- United States

- /

- Hospitality

- /

- NYSE:GENI

Genius Sports (GENI) Valuation Check After 2028 Roadmap, New Partnerships and Analyst Upgrades

Reviewed by Simply Wall St

Genius Sports (GENI) just laid out an ambitious 2028 roadmap, pairing long term revenue and cash flow targets with a push to become core infrastructure for data driven sports media, betting and advertising.

See our latest analysis for Genius Sports.

The latest roadmap lands after a busy stretch, with Genius Sports striking new partnerships with FanDuel, Publicis Sports and Brazil’s CBF. Despite a softer recent patch, the stock’s year to date share price return of 27.41% and three year total shareholder return of 141.20% suggest momentum is still broadly constructive rather than broken.

If Genius Sports’ trajectory has your attention, it could be worth seeing what else is transforming sports and media and exploring fast growing stocks with high insider ownership.

With analysts lifting targets, shares trading around a 40% discount to the Street, and management pitching predictable, contract driven growth into 2028, is Genius Sports a genuine mispriced compounder, or is that optimism already embedded in the stock?

Most Popular Narrative: 29.3% Undervalued

With the narrative fair value sitting at $15.32 against a last close of $10.83, the story leans firmly toward upside driven by growth and margin expansion.

Recent major exclusive rights wins (Serie A, European Leagues, expanded NFL deals) on multi year, fixed cost agreements are materially increasing the company's share of valuable sports content and rights while reducing cost volatility, enhancing both revenue visibility and EBITDA margin expansion.

Want to see how rapid top line growth, rising margins, and a premium future earnings multiple all connect to that upside view? The narrative reveals the bold revenue ramp, margin shift, and valuation bridge that have to line up almost perfectly for this fair value to hold. Curious which assumptions do the heavy lifting in that calculation? Read on to unpack the full blueprint behind this pricing story.

Result: Fair Value of $15.32 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained regulatory uncertainty and intensified competition for exclusive data rights could easily derail those bullish growth, margin, and valuation assumptions.

Find out about the key risks to this Genius Sports narrative.

Another Lens on Valuation

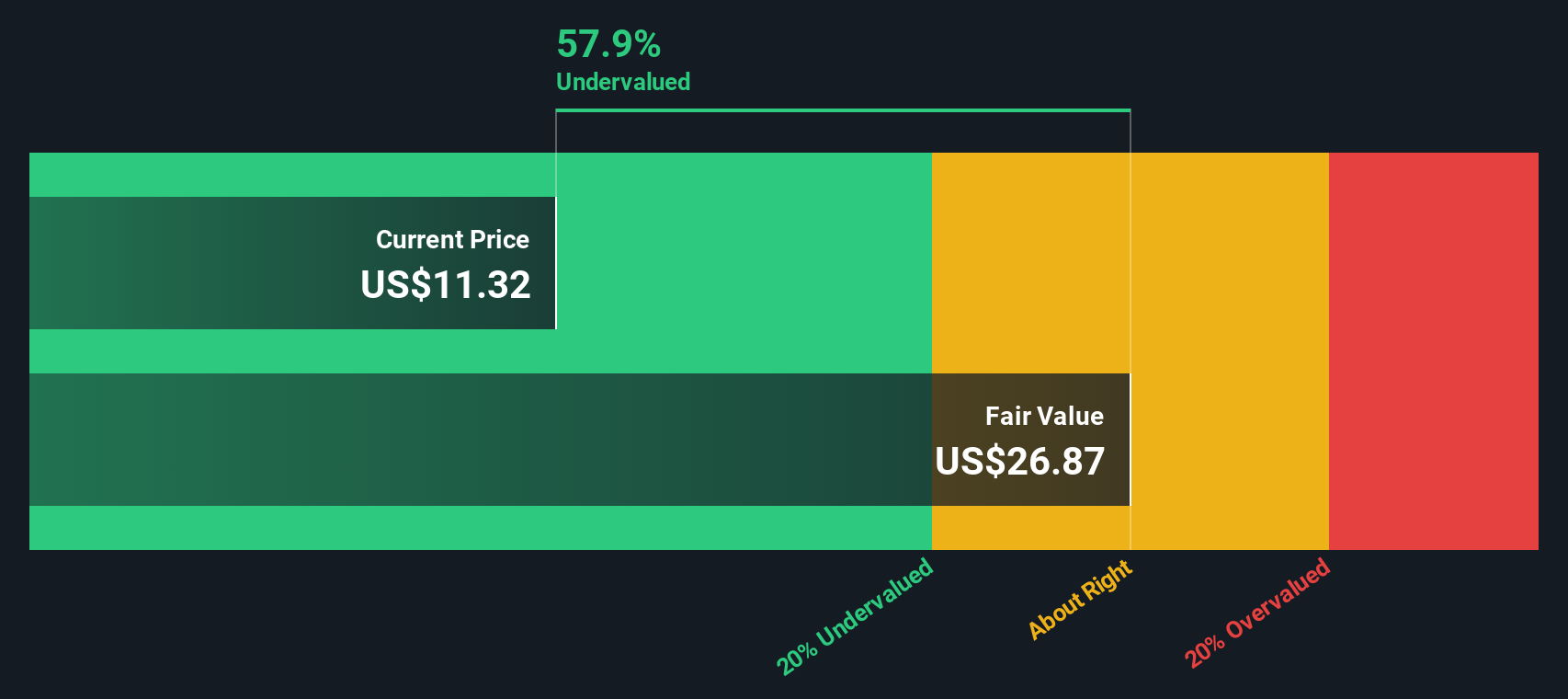

Stepping away from the narrative fair value, our DCF model presents an even stronger potential upside, with Genius Sports trading at roughly a 55% discount to its estimated intrinsic value. If both models are accurate regarding growth and margins, this raises the question: is the market underpricing execution?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Genius Sports Narrative

If you see things differently or want to stress test the assumptions with your own inputs, you can build a personalized view in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Genius Sports.

Looking for more investment ideas?

Before you move on, put your research to work by scanning fresh opportunities on Simply Wall Street, so you are not stuck watching others capture the upside.

- Target reliable income streams by reviewing these 15 dividend stocks with yields > 3% that can strengthen a long term, yield focused portfolio.

- Capitalize on market mispricing with these 906 undervalued stocks based on cash flows that look cheap relative to their cash flows and growth prospects.

- Ride powerful technology trends by assessing these 26 AI penny stocks positioned to benefit from accelerating demand for artificial intelligence solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GENI

Genius Sports

Engages in the development and sale of technology-led products and services to the sports, sports betting, and sports media industries.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026