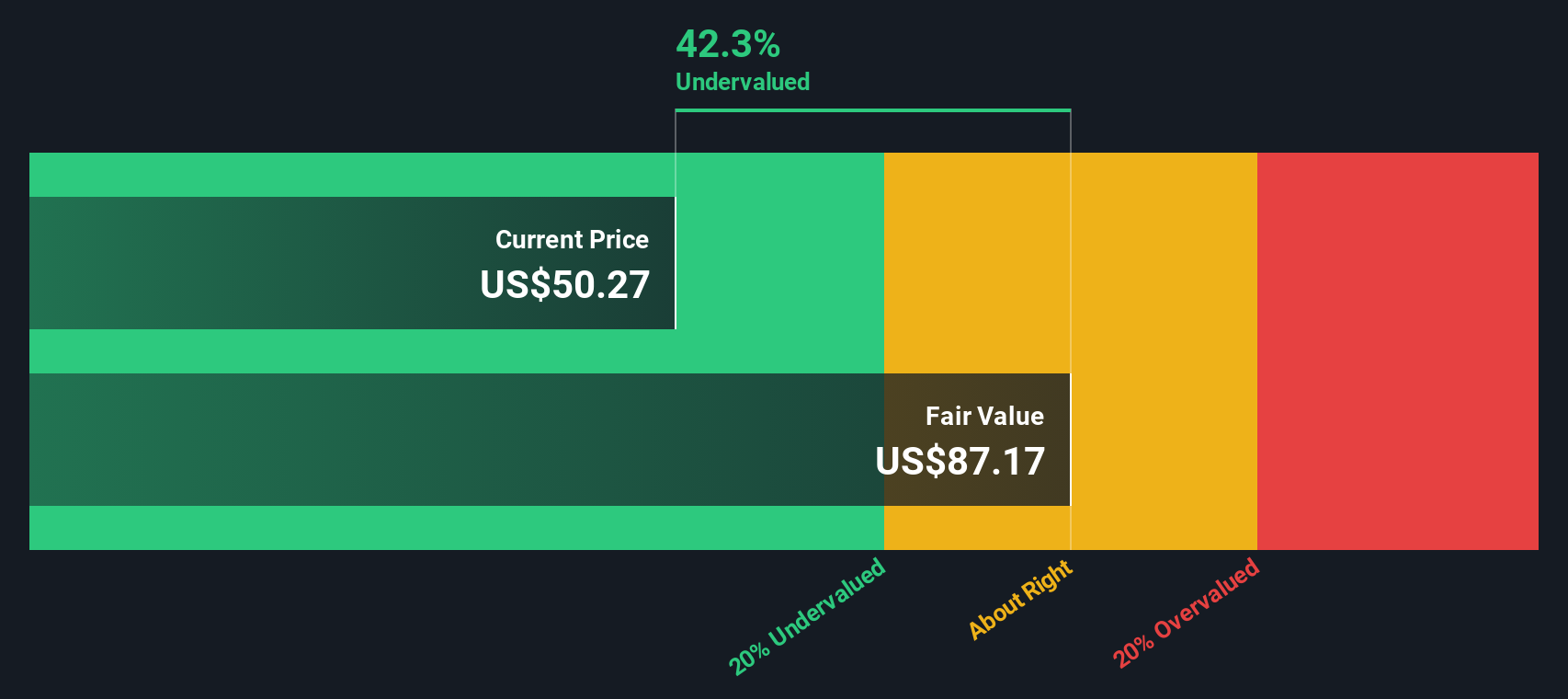

Based on these forecasts and appropriate discount rates, the DCF analysis produces an estimated intrinsic value for H&R Block shares of $75.89. With the current price representing a 45.0% discount to this value, the model indicates that H&R Block stock is significantly undervalued at present.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests H&R Block is undervalued by 45.0%. Track this in your watchlist or portfolio, or discover 928 more undervalued stocks based on cash flows.

Approach 2: H&R Block Price vs Earnings

The Price-to-Earnings (PE) ratio is widely considered the preferred valuation metric for profitable companies like H&R Block because it directly relates a company’s share price to its earnings. This gives investors a snapshot of how much they are paying for each dollar of profit. It is especially useful when the company is generating steady profits, as is the case here.

A company’s “normal” or “fair” PE ratio depends on future growth expectations, perceived risks, profitability, and how it compares to industry trends. If investors see strong, reliable growth ahead, they may be willing to pay a higher PE multiple. In contrast, higher risks or weaker outlooks usually mean a lower fair multiple is warranted.

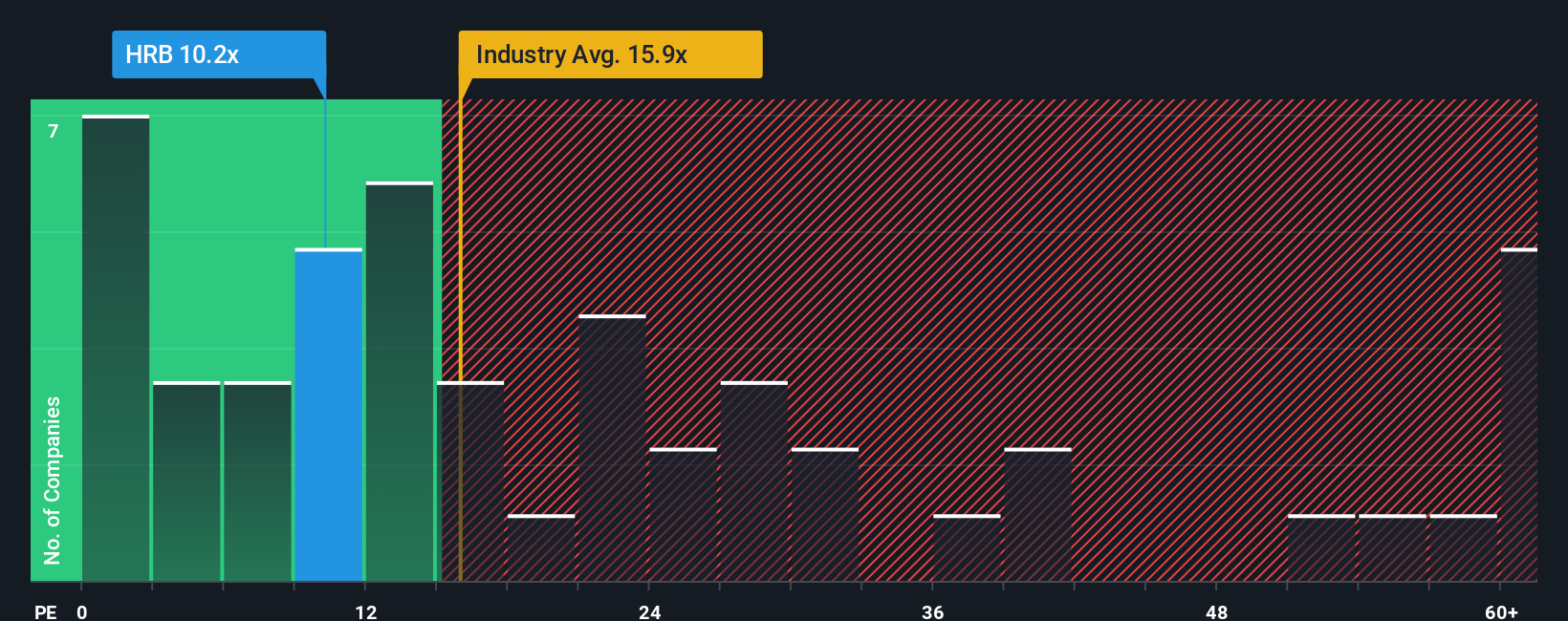

Currently, H&R Block is trading at a PE ratio of 8.6x. That is well below the Consumer Services industry average of 15.9x and also less than the average for similar peers at 16.2x. This initial impression suggests that H&R Block’s shares may be overlooked or underappreciated by the market right now.

Instead of just comparing to the industry or peer averages, Simply Wall St’s Fair Ratio digs deeper by factoring in unique aspects of the company, including growth forecasts, profit margin trends, its market cap, and risk factors specific to H&R Block’s business. This provides a more tailored benchmark for valuation. In this case, the Fair Ratio for H&R Block is 17.2x, which means the shares are trading significantly below what would be considered a fair price based on company and market fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your H&R Block Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple yet powerful concept that helps you build a clear, personal investment story for H&R Block. It brings together your assumptions about where the company is headed, your interpretations of its future financials, and your view of what it is truly worth.

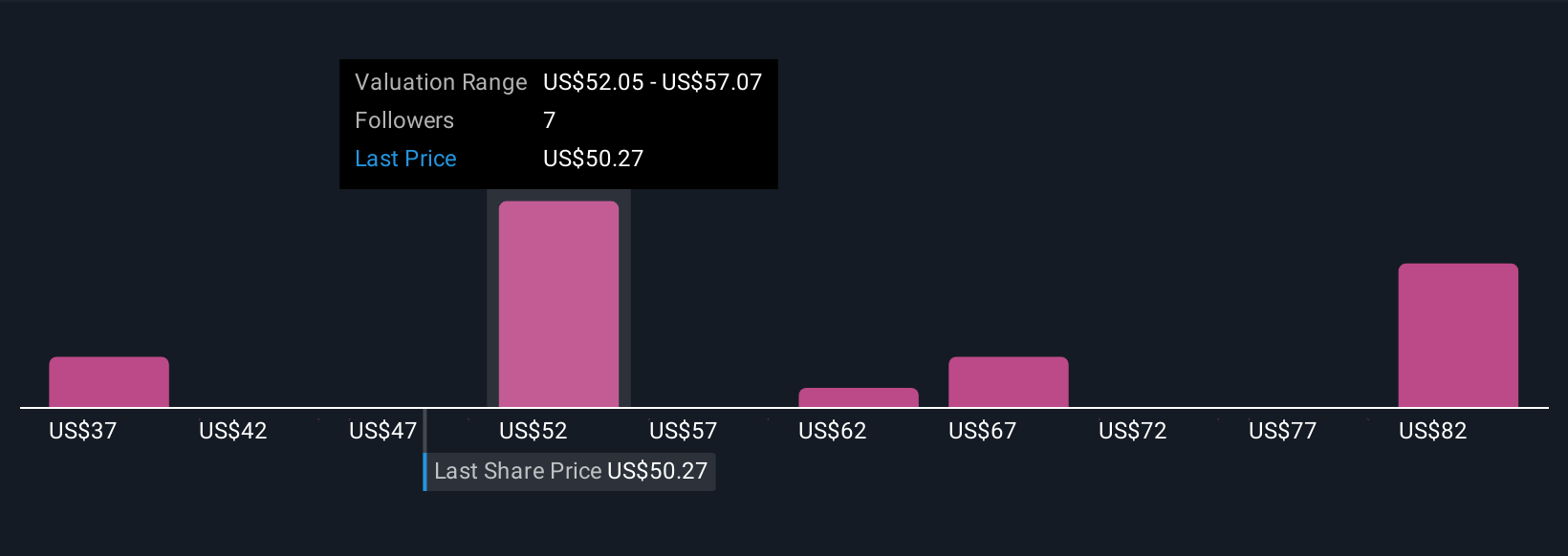

Narratives make investing easier by connecting the company's big picture, such as digital innovation or evolving tax laws, directly to its forecasted revenues, margins, and ultimately a calculated Fair Value. On Simply Wall St's platform, millions of investors use Narratives within the Community page to create and share these perspectives. This allows you to see at a glance how different stories about H&R Block translate into buy, sell, or hold decisions based on the gap between Fair Value and current Price.

Thanks to real-time updates, Narratives always reflect the latest news, earnings, or major events. For example, some investors believe H&R Block will maintain pricing power and steady growth, supporting a Fair Value as high as $62.00. Others see digital disruption as a risk, limiting Fair Value closer to $48.00. This dynamic approach helps you act confidently and decide when the story and the value align with your own view.

Do you think there's more to the story for H&R Block? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if H&R Block might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HRB

H&R Block

Through its subsidiaries, provides assisted and do-it-yourself (DIY) tax return preparation services in the United States, Canada, and Australia.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success