- United States

- /

- Tech Hardware

- /

- NasdaqGS:SMCI

Three US Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

The United States stock market has recently experienced a mix of record highs and slight retreats, with the Dow Jones Industrial Average closing at a new peak while the S&P 500 pulled back slightly. Amid these fluctuations, investors are increasingly interested in growth companies with high insider ownership, as these stocks often indicate strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.2% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.3% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 32.3% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Super Micro Computer (NasdaqGS:SMCI) | 25.7% | 28.0% |

| Hims & Hers Health (NYSE:HIMS) | 13.8% | 40.7% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.3% | 95% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

| Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

Let's take a closer look at a couple of our picks from the screened companies.

Super Micro Computer (NasdaqGS:SMCI)

Simply Wall St Growth Rating: ★★★★★★

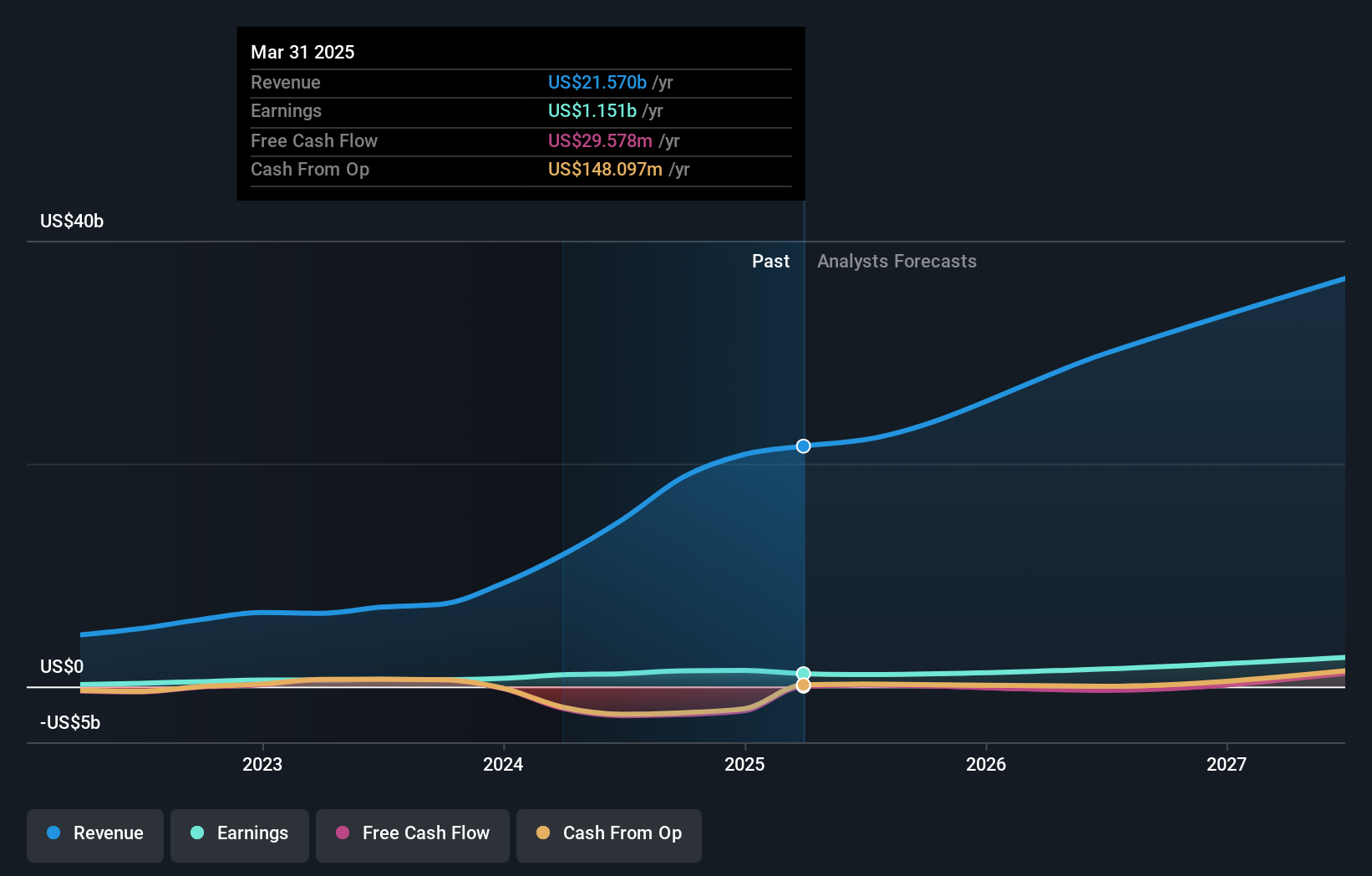

Overview: Super Micro Computer, Inc., with a market cap of $26.78 billion, develops and manufactures high-performance server and storage solutions based on modular and open architecture in the United States, Europe, Asia, and internationally.

Operations: The company's revenue segment includes developing and providing high-performance server solutions, generating $14.94 billion.

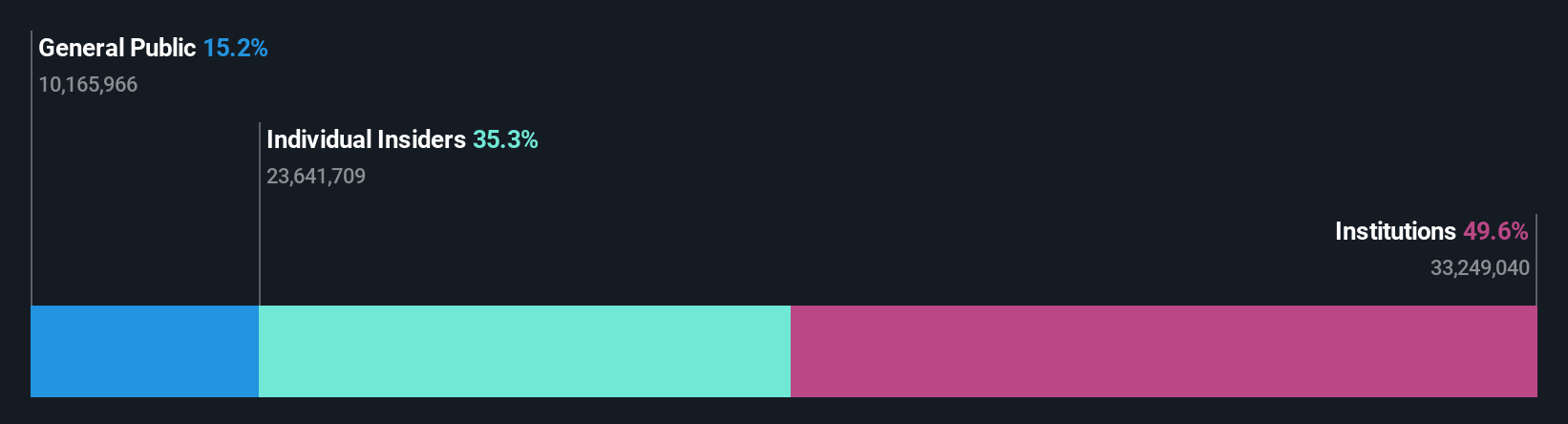

Insider Ownership: 25.7%

Earnings Growth Forecast: 28.0% p.a.

Super Micro Computer has shown significant earnings growth of 88.8% over the past year and is forecast to grow revenue by 20.8% annually, outpacing the US market. Despite high volatility in its share price recently, it trades at a substantial discount to estimated fair value. The company has faced legal challenges and delayed SEC filings but was added to the FTSE All-World Index, reflecting its prominence in high-performance computing solutions.

- Dive into the specifics of Super Micro Computer here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Super Micro Computer's current price could be quite moderate.

Daqo New Energy (NYSE:DQ)

Simply Wall St Growth Rating: ★★★★☆☆

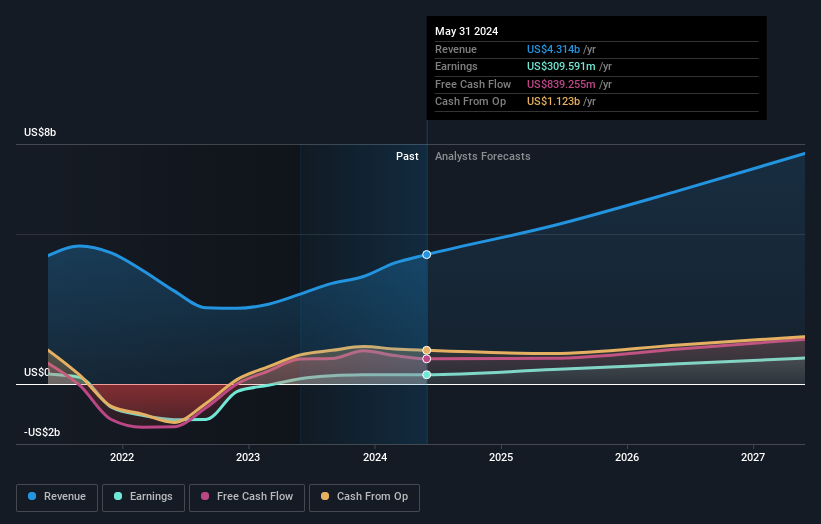

Overview: Daqo New Energy Corp., with a market cap of $1.07 billion, manufactures and sells polysilicon to photovoltaic product manufacturers in the People’s Republic of China.

Operations: The company's revenue segment includes $1.60 billion from polysilicon sales to photovoltaic product manufacturers in the People’s Republic of China.

Insider Ownership: 28.7%

Earnings Growth Forecast: 65.5% p.a.

Daqo New Energy is forecast to grow revenue by 14.7% annually, exceeding the US market average. Despite a challenging second quarter with a net loss of US$119.78 million and decreased sales, the company maintains strong insider ownership and trades at 89.3% below its estimated fair value. Recent announcements include a share repurchase program worth up to US$100 million and production adjustments to support pricing, indicating strategic financial management amidst industry volatility.

- Navigate through the intricacies of Daqo New Energy with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Daqo New Energy's share price might be on the cheaper side.

New Oriental Education & Technology Group (NYSE:EDU)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: New Oriental Education & Technology Group Inc. (NYSE:EDU) operates as a provider of private educational services in China and has a market cap of approximately $10.39 billion.

Operations: New Oriental Education & Technology Group Inc. generates revenue through various private educational services in China, contributing to its market cap of approximately $10.39 billion.

Insider Ownership: 12%

Earnings Growth Forecast: 25.4% p.a.

New Oriental Education & Technology Group's earnings are forecast to grow 25.37% annually, outpacing the US market. Despite trading at 76% below its estimated fair value, recent actions like a $300 million buyback plan increase and a special dividend of $0.06 per share underscore strong financial strategies. The company was added to the Hang Seng China Enterprises Index and reported significant revenue growth for Q4 2024, highlighting robust insider confidence and strategic positioning in the education sector.

- Click to explore a detailed breakdown of our findings in New Oriental Education & Technology Group's earnings growth report.

- Our valuation report here indicates New Oriental Education & Technology Group may be undervalued.

Where To Now?

- Embark on your investment journey to our 179 Fast Growing US Companies With High Insider Ownership selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SMCI

Super Micro Computer

Develops and manufactures high performance server and storage solutions based on modular and open architecture in the United States, Europe, Asia, and internationally.

Exceptional growth potential and good value.