- United States

- /

- Hospitality

- /

- NYSE:CAVA

Is There Value in CAVA After Expansion and Delivery Partnership News?

Reviewed by Bailey Pemberton

- Wondering if CAVA Group’s stock offers hidden value or if you’re just catching falling knives? You’re not alone, and there is more to the story beneath the ticker symbol.

- The share price has been volatile, rising 9.0% over the past week after a sharp 5.1% decline in the past month, and remains down 55.7% year-to-date.

- Recently, news about CAVA Group has focused on its aggressive expansion plans and partnerships with delivery platforms. These developments have excited some investors while raising concerns for others. The headlines are fueling hopes for future growth as well as questions about whether the market has overreacted to near-term challenges.

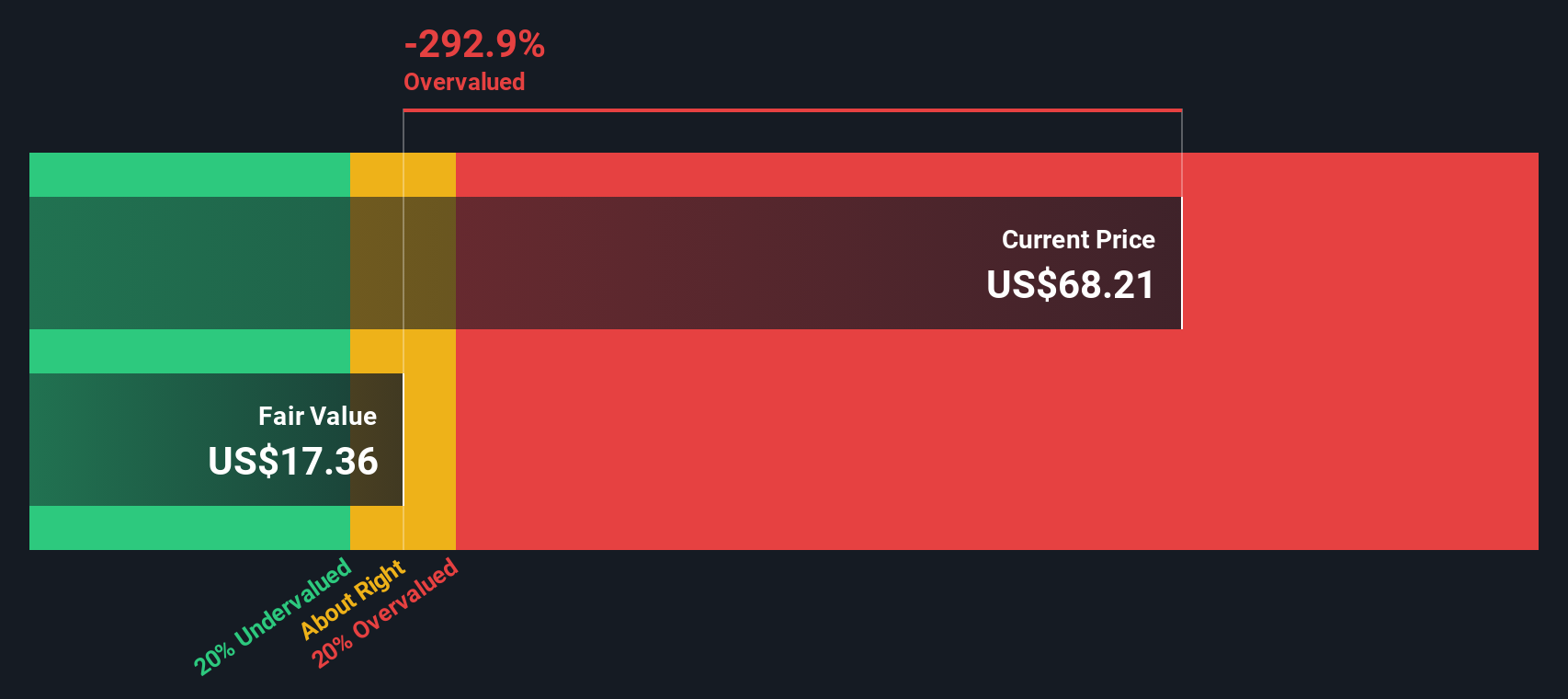

- With just a 1/6 valuation score, many are questioning whether CAVA Group is truly trading at a discount. Let’s break down the main valuation methods and present a more nuanced approach later in the article.

CAVA Group scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: CAVA Group Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today’s dollars. This approach focuses on what the business can realistically generate in cash over the coming years, rather than just looking at profits or revenues.

CAVA Group’s current Free Cash Flow is $8.1 million. Analyst forecasts suggest rapid growth, with Free Cash Flow expected to reach $195 million by 2029. For the first five years, these projections are based on analyst estimates. Subsequent years are extrapolated based on historical and expected trends. Over a ten-year period, future cash flows are anticipated to increase considerably, driven by the company’s expansion and scaling efforts.

According to this DCF model, the estimated intrinsic value per share comes to $38.69. However, with the stock currently trading above this level, the model implies the shares are about 31.9% overvalued relative to their fair value based on projected cash generation.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CAVA Group may be overvalued by 31.9%. Discover 922 undervalued stocks or create your own screener to find better value opportunities.

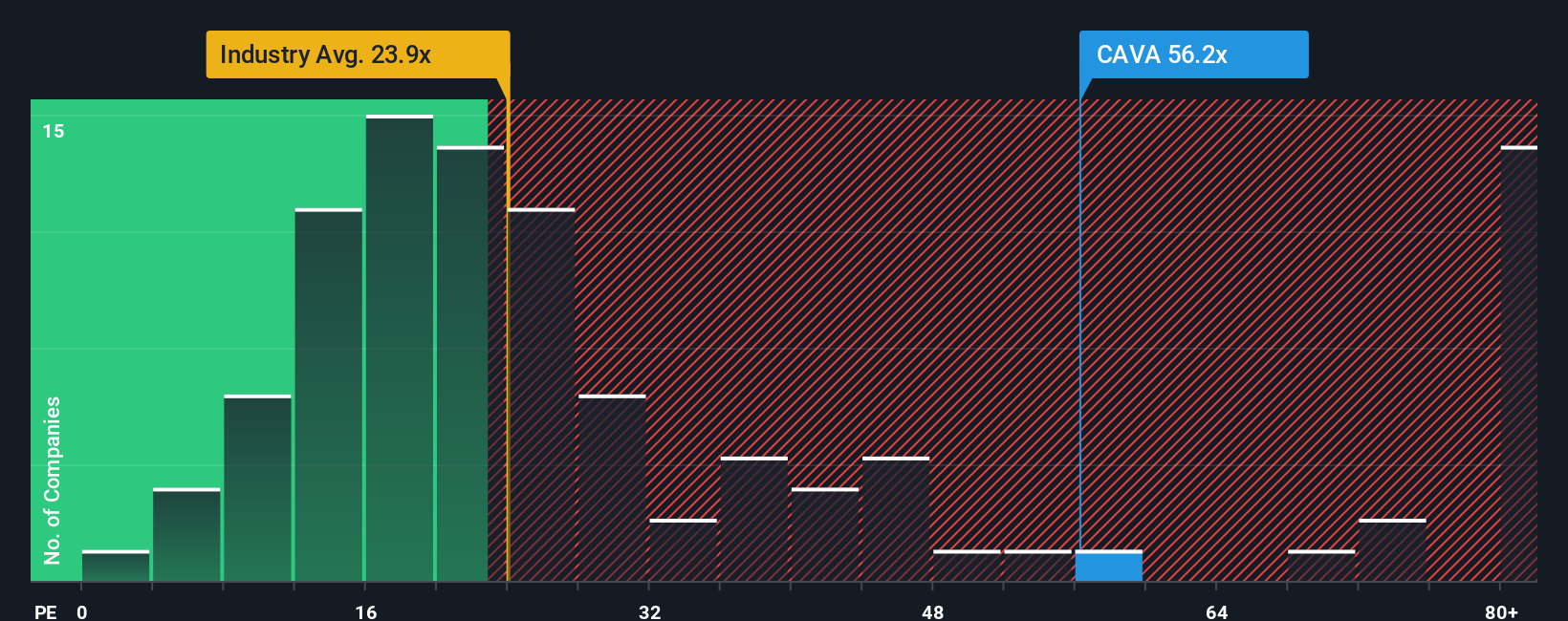

Approach 2: CAVA Group Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a widely respected valuation metric for profitable companies because it directly relates a company's share price to its per-share earnings. This makes it an accessible tool for gauging whether investors are paying a fair price for a company's current and expected profitability.

A "normal" or "fair" PE ratio can vary substantially, influenced by factors such as future growth expectations and business risks. Companies with high expected earnings growth or lower risk typically trade at higher PE multiples, while mature or riskier companies often see lower ones.

Currently, CAVA Group’s PE ratio stands at 43.0x. This is lower than the average of its peers, which sits at 65.2x. It is, however, meaningfully higher than the hospitality industry average of 21.4x. To provide a more nuanced perspective, Simply Wall St's Fair Ratio for CAVA Group is calculated at 15.8x, taking into account variables like projected earnings growth, profit margins, market capitalization, industry norms, and company-specific risks.

The Fair Ratio offers a more tailored benchmark than blanket comparisons with peers or the industry, as it factors in not just current profitability but also the unique qualities and prospects of CAVA Group itself.

Comparing CAVA’s actual PE ratio of 43.0x to its Fair Ratio of 15.8x, the stock appears substantially overvalued based on this method.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

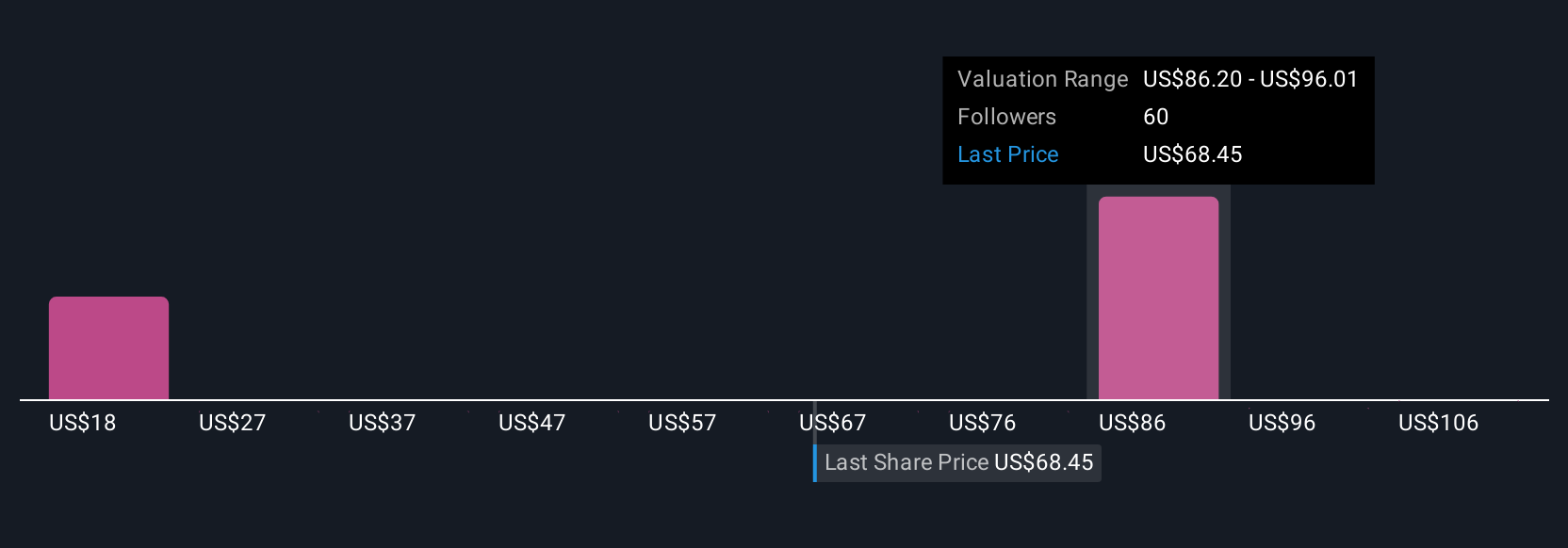

Upgrade Your Decision Making: Choose your CAVA Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story or perspective about a company, built on your own expectations for its future revenue, earnings, and margins. Narratives let you connect the broader story, such as expansion plans, consumer trends, or macro risks, to a set of quantifiable financial forecasts and an estimated fair value.

This approach is easy and accessible using Simply Wall St's platform, where millions of investors share and compare Narratives within each company’s Community page. Narratives help you decide when to buy or sell by showing you exactly how your Fair Value estimate stacks up against the current market price, all based on your underlying story, not just analyst consensus or static metrics.

Your Narrative updates dynamically when new news or earnings are released, so your fair value estimate and conviction stay relevant as conditions change. For example, some CAVA Group investors may base their Narrative on aggressive store expansion, digital engagement and innovation, leading them to the most optimistic price target of $125.0. Others may see risk from margin compression and competition, supporting a much more conservative target of $72.0. Narratives empower you to see both sides clearly and make smarter, story-driven investment decisions.

Do you think there's more to the story for CAVA Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CAVA

CAVA Group

Owns and operates a chain of restaurants under the CAVA brand in the United States.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026