- United States

- /

- Hospitality

- /

- NYSE:HLT

How Hilton’s Jacksonville Mayo Clinic Hotel Launch Could Shape HLT’s Southeast Expansion Strategy

Reviewed by Sasha Jovanovic

- The Hilton Jacksonville at Mayo Clinic opened its doors for the first time on October 1, 2025, marking Hilton Hotels & Resorts' debut in Jacksonville and the first full-service hotel launch in the city in nearly two decades.

- This highly anticipated property on the Mayo Clinic campus reflects Hilton’s refreshed brand identity and expands its reach into a key Southeast healthcare and leisure market.

- We'll examine how Hilton’s expansion into the Jacksonville market through this flagship hotel affects its broader investment narrative and growth prospects.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Hilton Worldwide Holdings Investment Narrative Recap

For Hilton shareholders, the core thesis centers on Hilton's ability to deliver consistent unit growth, maintain strong margin performance, and tap into secular demand for both leisure and business travel globally. The opening of Hilton Jacksonville at Mayo Clinic, while tangible proof of expansion into attractive healthcare-adjacent markets, is not likely to materially affect the most important short-term catalyst, which remains system-wide RevPAR growth. Likewise, the biggest current risk, ongoing weakness in key markets like China and potential softness in group travel demand, is largely unchanged by this specific hotel launch.

Among several recent developments, Hilton's Q2 2025 earnings report demonstrated both revenue and net income growth, highlighting the company's ability to convert pipeline activity and new openings, like Jacksonville, into financial results. With unit expansion continuing at pace, capturing growth in differentiated travel segments remains crucial to supporting both the topline and bottom-line progress Hilton aims for. The opening at Mayo Clinic ties directly into this broader approach, but investors should remain cognizant of...

Read the full narrative on Hilton Worldwide Holdings (it's free!)

Hilton Worldwide Holdings' narrative projects $14.8 billion in revenue and $2.5 billion in earnings by 2028. This requires a 45.4% yearly revenue growth and a $0.9 billion earnings increase from the current earnings of $1.6 billion.

Uncover how Hilton Worldwide Holdings' forecasts yield a $273.50 fair value, a 6% upside to its current price.

Exploring Other Perspectives

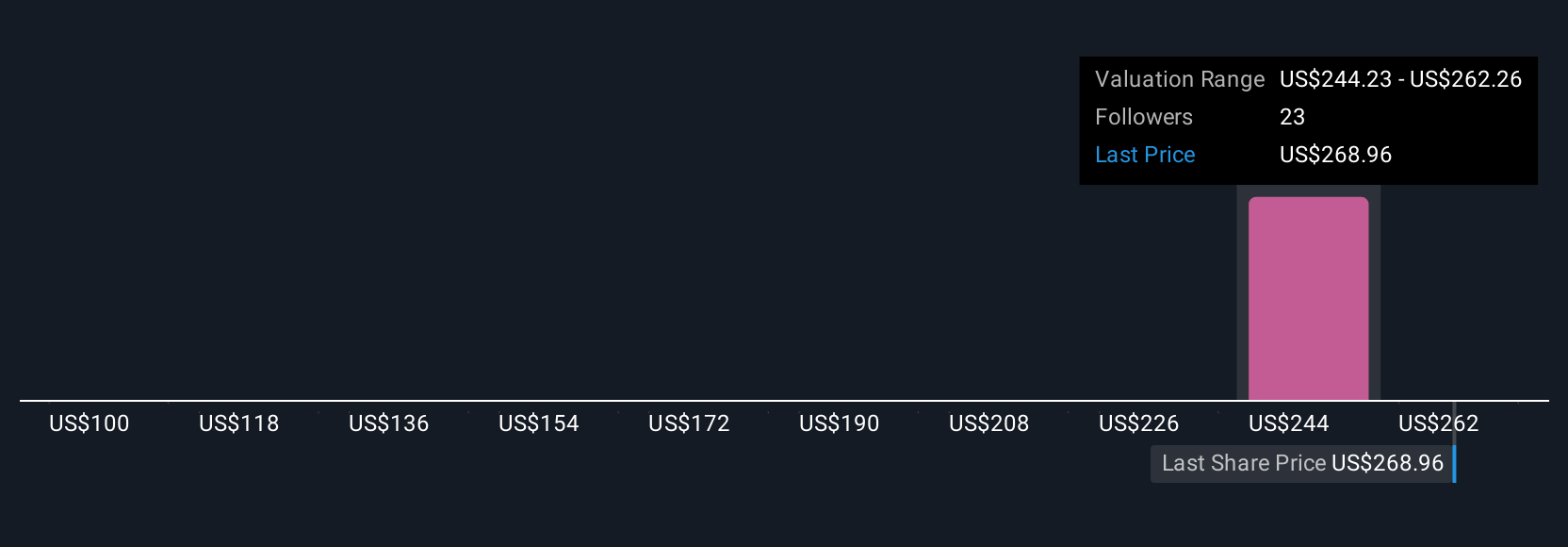

Private fair value estimates from four Simply Wall St Community members range from US$100.00 to US$280.29 per share. While community viewpoints span a wide spectrum, ongoing pressure in system-wide RevPAR could limit upside, so considering varying outlooks is essential.

Explore 4 other fair value estimates on Hilton Worldwide Holdings - why the stock might be worth less than half the current price!

Build Your Own Hilton Worldwide Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hilton Worldwide Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Hilton Worldwide Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hilton Worldwide Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hilton Worldwide Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HLT

Hilton Worldwide Holdings

A hospitality company, engages in managing, franchising, owning, and leasing hotels and resorts.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives