- United States

- /

- Consumer Services

- /

- NYSE:COUR

Coursera (COUR): Evaluating Valuation Following Strong Q3 Results and Weaker Profit Outlook

Reviewed by Simply Wall St

Coursera (NYSE:COUR) posted strong third-quarter results, outpacing expectations and boosting its full-year sales forecast. However, shares still dropped as the company projected lower fourth-quarter profitability, raising fresh concerns about margin pressure.

See our latest analysis for Coursera.

Despite Coursera’s upbeat revenue growth, leadership changes, and high-profile AI partnerships, investor sentiment turned sharply negative after the fourth-quarter margin outlook. The 1-year total shareholder return is a solid 33.7%. However, a recent sharp sell-off erased much of the year’s share price gains, with share price down 21.5% in the past month and 26.5% over the last 90 days. This may signal that growth optimism has given way to fresh concerns about profit sustainability.

If the volatility in online learning stocks is catching your attention, this could be a smart moment to broaden your search and check out fast growing stocks with high insider ownership.

With Coursera trading at a sizeable discount to analyst price targets and showing renewed top-line momentum, investors may wonder whether the recent sell-off presents an opportunity to buy into future growth or if the market is already pricing in what comes next.

Most Popular Narrative: 24.8% Undervalued

With Coursera’s fair value from the most widely followed narrative estimated notably above its recent $9.20 close, the stock’s valuation attracts attention. What supports this gap? Analyst and industry assumptions about revenue expansion and margin improvements over the next few years offer some answers.

Expansion and deepening of enterprise partnerships, especially across business, government, and campus verticals, provide large-scale, recurring, and higher margin revenues. As these contracts mature and the enterprise customer base grows, net margins and earnings are positioned to improve further.

Want to know what’s fueling this bullish forecast? The narrative relies on bold assumptions for future sales and profitability. Curious which numbers analysts think Coursera can achieve? The driver may surprise you.

Result: Fair Value of $12.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing competition from free alternatives and persistent skepticism about online credentials could present challenges for Coursera’s revenue growth and margin improvement expectations.

Find out about the key risks to this Coursera narrative.

Another View: What Do Market Multiples Say?

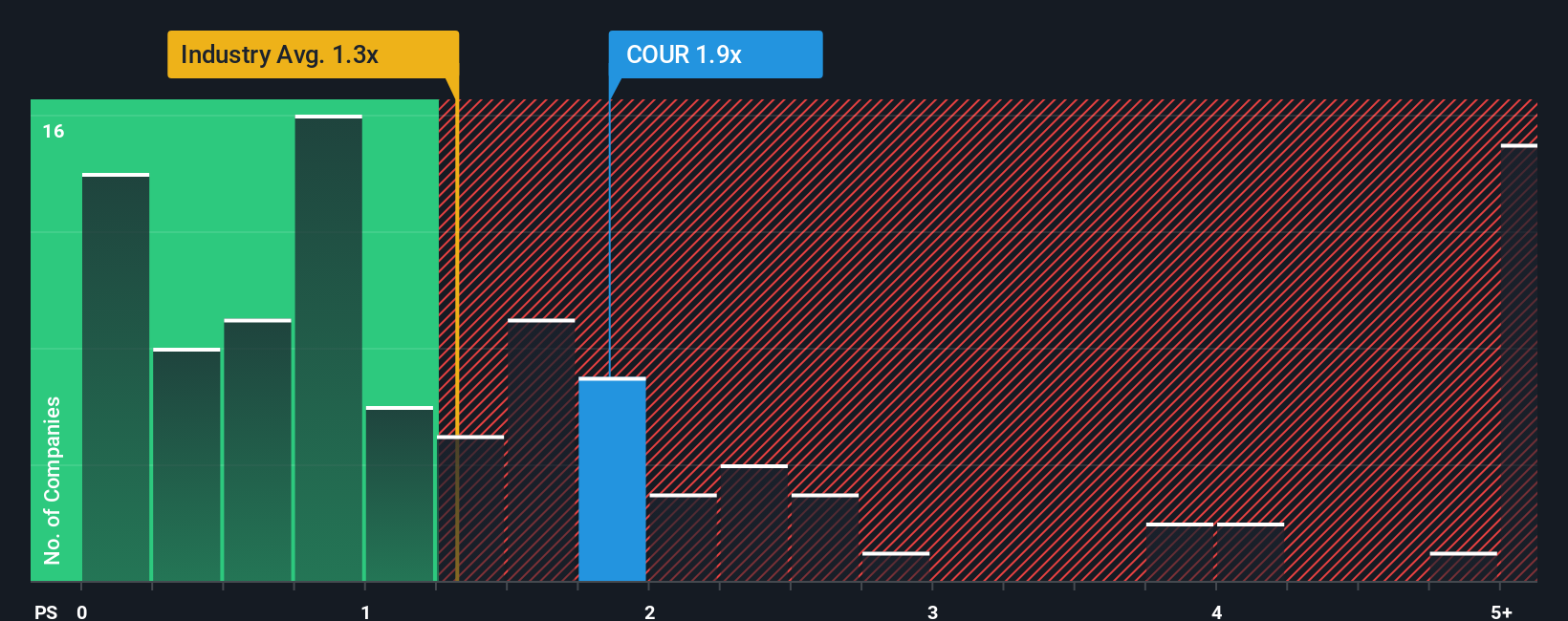

Looking at Coursera’s price-to-sales ratio of 2x shows a different side of the story. This is notably higher than both the US Consumer Services industry average of 1.5x and the company’s own fair ratio of 1.3x. While this might signal growth expectations, it also means investors are paying a premium versus peers. Could this premium be justified, or does it hint at valuation risk if growth stalls?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Coursera Narrative

If you want to test your own thesis, the full data is available for you to explore and generate a fresh perspective in just a few minutes. So why not Do it your way.

A great starting point for your Coursera research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Your next great investment opportunity could be just a click away. Uncover powerful market trends and boost your research with these hand-picked stock ideas, each offering a unique angle to grow your portfolio.

- Supercharge your income by tapping into these 17 dividend stocks with yields > 3% that consistently deliver yields above 3%. This approach is well suited for building steady, reliable returns.

- Accelerate your portfolio’s potential with these 28 quantum computing stocks at the forefront of the quantum computing revolution, where innovation aligns with strong growth opportunities.

- Gain an edge in the rapidly evolving digital landscape by tracking these 27 AI penny stocks positioned to shape tomorrow’s breakthroughs in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COUR

Coursera

Provides online educational services in the United States, Europe, Africa, the Asia Pacific, the Middle East, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives