- United States

- /

- Hospitality

- /

- NYSE:CMG

Is Chipotle Stock Reflecting Recent Momentum and Growth in Digital Ordering for 2025?

Reviewed by Bailey Pemberton

- Ever wondered if Chipotle Mexican Grill stock is truly worth its price, or if there's value yet to be discovered? You are not alone, especially as more investors start asking tough questions about big-name restaurant stocks.

- Despite a turbulent year with the stock down 42.8% year to date, recent weeks have shown signs of a rebound, posting a 9.8% gain over the past week and 8.0% over the last month.

- Chipotle's recent momentum has followed industry news highlighting growing demand for fast-casual dining along with headlines about their push into digital ordering and new menu items. These developments have helped shift the conversation from risk to potential as the company adapts to changing consumer habits and competitive pressures.

- Right now, Chipotle lands a 3 out of 6 on our undervaluation checks. In this article, we break down the major valuation approaches investors use and share a smarter way to size up Chipotle’s true worth at the end.

Find out why Chipotle Mexican Grill's -43.4% return over the last year is lagging behind its peers.

Approach 1: Chipotle Mexican Grill Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and converting those amounts to today's dollars using a discount rate. For Chipotle Mexican Grill, this method provides a clearer picture of what the business may truly be worth based on its future cash-generating ability, rather than simply its current financials.

Chipotle's latest reported Free Cash Flow stands at $1.57 billion. Analysts forecast steady growth, expecting annual Free Cash Flow to reach $2.48 billion by 2029. Beyond the five-year analyst window, projections are extrapolated to account for continued performance, with long-term estimates rising to approximately $3.51 billion by 2035. All cash flows are considered in US dollars ($).

After applying these projections in the 2 Stage Free Cash Flow to Equity model, the resulting intrinsic value for Chipotle is approximately $35.79 billion. This figure implies the stock is currently about 4.3% below its estimated fair value, which suggests shares are trading in line with, or just slightly below, their intrinsic worth.

Result: ABOUT RIGHT

Chipotle Mexican Grill is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

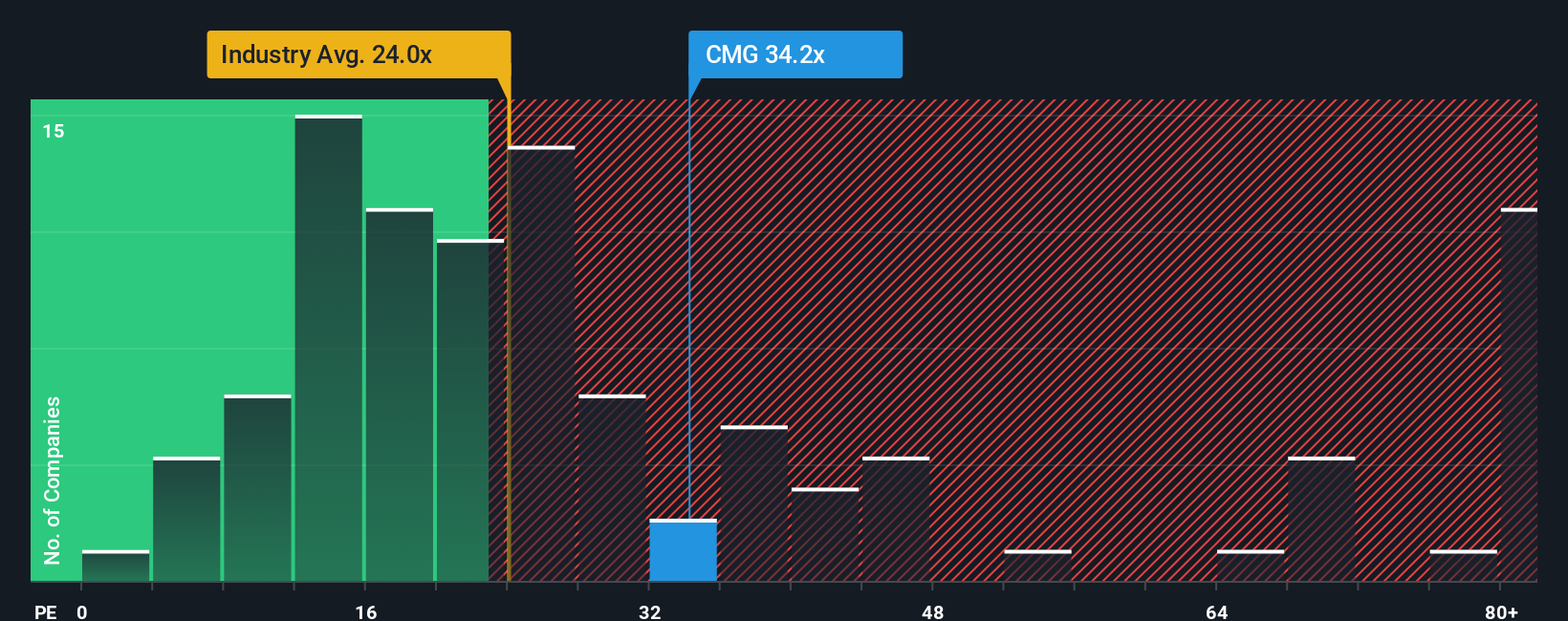

Approach 2: Chipotle Mexican Grill Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies like Chipotle Mexican Grill, as it relates the company's share price to its earnings per share. This metric helps investors gauge whether the stock price accurately reflects the company's current and expected profitability.

When considering what a “normal” or “fair” PE ratio should be, growth expectations and risk play a major role. Companies with strong earnings growth and lower risk typically command higher PE multiples, while those facing more uncertainty or slower growth trade at lower multiples.

Currently, Chipotle trades at a PE ratio of 29.5x. For context, the average PE for the hospitality industry is 21.3x and direct peers average 43.8x. These differences highlight the market's outlook on Chipotle's future performance relative to its competitors and the industry as a whole.

Simply Wall St’s proprietary “Fair Ratio,” calculated at 26.2x for Chipotle, is designed to provide a more nuanced view than traditional benchmarks. It weighs fundamentals such as projected earnings growth, profit margins, business risks, industry traits, and market capitalization, offering a valuation that is tailored to Chipotle’s specific profile rather than broad averages.

Comparing Chipotle’s actual PE of 29.5x with its Fair Ratio of 26.2x shows that while the stock trades slightly above its tailor-made fair value, the difference is marginal. Judged by this approach, Chipotle appears to be roughly in line with fair value for investors with a long-term outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1444 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Chipotle Mexican Grill Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, intuitive story you build about a company. It connects your expectations for Chipotle Mexican Grill’s future, such as revenue and earnings growth, with a fair value you believe in, all grounded in your personal view of the business’s prospects and risks.

Narratives transform investing from dry number crunching into a dynamic process where you can frame your own outlook. For example, you might see international expansion or restaurant innovation fueling growth, or instead focus on competition and economic uncertainty as drags on performance. This approach is easy to use and accessible right on the Simply Wall St platform’s Community page, which is used by millions of investors to refine and share their perspectives.

Each Narrative links your story directly to a financial forecast and automatically calculates a fair value, allowing you to see if Chipotle Mexican Grill is trading above or below your estimate and decide when it is the right time to buy or sell.

Narratives stay up to date as new information arrives, such as earnings or major news, helping you stay ahead of the market. Real Chipotle Mexican Grill examples range from bullish price targets as high as $65.00 to bearish views at $46.00 per share, depending on investors’ own outlooks and assumptions.

Do you think there's more to the story for Chipotle Mexican Grill? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMG

Chipotle Mexican Grill

Owns and operates Chipotle Mexican Grill restaurants.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026