- United States

- /

- Hospitality

- /

- NYSE:H

How Investors Are Reacting To Hyatt Hotels (H) Turning a Net Loss Despite Higher Revenue

Reviewed by Sasha Jovanovic

- Hyatt Hotels Corporation recently reported its third quarter 2025 earnings, showing revenue growth to US$1.79 billion but a shift to a net loss of US$49 million, with updated full-year net income guidance projected between US$70 million and US$86 million.

- The results reflected a year-over-year revenue increase alongside a significant swing from net income to net loss, underscoring the potential impact of market or operational challenges despite topline gains.

- We’ll examine how Hyatt’s transition to a net loss, despite increased revenue, impacts the company’s future investment outlook and margin expectations.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Hyatt Hotels Investment Narrative Recap

To own Hyatt Hotels stock, an investor has to believe in the company's ability to convert revenue growth into stronger margins, even as Q3 2025 saw revenues rise to US$1.79 billion but swing to a net loss, putting short-term focus squarely on improving profitability. This earnings update directly highlights a key short-term catalyst: the need for better margin expansion, while the biggest current risk is potential weakness in upscale demand or shifting booking patterns; the results reinforce that these risks remain front and center for shareholders.

Among Hyatt’s latest announcements, the new US$1.5 billion revolving credit facility, with no borrowings currently outstanding, stands out in this context. While not directly impacting margins, this facility provides Hyatt added financial flexibility as it addresses operational challenges and margin pressures identified in recent earnings, potentially supporting future investments or cash flow needs as growth initiatives proceed.

Yet in contrast, investors should also be mindful of what happens if demand in the upscale segment continues to soften and how that could affect revenue momentum...

Read the full narrative on Hyatt Hotels (it's free!)

Hyatt Hotels' narrative projects $8.4 billion revenue and $551.3 million earnings by 2028. This requires 37.6% yearly revenue growth and a $119.3 million earnings increase from $432.0 million.

Uncover how Hyatt Hotels' forecasts yield a $160.63 fair value, a 10% upside to its current price.

Exploring Other Perspectives

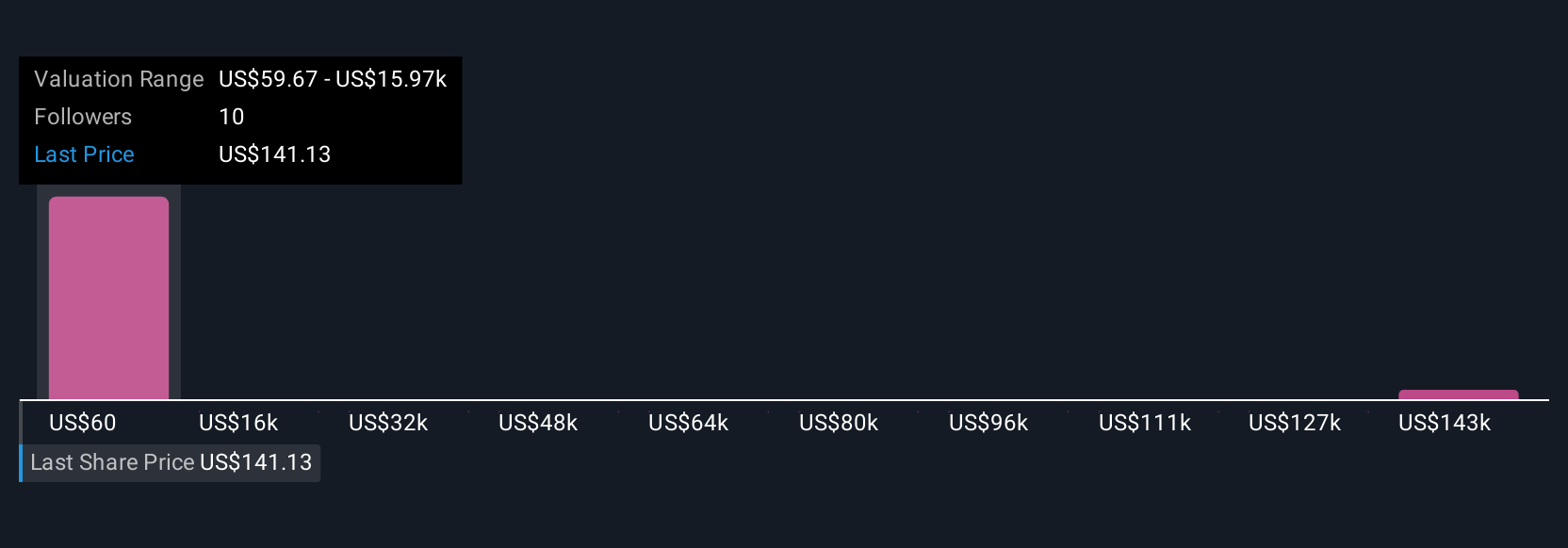

Community valuations for Hyatt span from US$160.63 to US$159,128.03, with five unique perspectives from the Simply Wall St Community. That kind of range underlines just how much opinions can differ, while margin expansion remains a central focus for company performance.

Explore 5 other fair value estimates on Hyatt Hotels - why the stock might be a potential multi-bagger!

Build Your Own Hyatt Hotels Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hyatt Hotels research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Hyatt Hotels research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hyatt Hotels' overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hyatt Hotels might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:H

Hyatt Hotels

Operates as a hospitality company in the United States and internationally.

Exceptional growth potential and fair value.

Similar Companies

Market Insights

Community Narratives