- United States

- /

- Hospitality

- /

- NYSE:GBTG

How Boundary Creek's Complete Portfolio Shift and Massive Shelf Filing Will Impact GBTG Investors

Reviewed by Sasha Jovanovic

- Global Business Travel Group, Inc. recently filed a US$412.66 million shelf registration for over 50 million shares of Class A Common Stock, while Boundary Creek Advisors LP disclosed a new US$22.91 million stake marking a complete portfolio shift to the company as of September 30, 2025.

- This substantial investment ahead of the company’s Q3 2025 earnings announcement reflects increased attention from institutional investors, even as Global Business Travel Group faces modest sales growth and slightly softened revenue estimates for the coming year.

- We’ll now explore how Boundary Creek Advisors’ full portfolio allocation to Global Business Travel Group may influence the company’s outlook.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Global Business Travel Group Investment Narrative Recap

To be a shareholder in Global Business Travel Group, you need to believe that scale, digital transformation, and sector consolidation can offset ongoing slower industry growth. The recent US$412.66 million shelf registration, paired with Boundary Creek Advisors LP’s full portfolio allocation, signals added institutional interest, but does not fundamentally change the core near-term catalyst of successful CWT integration or the prevailing risk of margin compression from higher sales costs and price competition.

Among recent announcements, the completion of the CWT acquisition stands out for its relevance. The clearance from the Department of Justice allows Global Business Travel Group to pursue expected synergies, cost savings, and expanded service offerings, all of which are central to near-term earnings prospects and could influence management’s success in maintaining profitability as growth in core markets slows.

However, investors should also be aware that, despite these positive developments, rising digital transactions and competition are putting pressure on revenue yields, meaning...

Read the full narrative on Global Business Travel Group (it's free!)

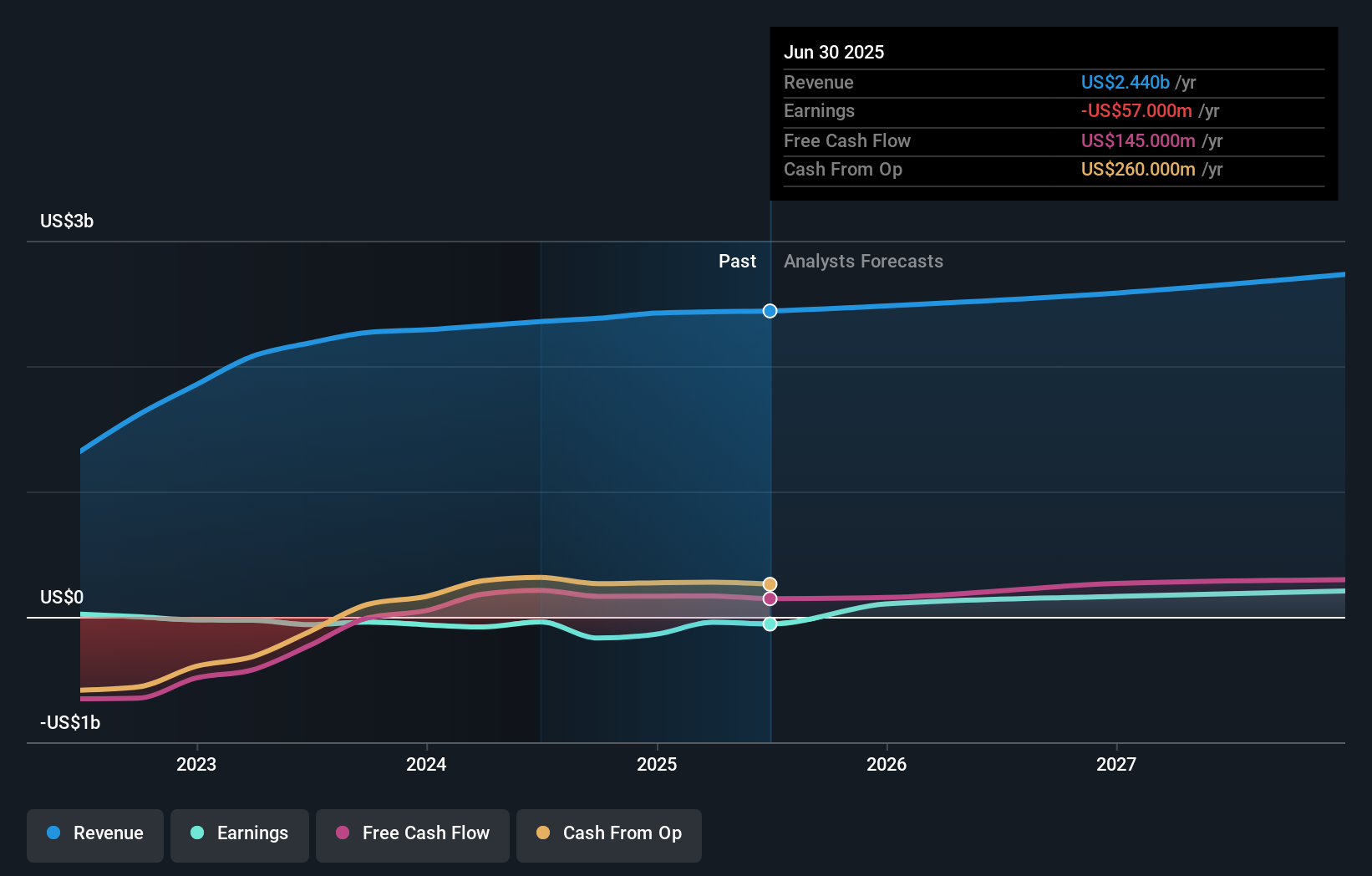

Global Business Travel Group's outlook anticipates $2.8 billion in revenue and $324.4 million in earnings by 2028. This projection depends on a 5.0% annual revenue growth rate and a $381.4 million increase in earnings from the current -$57.0 million.

Uncover how Global Business Travel Group's forecasts yield a $9.91 fair value, a 25% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community includes 1 fair value estimate for Global Business Travel Group, pinpointing US$21.46 per share. With institutional buyers entering and pressure on revenue yields increasing, views on the company’s outlook can be quite different, explore how these perspectives might impact your assessment.

Explore another fair value estimate on Global Business Travel Group - why the stock might be worth just $21.46!

Build Your Own Global Business Travel Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Global Business Travel Group research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Global Business Travel Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Global Business Travel Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GBTG

Global Business Travel Group

Provides business-to-business (B2B) travel platform in the United States, the United Kingdom, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives